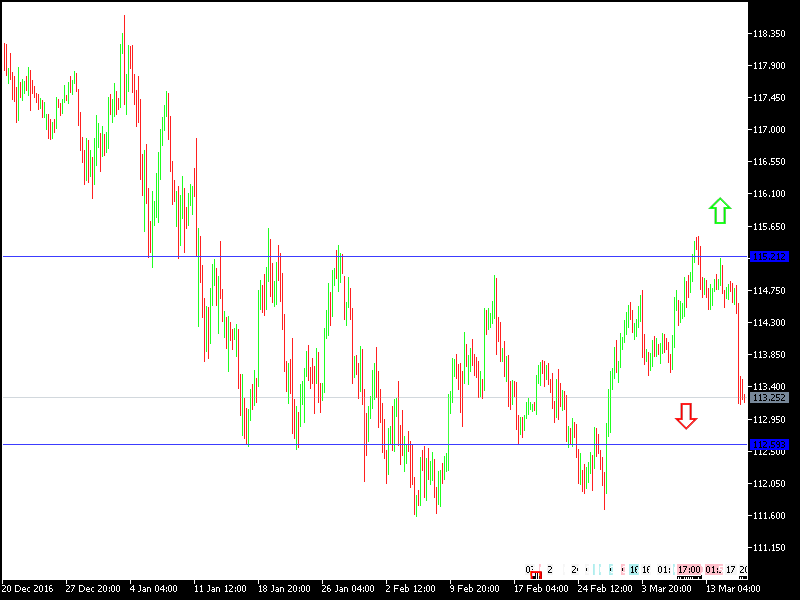

Unexpectedly, the USD/JPY loses extended to almost 200 points, after the Federal Bank announced to raise the US rates, and mentioned that they are ready for two more rate hikes during the year. Giving up on the dollar helped the pair make strong gains pushing it towards 113.00 at the time of writing, and any move below that level would support the motion towards 112.50 and 112.00 after that. The 112.00 is the best level to buy this pair at the moment. The interest rate variance between the US Federal Bank and the Bank of Japan will support the bullish trend in this pair. The Fed raised the rates yesterday, and today, the Bank of Japan maintained his monetary policy as is at the negative rates.

On the bullish side: the nearest current resistance levels are 113.60 and 114.20, and any move above the later would open the way for return to the strong bullish trend.

From the economic data side: after getting over the Bank of Japan decisions, the focus will shift towards the US data announcements, which are the US claimant count, Philly Manufacturing Index, housing data and market sentiment towards the Fed decisions.