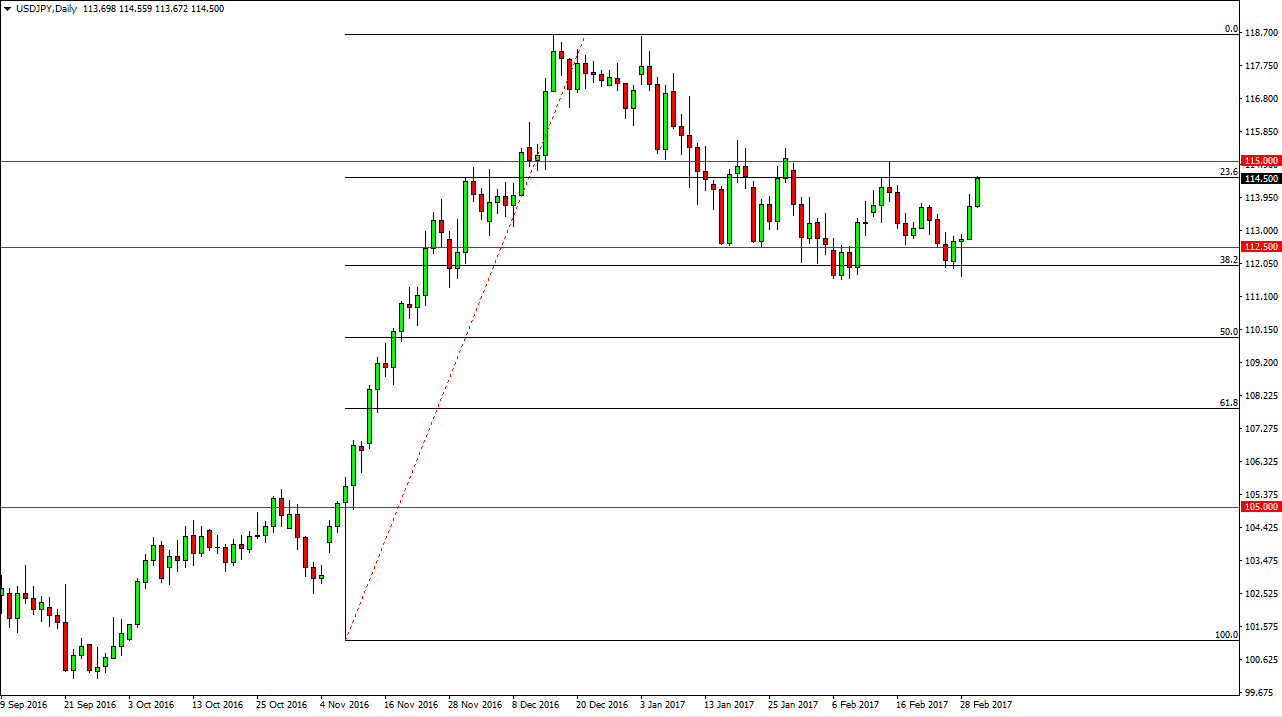

USD/JPY

The US dollar rallied against the Japanese yen during the day on Thursday, as it took off against almost everything. It looks as if the market is going to continue to price in interest rate hikes coming out of the Federal Reserve for the month of March, and the means that the US dollar must go higher. If we can break above the 115 level, the market should then be free to go towards the 118.50 level. If we pull back from here, and we could very easily, I believe the buyers will be found below as the 111.50 level continues to be massively supportive. Once we break above the 150 level, I feel that the momentum will search pick up massively in the moved to the 118.50 level might be rather quick.

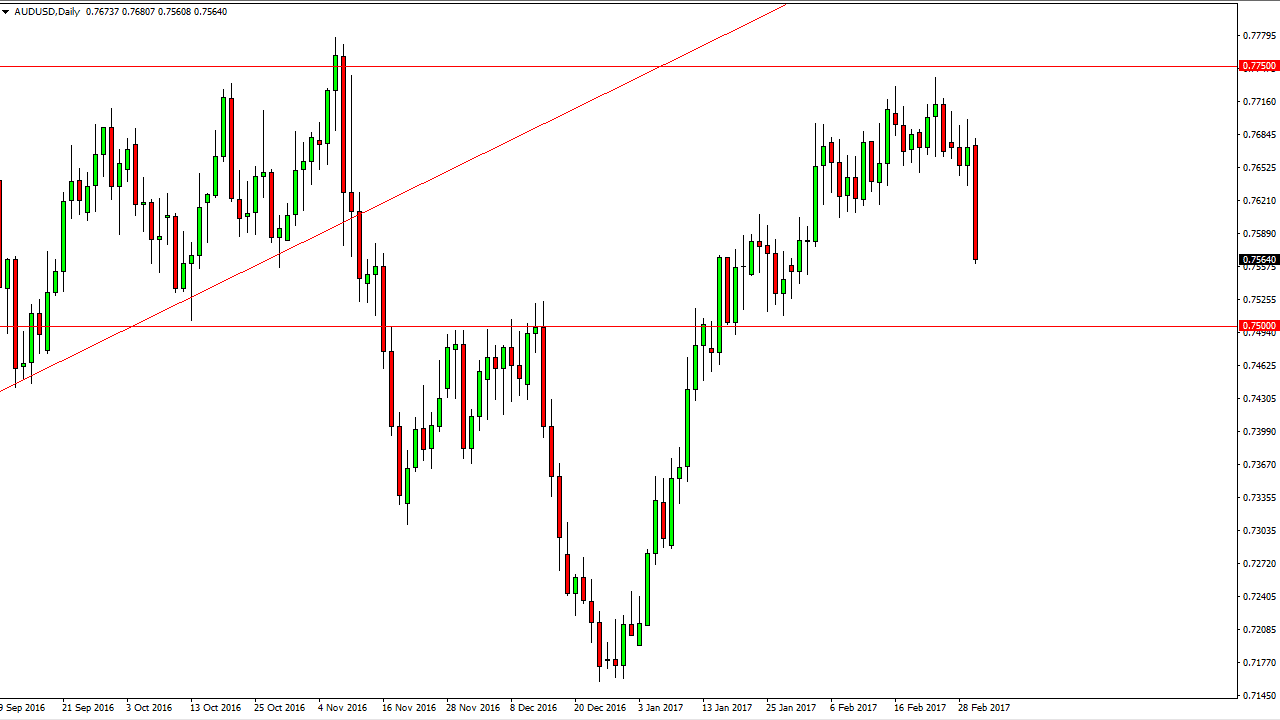

AUD/USD

The Australian dollar got absolutely hammer during the session, as the US dollar is the currency that the market is trying to buy now. I believe that there is still a significant amount of support at the 0.7500 level however. That, and the fact that the candle is so long tells me that we probably need to bounce a little bit. I’m going to wait to see whether we get some type a supportive candle on the daily chart to start buying again. However, if we do breakdown below the 0.7500 level with any type of significance, I think at that point the market will probably drop much farther.

Pay attention to gold, there’s always the correlation between the Australian dollar in the gold markets, so of course you must keep an eye open over the next couple of sessions. Currently, I think that the downward pressure will continue and the short-term, but as we are in an uptrend over the last couple of months, we could get sudden bounces.