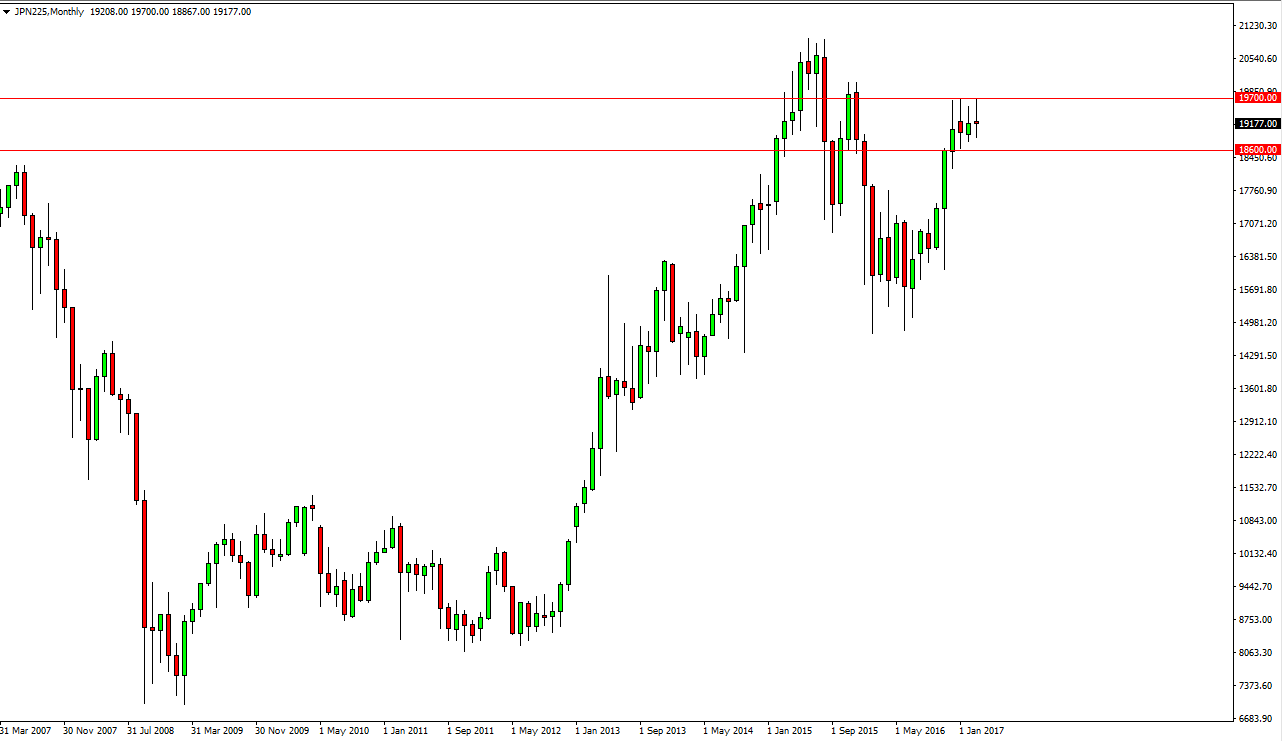

The Nikkei 225 has been very volatile over the last several months, consolidating between the ¥18,600 level and the ¥19,700 level. I believe that the Japanese yen will turn around and start selling off, and once it does that should be acceptable signals for buying opportunities, as the market should reach towards the ¥20,000 level after that. I believe that we go much higher than that, and the recent exhaustion is simply a function of a market that had risen so rapidly over the last several years. However, sooner rather than later buyers will return to this market and I believe that the Q2 of 2017 will be when it happens.

Buying pullbacks

I believe as long as we can stay above the ¥2600 level, buying pullbacks will be the way to go. Once we break above the ¥19,700 level, the market should then go to the highs. There will be a certain amount of psychological resistance at the ¥20,000 level, because it is such a large, round, psychologically significant number. With that being the case, I think it will simply add more volatility to the market that has been very choppy.

If we did breakdown below the ¥2600 level, I think the market will then go looking for support closer to the ¥17,000 level. So, having said this, I believe that this quarter will be very interesting for the Nikkei 225. I still believe in the upside though, although it certainly has struggled as of late. Even with that being the case though, the support has held true, and that suggests to me that the bullish traders still remain underneath.

Bank of Japan economic policy will continue to be rather soft, and that should continue to stoke the economy going forward. If the yen can continue to lose value, that helps with exports which is a major component of the Nikkei 225.