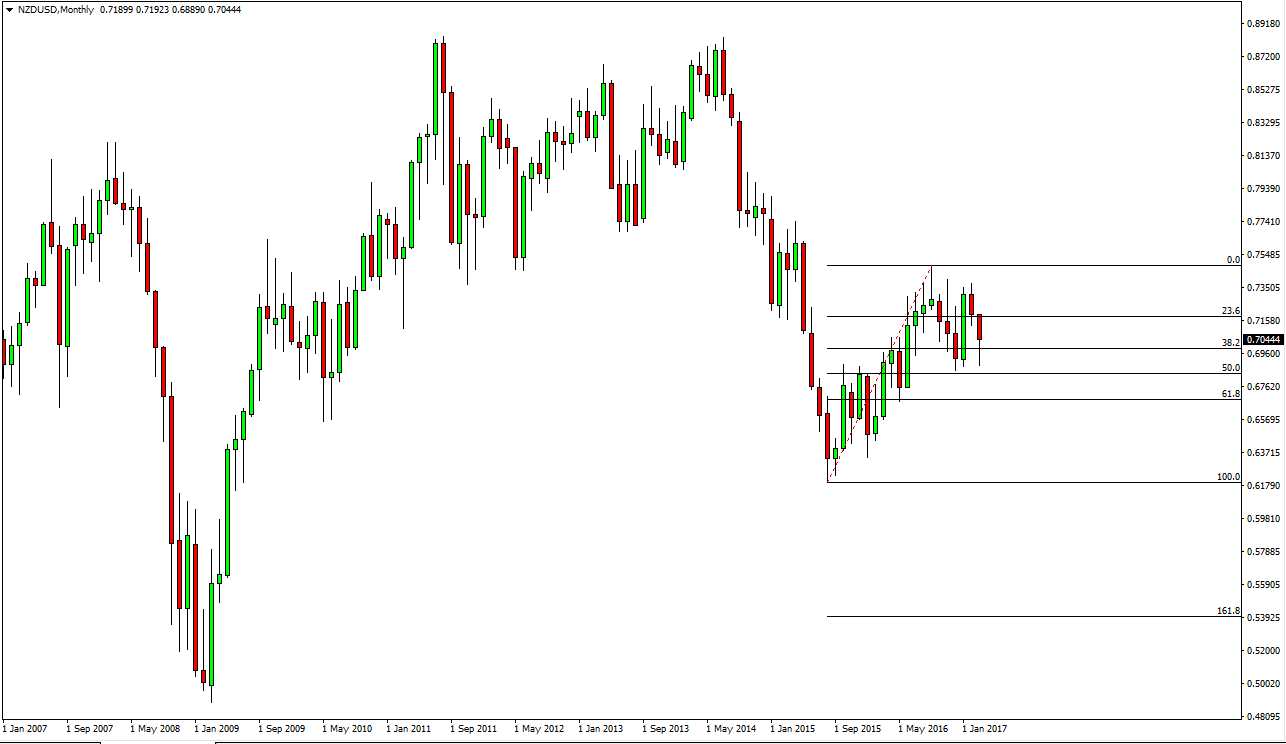

The New Zealand dollar had a relatively rough couple of months, but we still find plenty of support near the 50% Fibonacci retracement level from the bounce. The question now is whether we can continue to go higher. I think there are a lot of factors going on at the same time that will have an influence on this pair, not the least of which of course will be Federal Reserve interest rate hike expectations. I am of the camp that believes that 2 more interest rate hikes are coming, and therefore I think the dollar will firm up a bit. However, there is something to be said about the so-called “reflation trade”, and that helps commodities in general. Commodities help the New Zealand dollar as well, so if they can continue to rise, I believe it’s only a matter of time before this pair does.

Hammer?

The most recent monthly candle looks as if it wants to be a hammer, and if we can break above the top of that I feel that this market can go much higher. We should at least go to the most recent highs near the 0.75 handle, which of course is a large, round, psychologically significant number and tends to attract a lot of attention. A break above there since this pair to the 0.80 handle. It’s not even that I like the New Zealand dollar so much, it’s that the Australian dollar looks like it is ready to continue going higher, and there is a bit of a sympathy trade between these 2 currencies as they move in the same direction overall. With this in mind, it makes quite a bit of sense that the Australian dollar will simply “drag” the kiwi higher as well.

Alternately, if we can break down below the 61.8% Fibonacci retracement level at the 0.6750 level, I think the pair collapses and we go much lower.