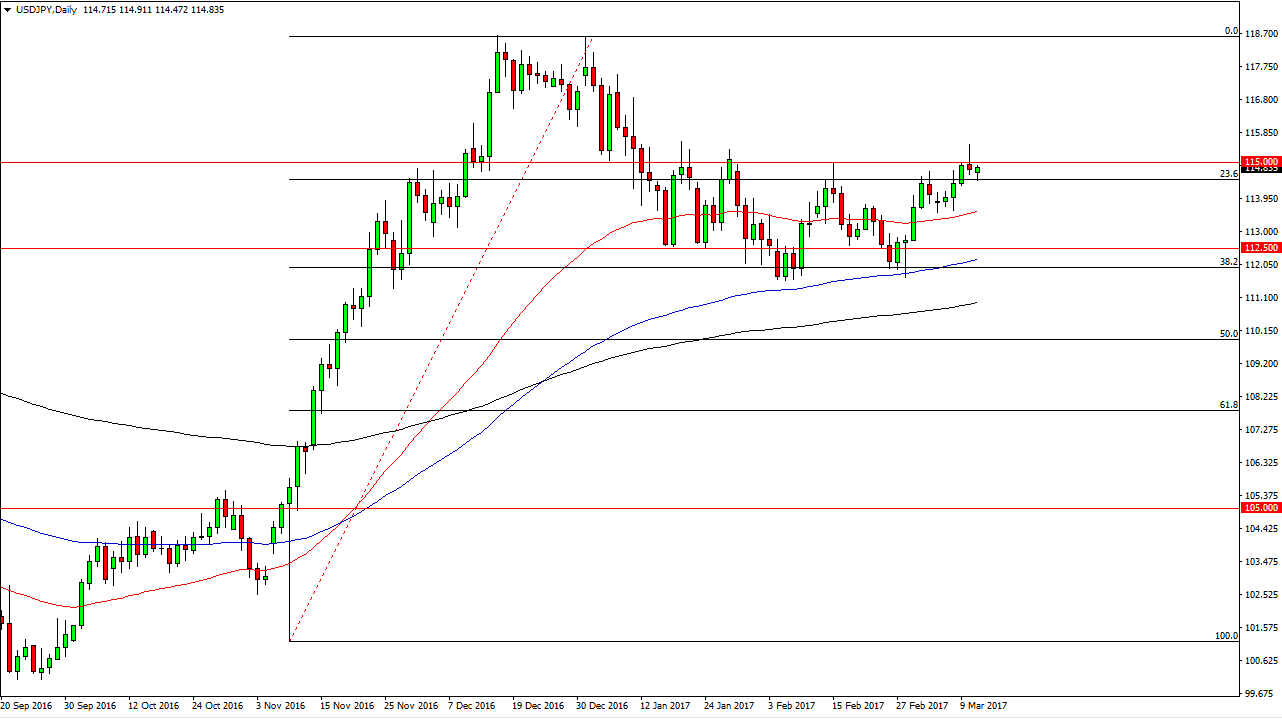

USD/JPY

The USD/JPY pair initially fell on Monday but turned around to form a positive candle. Because of this, the market looks as if it is going to try to reach above the 115 level again. If we can break above the top of the shooting star from Friday, I believe that this market continues to go much higher. Until then, it would not surprise me at all if we get a pullback some time to time. On the other and, if you can break above the top of the shooting star, the market will more than likely reach towards the 118.50 level again. I believe that the 50-day exponential moving average below should continue to offer dynamic support.

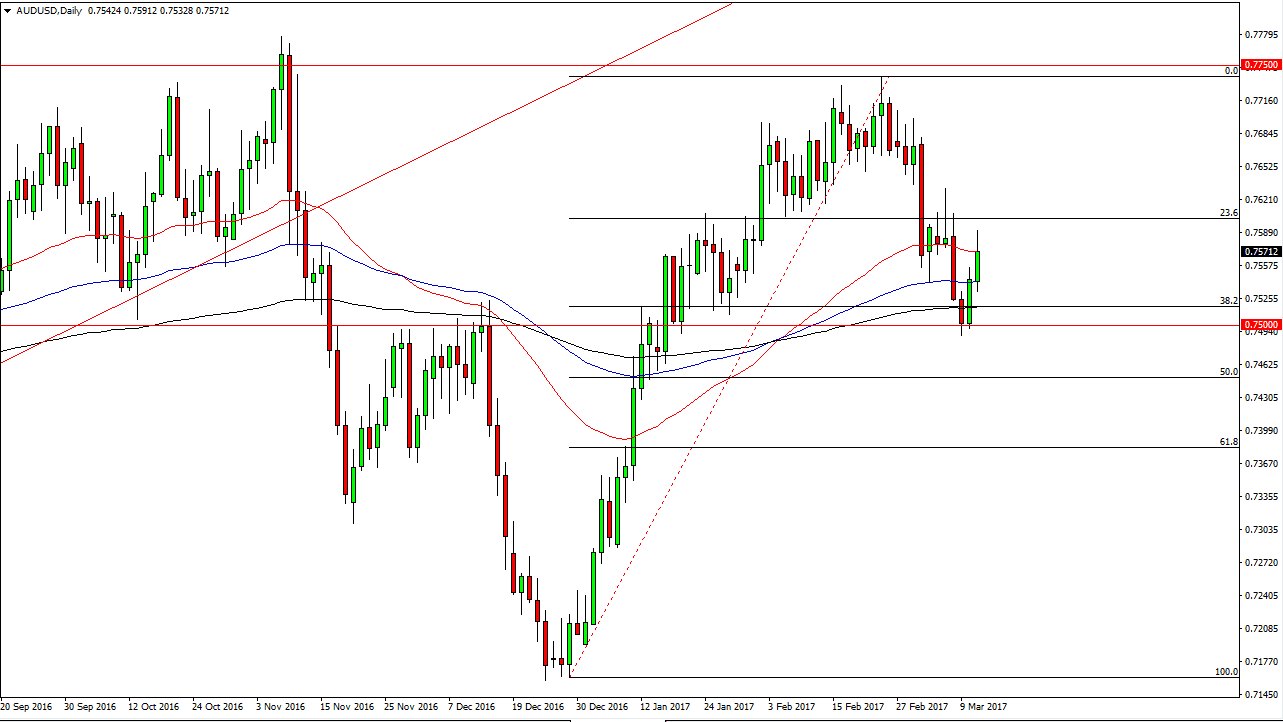

AUD/USD

The Australian dollar rallied again during the session on Monday, as we continue to see strength in the currency. I recognize that the 0.75 level was massively supportive, and it now looks as if we’re going to try to go higher from here. Given enough time, the correlation between gold and the Australian dollar tends to pan out, and I believe if we see some type of strength in the gold markets, the Australian dollar will follow. The 0.7750 level above will be targeted, but I think there’s going to be a lot of volatility between here and there, and as a result it looks likely that it will be a choppy move higher.

I believe that the 0.75 level underneath continues to be massively supportive, and even if we break low there I think there is a significant amount of support at the 50% Fibonacci retracement level as well. In the meantime, I’m a buyer and not a seller recognize that the market is going to be a bit of a struggle, but I still believe that longer-term you will be rewarded.