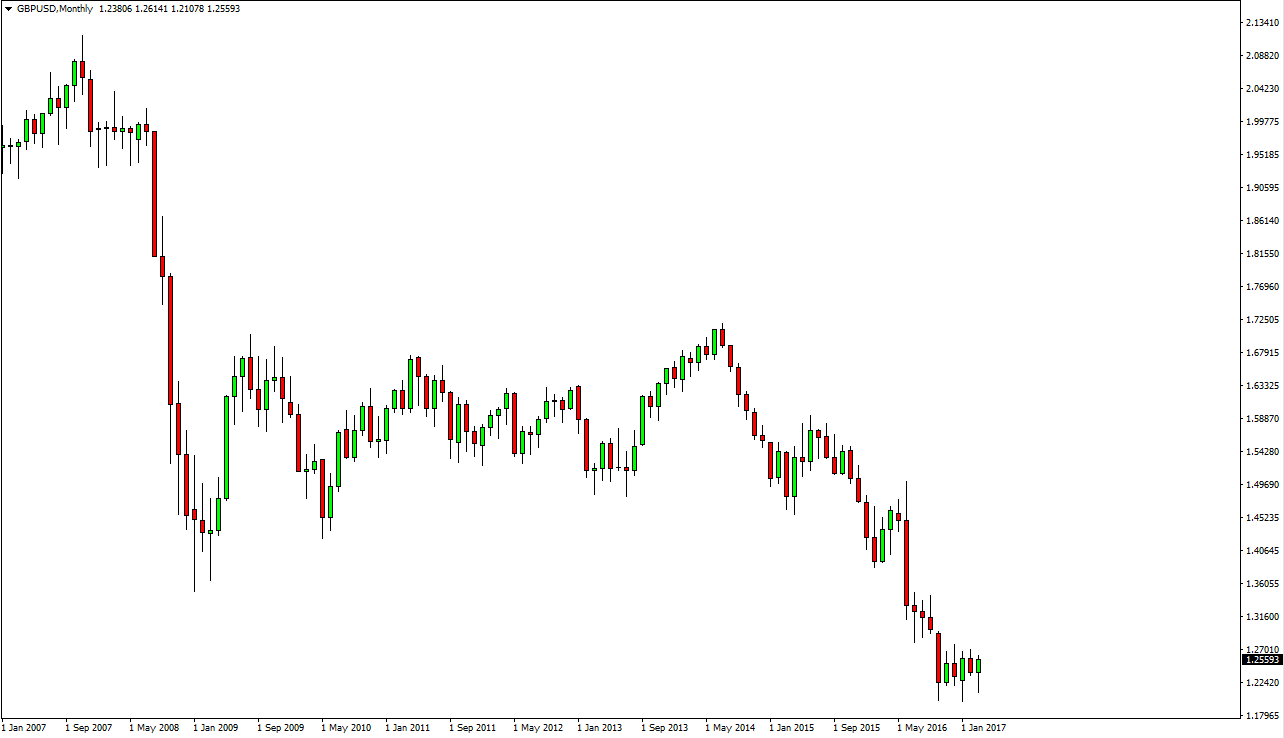

The GBP/USD pair has been the epicenter of quite a bit of volatility as of late. After all, one of the British decided to leave the European Union, it shocked the world. The British pound sold off drastically, and as I write this we are within a few sessions of triggering the so-called “article 50”, which is the beginning of the end of British participation and the European Union. This will have a bit of an effect in the markets but it’s not a surprise anymore so it’s difficult to imagine that there will be a major reaction. Quite frankly, I think we are starting to see the beginning of the end when it comes to the downtrend, and the monthly charts are starting to show the same thing as well as we have formed a couple of hammers off the 1.20 level below.

Longer-term uptrend?

Because of the Article 50 being triggered, that will get rid of some of the uncertainty when it comes to the British pound, and the next move by the British government. Because of this, I believe that it’s only a matter of time before the rally starts, and once we break above the 1.27 level I think that we have cleared enough resistance to continue to go higher. At that point, I would anticipate that the market will probably make a move all the way to the 1.45 handle, but I don’t necessarily think that it’s going to happen right away. It’s going to be a volatile ride to the upside, but I believe that the increasing inflation in the United Kingdom will continue to put pressure to the upside on the British pound as the Bank of England may be forced to raise interest rates much sooner than anticipated. With that in mind, I believe that a “buy on the dips” general strategy may be employed by a lot of traders. If we do get a pullback from the Article 50 being triggered, I believe that the 1.20 level will be an optimal buying opportunity.