The South African Rand has been rallying against the Japanese yen for quite some time. The pair tends to be quite sensitive the risk, but it also serves as a nice carry trade. The South African Rand is one of the highest pain currencies, so therefore at the end of each day you get a little bit of pay.

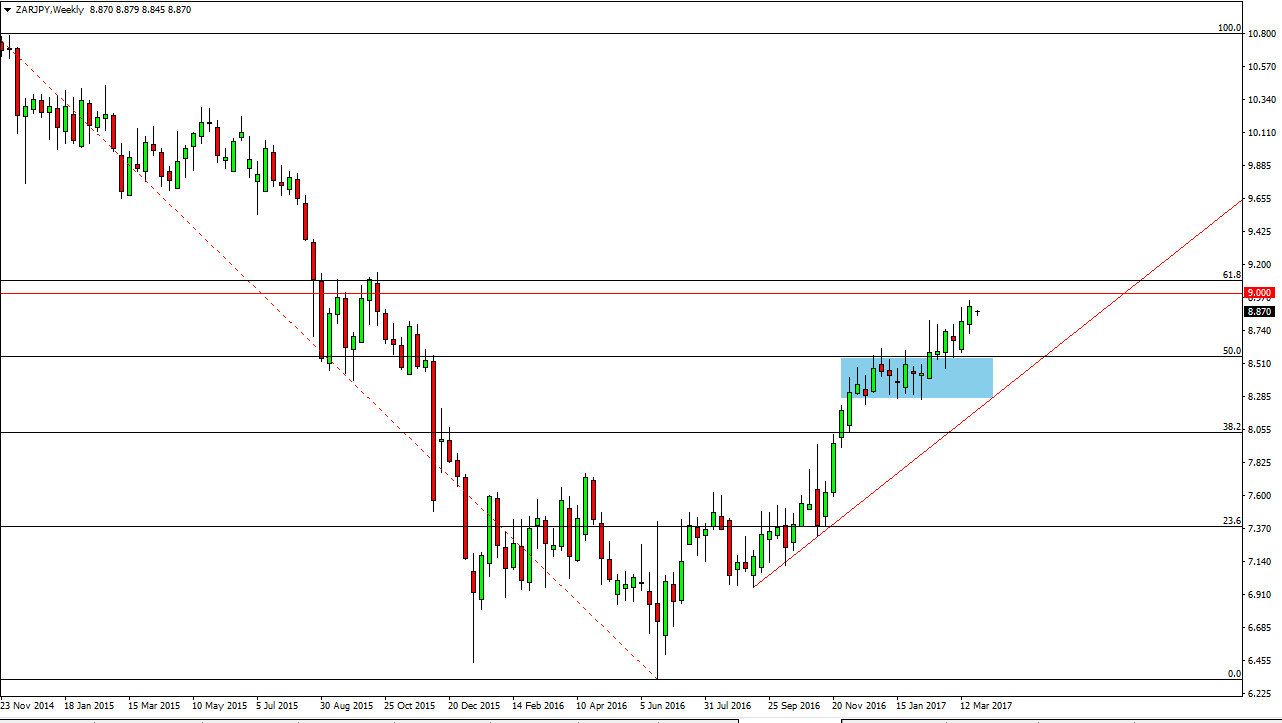

On the chart, you can see that we are approaching the 9 handle. It also coincides with the 61.8% Fibonacci retracement level from the massive selloff, and I believe because of this that April will become very important for this pair. We could get a bit of a pullback from time to time, but if we can break above the 9.10 handle, it’s very likely that this market will continue to go all the way to the 100% Fibonacci retracement level at the 10.80 level.

Buying pullbacks

On the chart, you can see that I have an uptrend line, which of course has been reliable in the past. But we also have recently had consolidation as the noted by the blue rectangle. Because of this, I believe there will be a significant amount of support near the 8.55 handle, so every time you pull back I would expect that there should be buyers. Remember, you get paid to wait on this pair, and the Japanese yen is probably the more important currency in this market, as this is simply a referendum on what happens to that market and the ability to hang onto a carry trade.

I have no interest in selling this pair anytime soon, but I do recognize that the psychologically significant 9 handle could cause trouble ahead. I think by the end of the month though, we should break out to the upside and continue to go much higher. It is not until we break down below the uptrend line that I would consider selling.