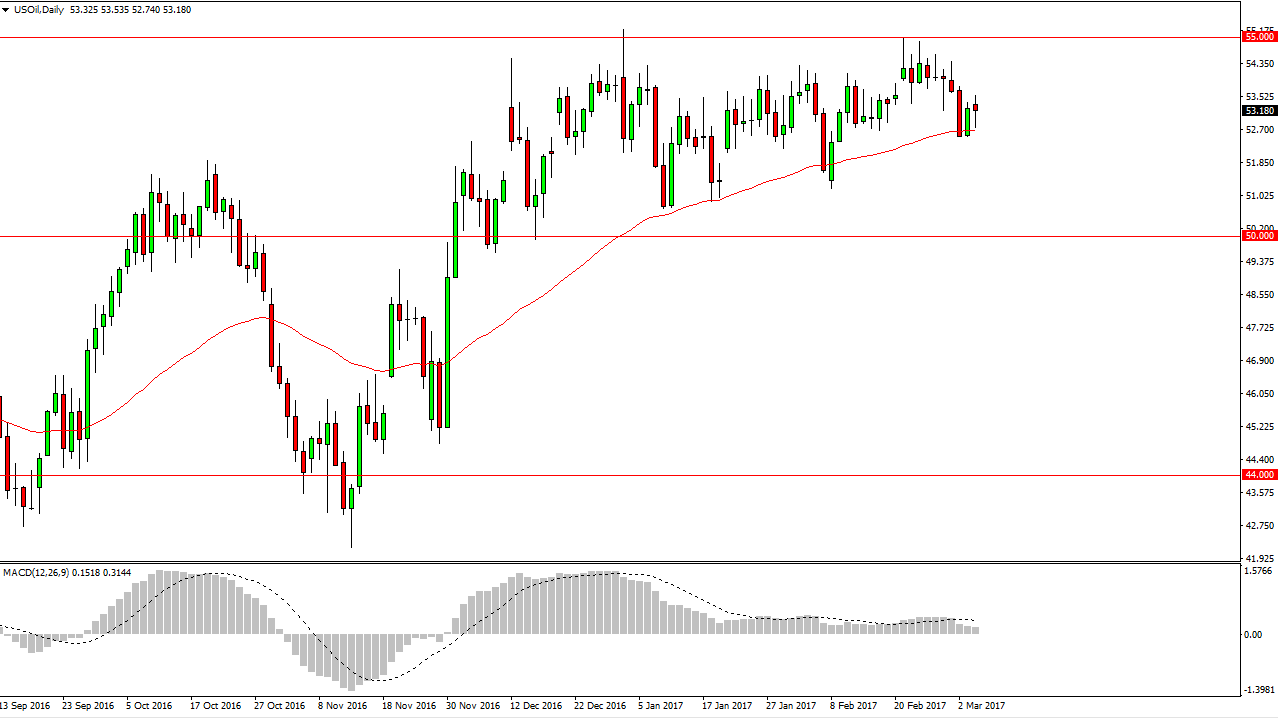

WTI Crude Oil

The WTI Crude Oil market initially fell on Monday, but found enough support at the 50-day exponential moving average to turn around and form a hammer. The hammer of course is a bullish sign, and the 50-day exponential moving average tends to attract a lot of attention. If we can break above the top of the candle, the market should then reach towards the $55 level. That is a level of considerable resistance is going to be difficult to break above, and once we do that could send this market towards the $60 level. A breakdown below the 50-day exponential moving average should send this market looking for the $51 level underneath. Regardless, expect a lot of choppiness as this market tends to be very difficult now, because quite frankly there is a lot of concern when it comes to oversupply, but at the same time there’s a lot of concern when it comes to OPEC production cuts.

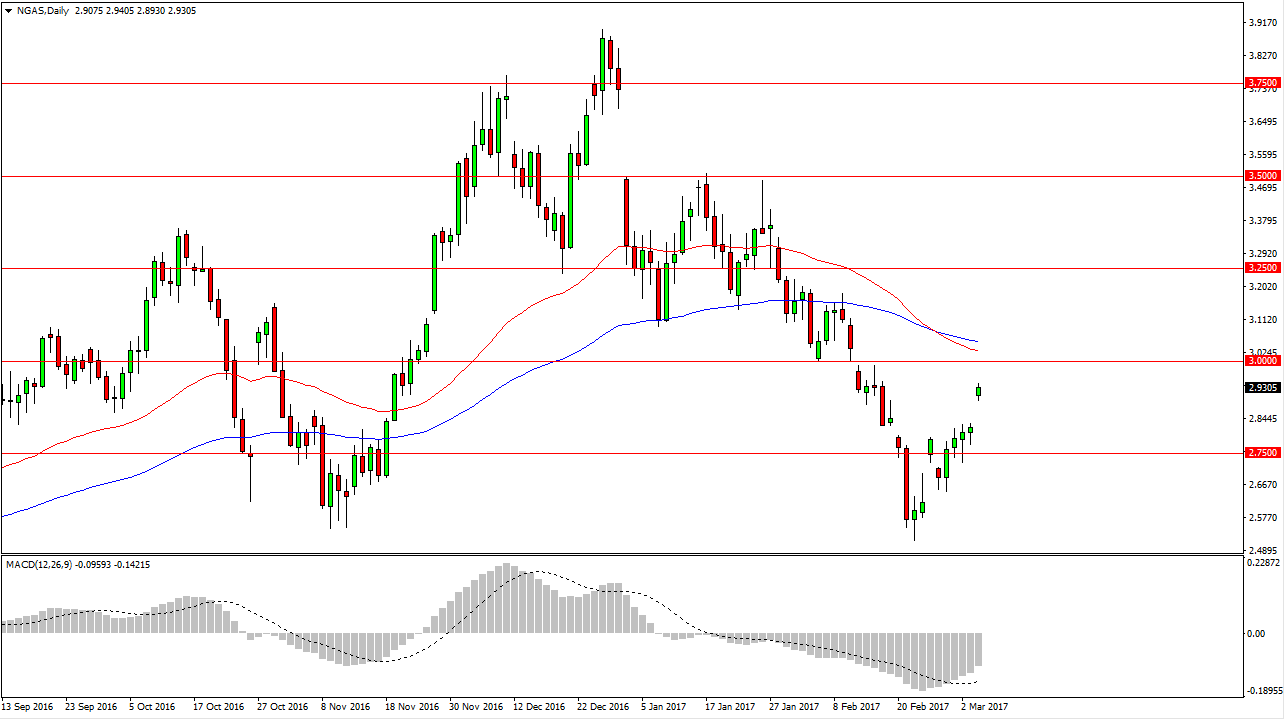

Natural Gas

The natural gas markets gapped higher at the open on Monday, showing real signs of strength. I think that the $3 level above will continue to be massively resistive, and because of this I believe that the market will eventually form a negative candle, which of course I will start selling. The 50-day moving average, pictured in red on this chart, has recently crossed below the 100-day moving average which of course is a longer-term negative sign. I believe at that point we will reach towards the $2.75 level underneath, and then eventually the $2.50 level. Longer-term, I would not be surprised at all to see this market breakdown from there, and continue to go much lower.

I have no interest in buying this market, and believe that if you are patient enough you should get nice selling opportunities for longer-term moves to realize significant profit.