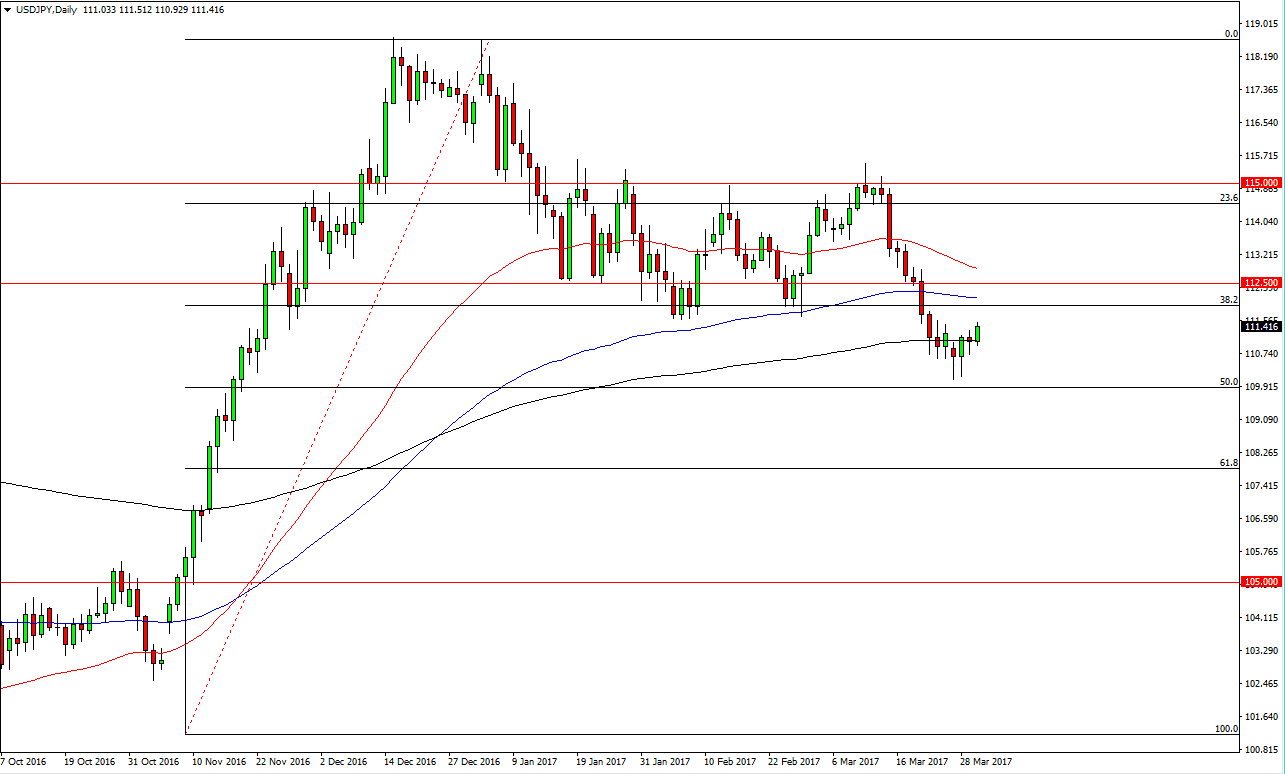

The USD/JPY pair broke higher during the day on Thursday, breaking above the top of the hammer that formed on Wednesday. This suggests that serious bullish pressure is starting to build around the 200-exponential moving average, so I remain bullish of this market but I do recognize that there is a significant amount of noise just above. The 112 level above will cause quite a bit of noise, and a break above the level should send this market higher. I think that is can be difficult to get above there, but it seems as if we are hell-bent on doing that. The 50% Fibonacci retracement level below at the 110 level looks as if it is trying to offer a bit of a floor as well, so with interest rate hikes coming, I believe that this market continues to grind higher.

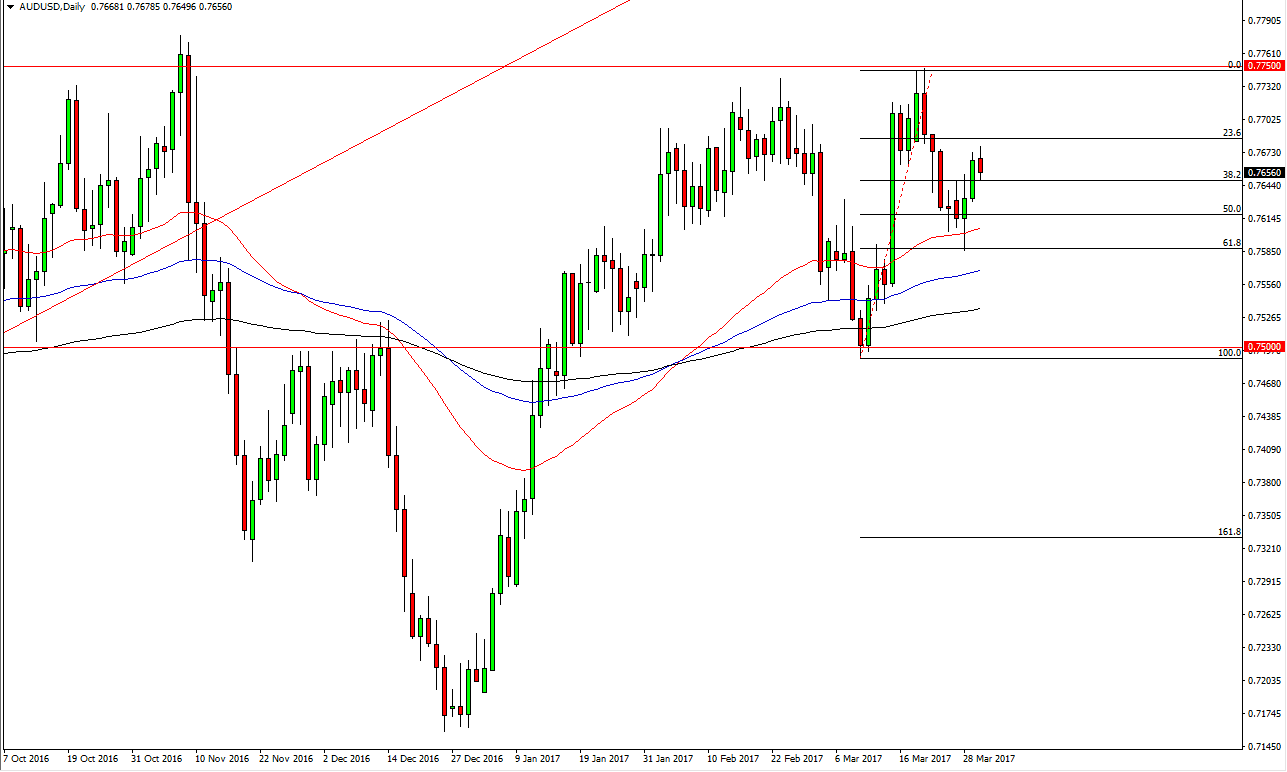

AUD/USD

The AUD/USD pair tried to rally during the day on Thursday, but found enough resistance to turn around and fall. It appears that the 38.2% Fibonacci retracement level is going to offer a bit of support, so I think if we can turn around and show signs of support, it’s time to serve buying again. Keep in mind that the gold markets look very well supported below but are fighting a significant amount of resistance. If they can finally break out above the $1261 level, I feel that the Aussie dollar should follow as it typically moves in the same direction over the longer term. I look at the moving averages and see that they are fanned out quite nicely, which is something that longer-term traders like to see, and I also recognize that the resistance above at the 0.7750 level will be a significant place in the market. If we can break above there, I think that the market can finally go to the 0.80 level which is much more important on longer-term charts.