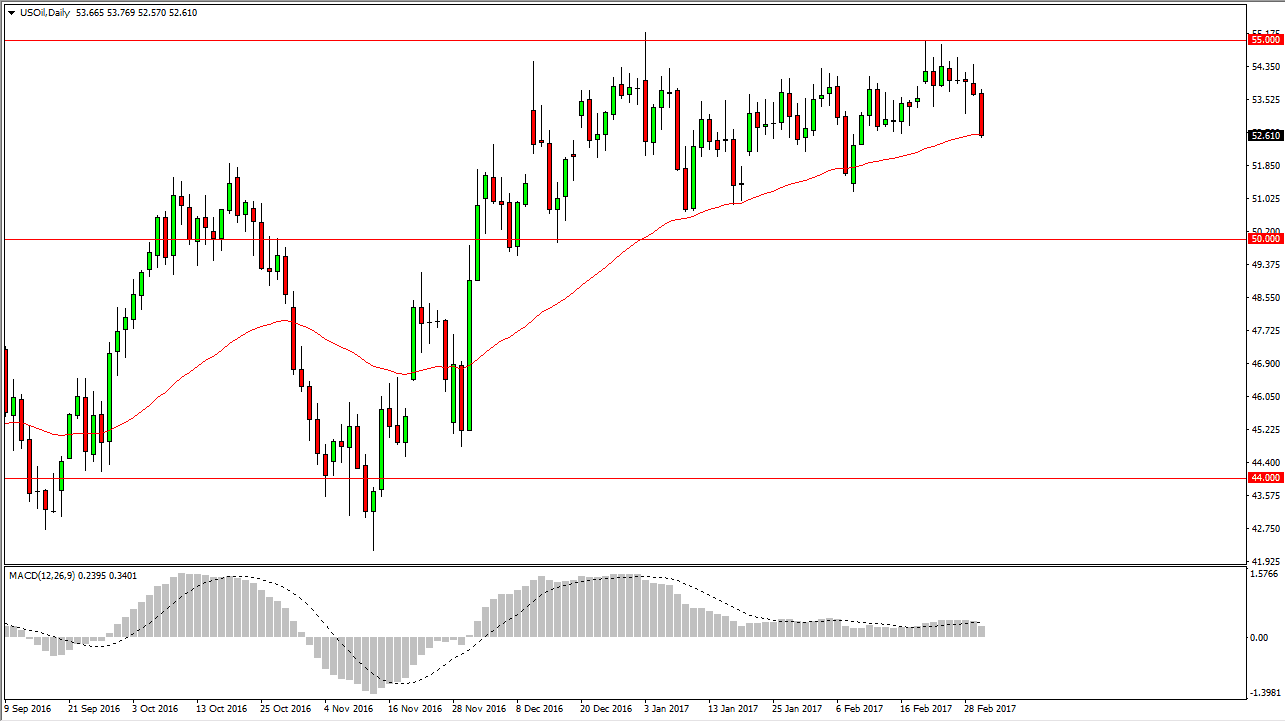

WTI Crude Oil

Oil markets fell significantly during the Thursday session, reaching down to the 50-day exponential moving average. The market has been struggling with the OPEC production cuts and the oversupply happening at the same time. It looks likely that the sellers are going to continue to press the issue, but we would need to see a continuation of the negativity to start selling again. We are essentially in the middle of the consolidation area, so it’s unlikely that it’s going to be an easy move lower. Rallies at this point should be sold off though, so I would be looking for short-term rallies that show signs of exhaustion in order to get short of this market yet again.

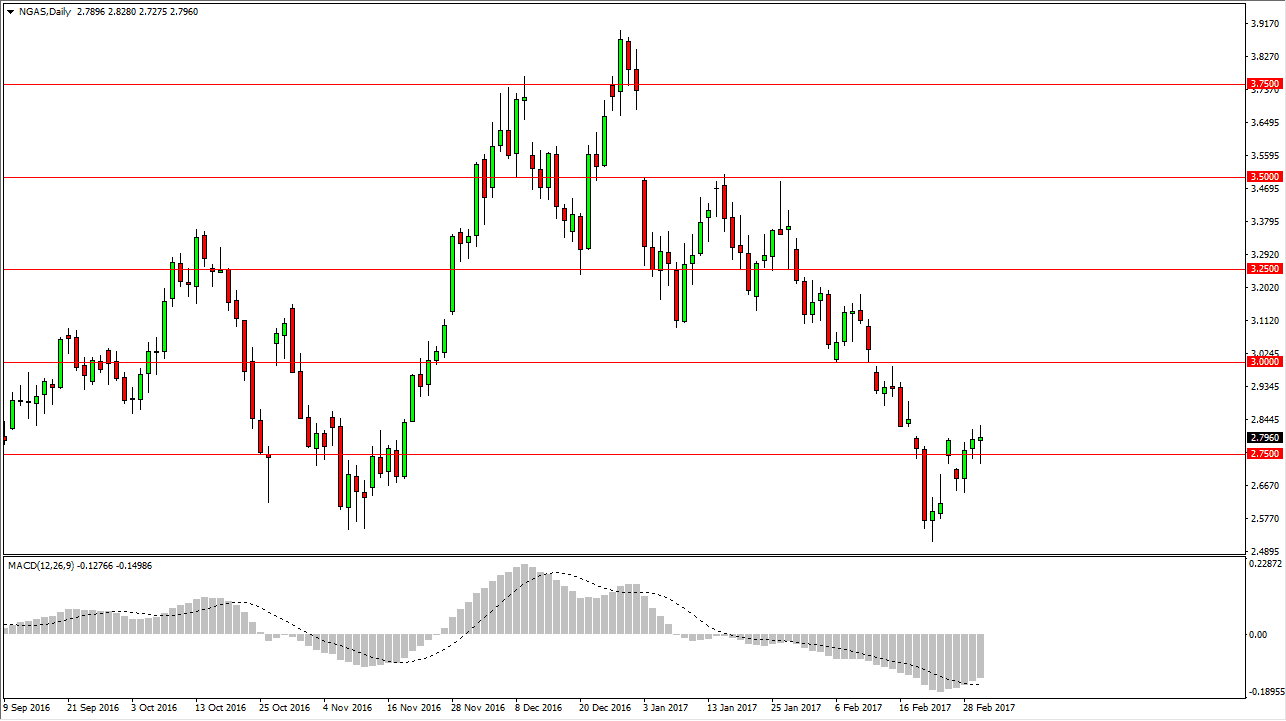

Natural Gas

Natural gas markets had a choppy day on Thursday, as the $2.75 level continues to be a bit of a magnet for price. It did offer support, so if we can break above the top of the candle for the day, it’s likely the buyers will try to push this market towards the $3 handle. It will be interesting to see whether we can make it there, but I believe it’s only a matter of time before the sellers return anyway. Natural gas markets are oversupplied to say the least, so given enough time the downward pressure will continue. On signs of exhaustion, or perhaps a breakdown below the bottom of the candle, I am not only a seller but I’m looking for moves back down towards the $2.50 level as the 2 pictures in the United States stay too warm to drive up demand.

The $3 level should be the ceiling, and I would be quite surprised if we managed to break above it. I think it’s more likely to see this market go down to the $2.25 level that it is to break out to the upside.