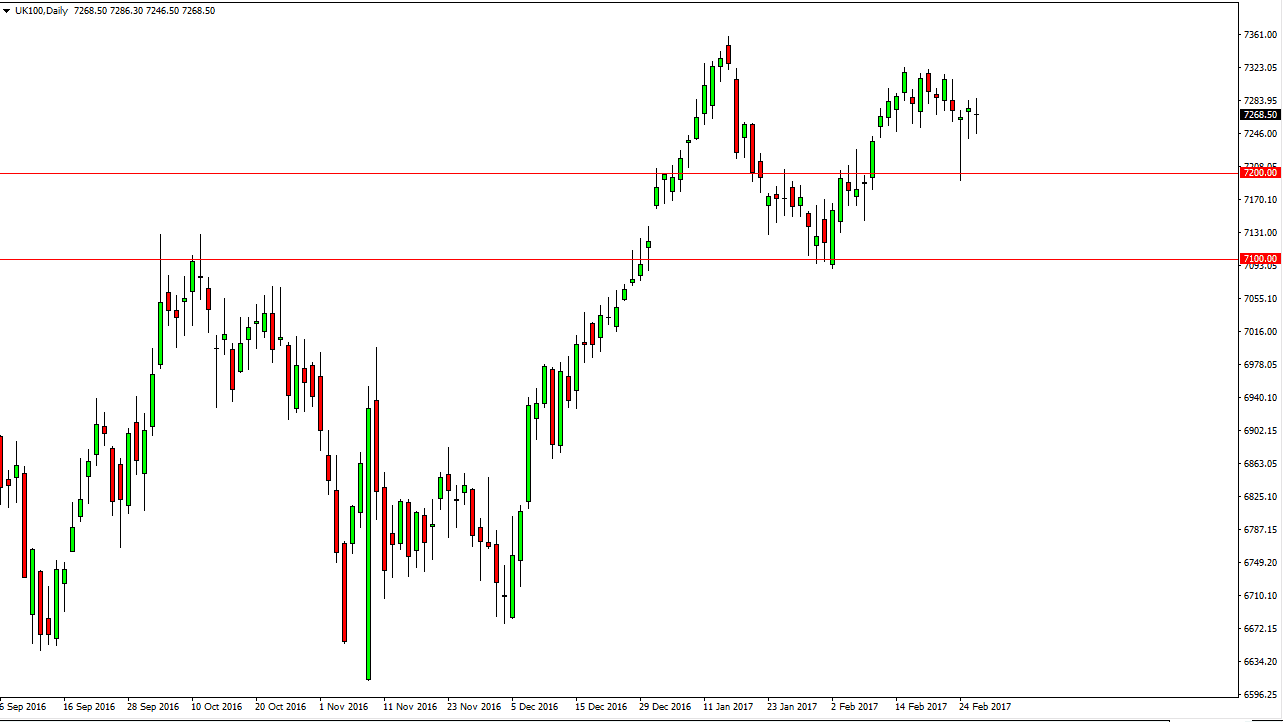

The FTSE 100 had a choppy session during session on Tuesday, but what catches my eye is the fact that we formed a hammer on both Monday and Friday from the previous week, and that the hammer used the 7200 level to bounce and show signs of life again. One thing that I’m looking at is the fact that we have been in a longer-term uptrend, and the most recent low, down at the 7100 level, was a significant pull back but hardly a trend change in event.

British economy

Despite what many would have said, the British economy has not fallen apart and quite frankly I think in the end it will be realized that the European Union economy is probably in more trouble. With this being the case, the FTSE 100 should continue to go higher, as a lot of the original selloff would have been since there were concerns about trade agreements, but quite frankly most of the world is lining up to sign unilateral agreements with the British.

Now that we have seen the 7200-level act so supportive, I believe that it’s only a matter of time before the buyers get involved every time we dip, so short-term charts could be used. I think that buying this market is more of a longer-term trade, but eventually we will break above the 7360 handle, and continue to the upside as there has been some of bullish pressure. I have no interest in selling, at least not until we break down below the 7100 level which would be a “lower low” on the longer time frames. I believe that the FTSE 100 will continue to go higher, just as many other stock indices around the world have been. Ultimately, I believe that the 7500 level will be targeted as it is a large, round, psychologically significant number.