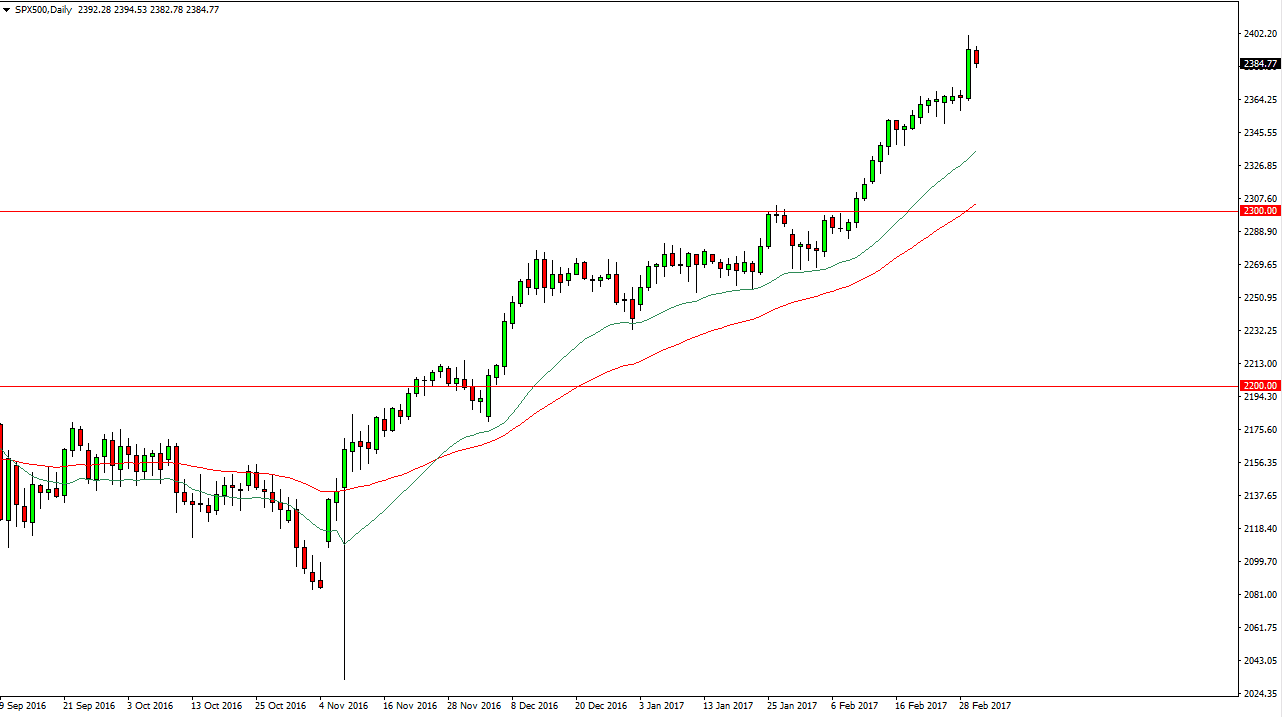

S&P 500

The S&P 500 fell slightly during the day on Thursday, but quite frankly after the run we’ve had it’s not a huge surprise. In fact, this pullback could be an opportunity to pick up a little bit of value. That value of course gives us an opportunity to take advantage of the market being “cheap.” Because of this, I’m waiting for some type a supportive candle to start going long. I think that somewhere near the 2375 level the buyers will return and we could bounce towards the 2400 level. I have no interest in selling, and think that eventually we will go to the 2500 level.

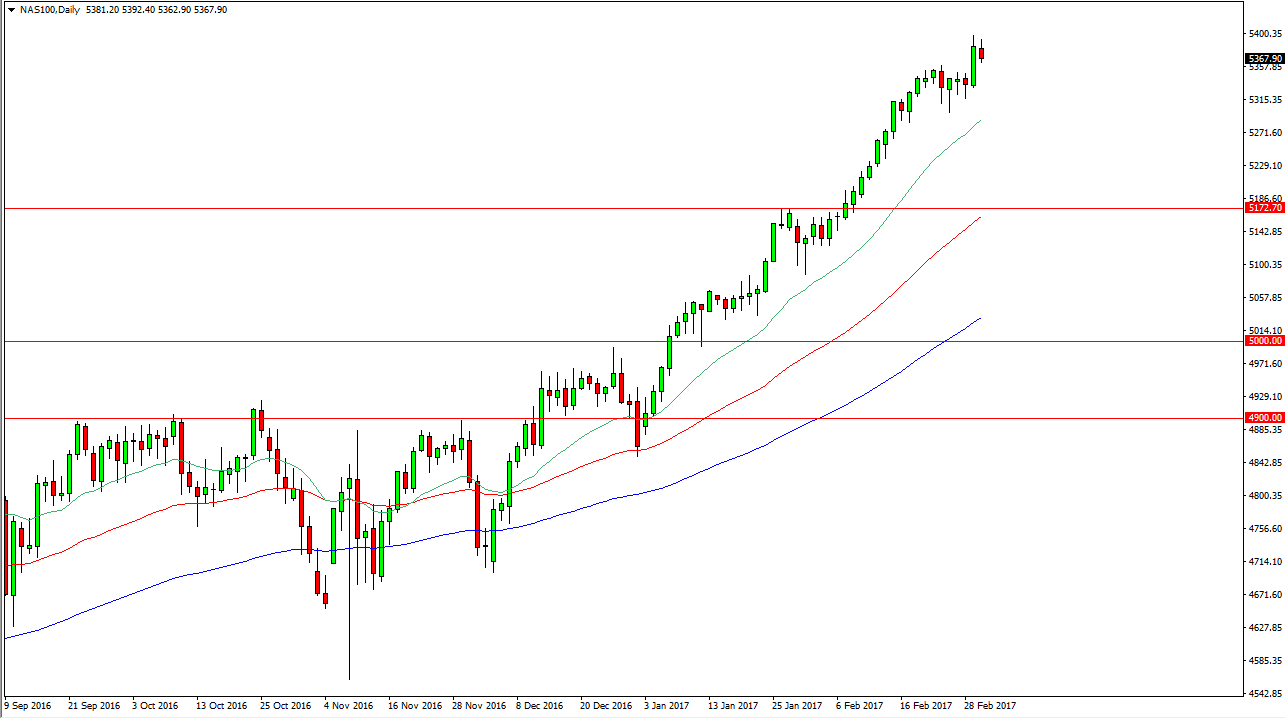

NASDAQ 100

The NASDAQ 100 fell a bit during the day on Thursday, taking little bit of a breather after taking off to the upside. Because of this, I believe it’s only a matter of time before the buyers get involved, and that should continue to push this market towards the 5500 level which is my longer-term target. Ultimately, I have no interest in selling and I believe there is more than enough support below at the 5300 level to keep this market afloat. The NASDAQ 100 has been one of the leaders when it comes to stock markets around the world and I think that will continue to be the case. You can see that the major moving averages are split far apart, and with that being the case the trend is still strong.

I think that we will not only reach the 5500 level, but I think that the market will go well above there. However, expect volatility from time to time but given enough time it’s only a matter of buying on the dips, and I don’t see any significant scenario where you would become a seller. Because of this, it’s long only for me.