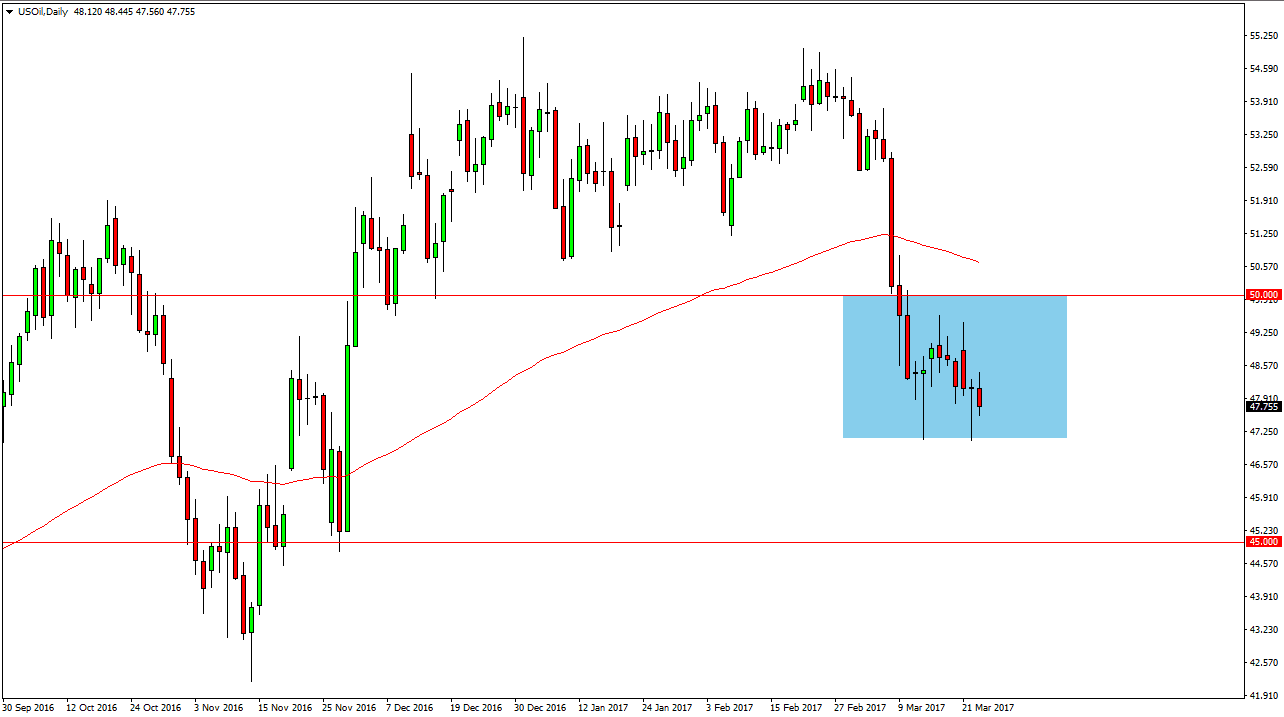

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Thursday but then fell as we drifted towards the bottom of the overall consolidation area. This is a market that is stuck between $50 at the top, and the $47 level on the bottom. Ultimately, this is a market that will continue to be choppy but I believe in the longer-term downside. Ultimately, I believe that this market will break down to the $45 level, but currently we have a lot of moving pieces. We have recently had a significant breakdown, so perhaps a little bit of consolidation is needed in order to build up more downward momentum. I would be very surprised if we can break above the $50 handle, and therefore look at this as a “sell the rallies” type of marketplace.

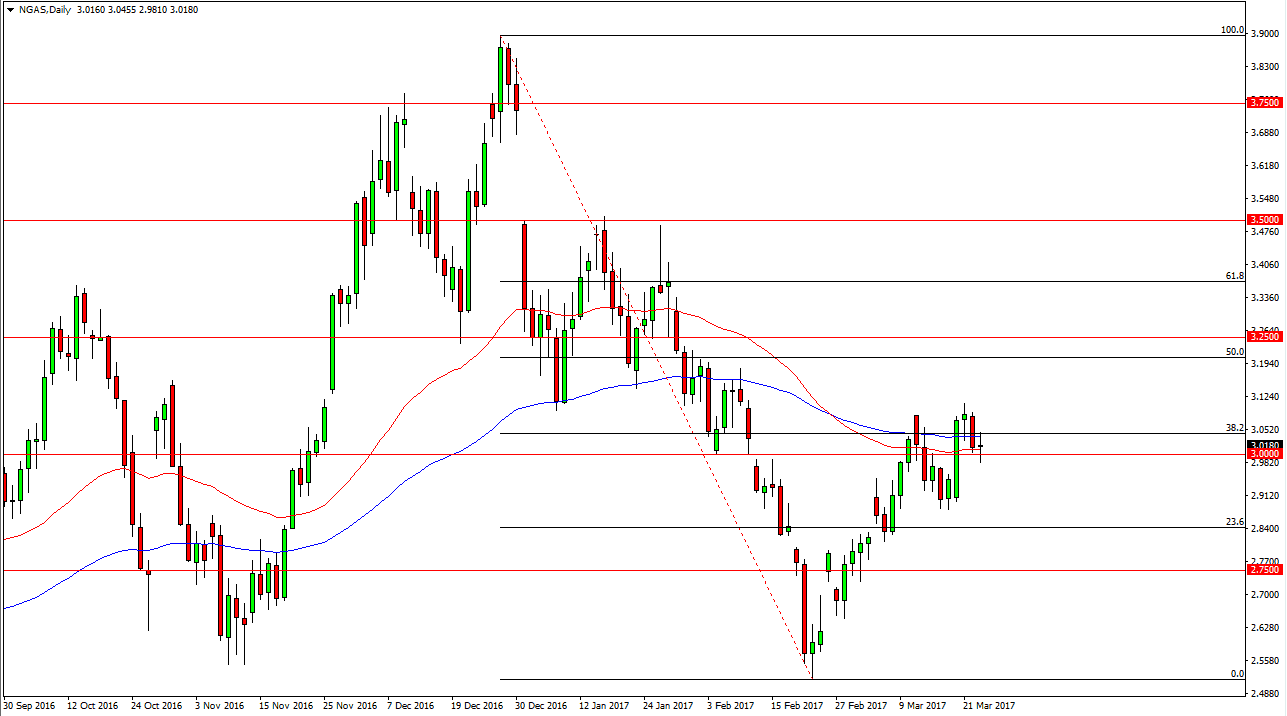

Natural Gas

Natural gas markets went back and forth during the day on Thursday, showing signs of indecision. The $3.00 level underneath continues to be massively important, so a break below the candle would be a very negative sign in this market and I think at that point the sellers would really start to take over. If that happens, I suspect that the $2.90 level will be targeted, and then possibly the $2.75 level after that. I have no interest whatsoever in buying this market, and I believe that if we do breakout to the upside, it’s likely that we will then see opportunities to sell this market higher levels.

Natural gas markets are massively oversupplied, and because of that I don’t have any desire whatsoever to buy this market. I believe that we will continue the longer-term downtrend, and as temperatures rise in the United States, it will bring down some of the demand for natural gas. Because of this, I simply look for weakness.