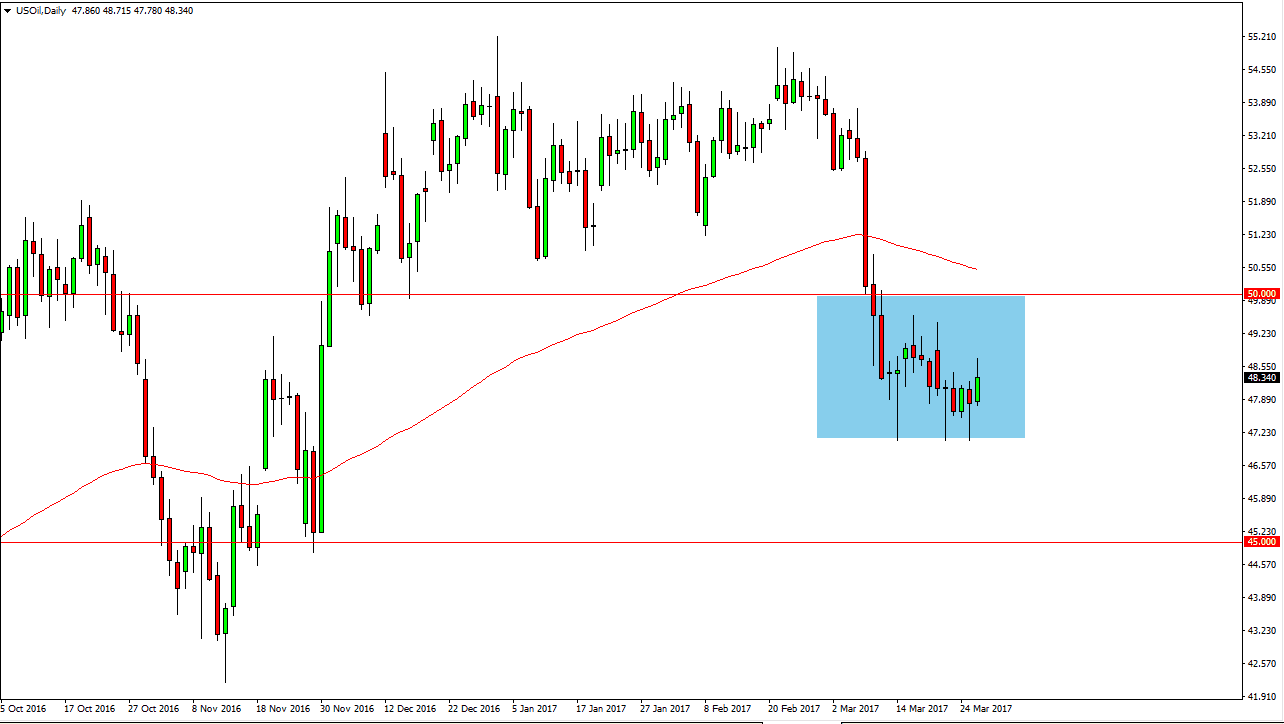

WTI Crude Oil

The WTI Crude Oil market had a wild day as we initially fell, but found enough support near the $47.90 level to break above the top of the hammer from the previous session. I believe that the market will continue to be very volatile and with today having the Crude Oil Inventories number coming out, you can expect more of the same. I believe that the market has a hard ceiling near the $50 handle, and will start looking for shorting opportunities near $49.50 if we rise. On the other hand, if we can break down below the $47 level, that would be extraordinarily bearish and have me not only selling, but selling aggressively. The markets continue to deal with an oversupply issue, and although OPEC is talking about more production cuts, quite frankly it has not made much of a difference so far, so I don’t think things are going to change anytime soon. I still believe that the occasional rally will be a nice selling opportunity on signs of exhaustion in the market the quite frankly has no business being this high.

Natural Gas

Natural gas markets initially fell during the day on Tuesday but found the $3.00 level to be supportive enough to turn things around. We also have the 100 and the 500 day moving averages just below, and that of course causes a bit of psychological support. Because of this, I believe that the markets will continue to find a quite a bit of volatility in this area, but given enough time I think that we will break down below the $3.00 level. Ultimately, and the short-term I believe that we may have a little bit of bullish pressure going forward. The markets are very choppy, but I recognize that there is still a major oversupply issue that the market has not been paying much attention to.