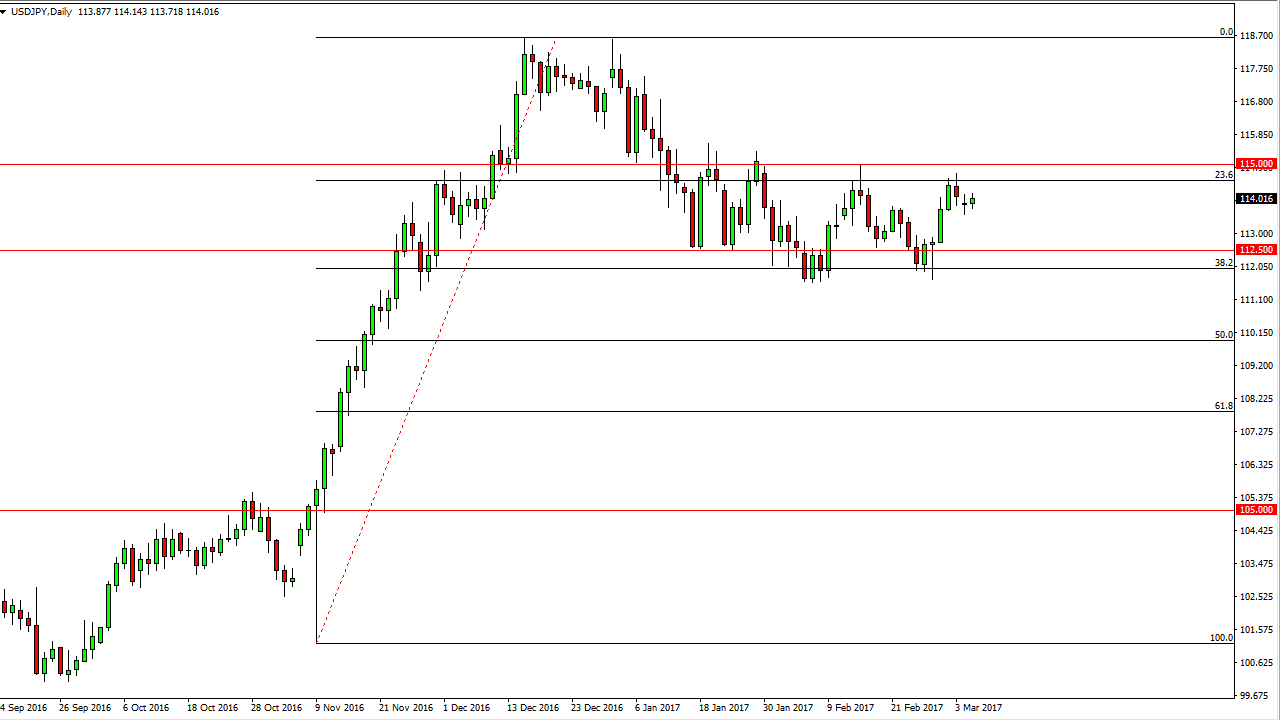

USD/JPY

The US dollar rose slightly against the Japanese yen during the session on Tuesday, as we continue to see interest in this pair. I still believe that the absolute floor is closer to the 112 level, so I have no interest in selling. I believe that eventually we will break above the 115 handle, and when we do we should see an attempt to reach the 118.50 level next. Ultimately, the Federal Reserve will continue to raise interest rate while the Bank of Japan is light years away from doing so. This should continue to drive this pair much higher, and therefore I have no interest in selling. In fact, even if we were to break down below the recent lows, I feel that there’s even more support at the 110 level.

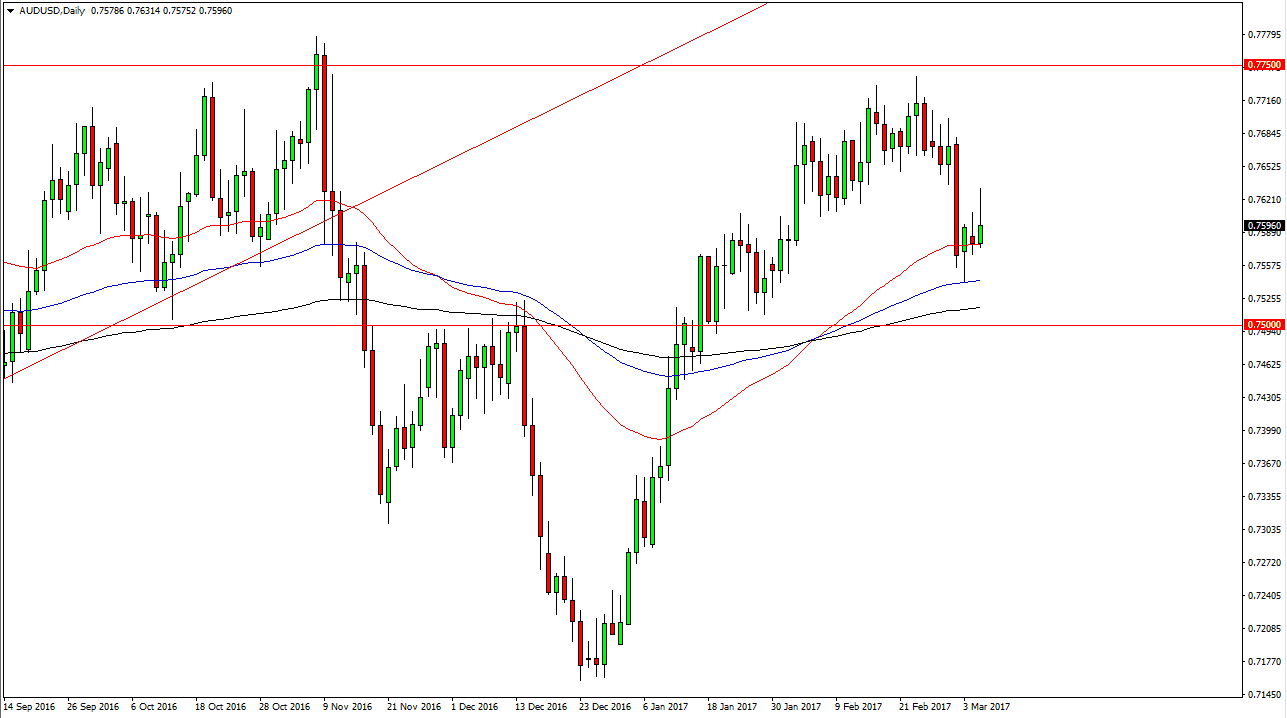

AUD/USD

The Australian dollar rallied initially during the day on Tuesday, became back quite a bit of the gains. A lot of this would been predicated upon the central bank suggesting that the global economy is starting to pick up a little bit, and that of course should drive the demand for commodities higher. However, technically speaking we did bounce off the 50-day exponential moving average and broke above the top of the shooting star from the Monday session, so I believe that longer-term we are going higher. That’s not to say that it won’t be choppy and the short-term, I believe that’s exactly what we’re likely to see. However, I don’t have any interest in selling and I believe that the 0.75 level below is the absolute “floor” in the market currently.

Given enough time, the Australian dollar will make another attempt at the 0.7750 level, but with Tuesday’s action I think that it shows we are going to see a lot of choppiness. If you can hang on for volatility, we could see profits.