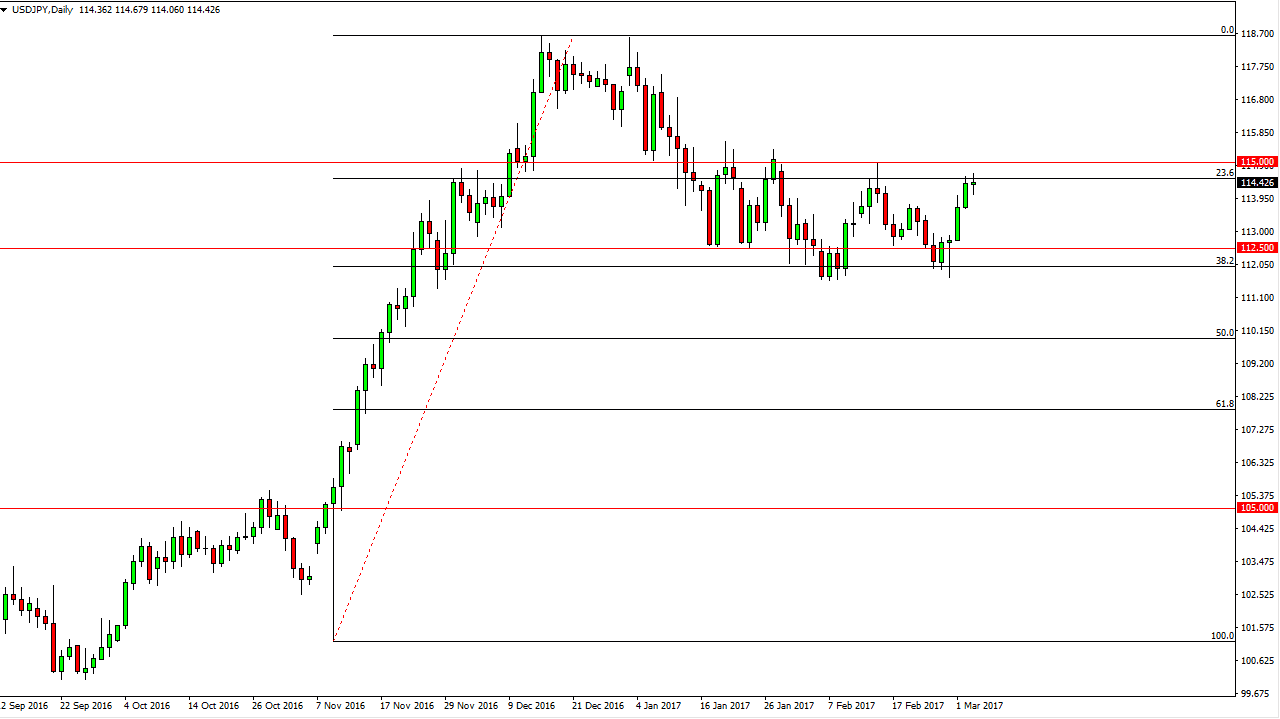

USD/JPY

The USD/JPY pair had a choppy session on Friday, as we approached the 115 handle. That’s an area that will more than likely continue to be resistive, and if we can break above there I think that the market can continue to go much higher. Pullbacks will more than likely find buyers below, but I believe that the overriding pressure is to the upside, and once we do breakout I think that the 118.50 level will be targeted next. The 38.2% Fibonacci retracement level underneath has held up as support, and I believe will continue to be supportive in the future. The Federal Reserve looks likely to raise interest rate a couple of times this year, so I believe that the market continues to reward the US dollar.

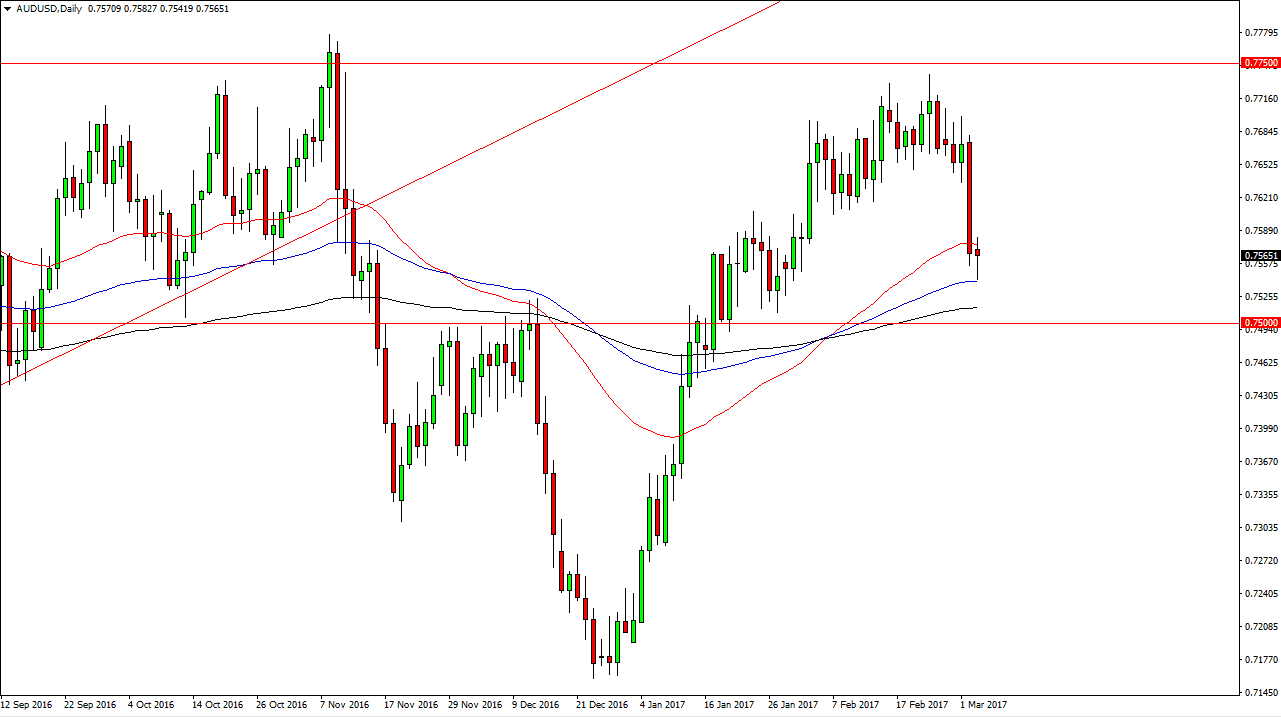

AUD/USD

The Australian dollar fell a bit during the day on Friday, but found the 100-day exponential moving average below supportive enough to turn things around. The hammer that formed for the day is a bullish sign, and I believe that is only a matter of time before the Australian dollar rallies. A break above the top of the candle is reason enough to go long. I believe that the 0.75 level underneath should continue to be supportive, and the 200-exponential moving average being just above there course will help. Pay attention to the gold markets, they tend to coincide quite nicely with the Australian dollar, so a move to the upside in both markets would be a nice signal.

On the bounce, I believe that the market will reach towards the 0.7650 level above, which should be resistive, and thus I think that the bounce would be somewhat short-lived. This is a market that continues to be volatile, but I believe it’s only a matter of time before the market makes its intentions much clearer.