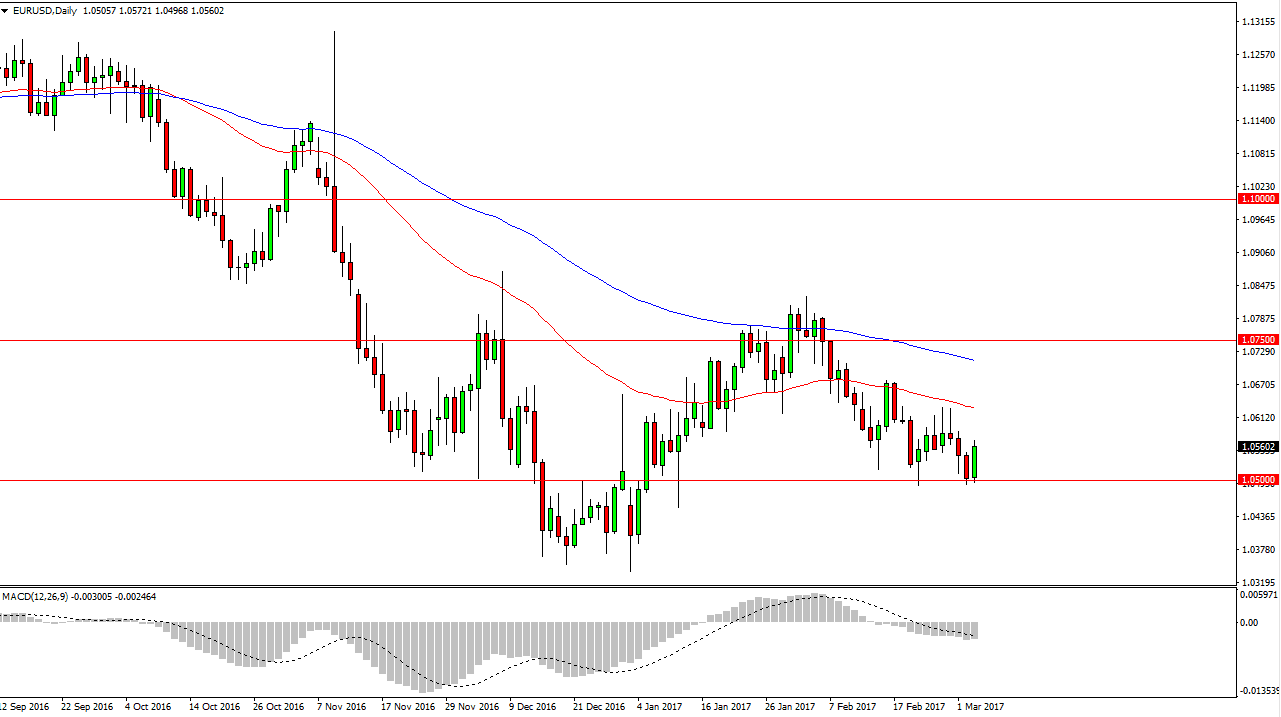

EUR/USD

The EUR/USD pair rallied a bit during the day on Friday, bouncing off the 1.05 level. That’s an area that has been supportive lately, so having said that it’s likely that we will continue to see buyers in that area, so having said that it’s likely that we will see market participants pay close attention to that area. If we can break below that support though, that would be very negative and we could see the EUR/USD pair reaching towards the 1.0350 level rather quickly. This is a market that every time it rallies I believe that the sellers will get involved, and the 50-day exponential moving average above continues to be resistive as far as I can see.

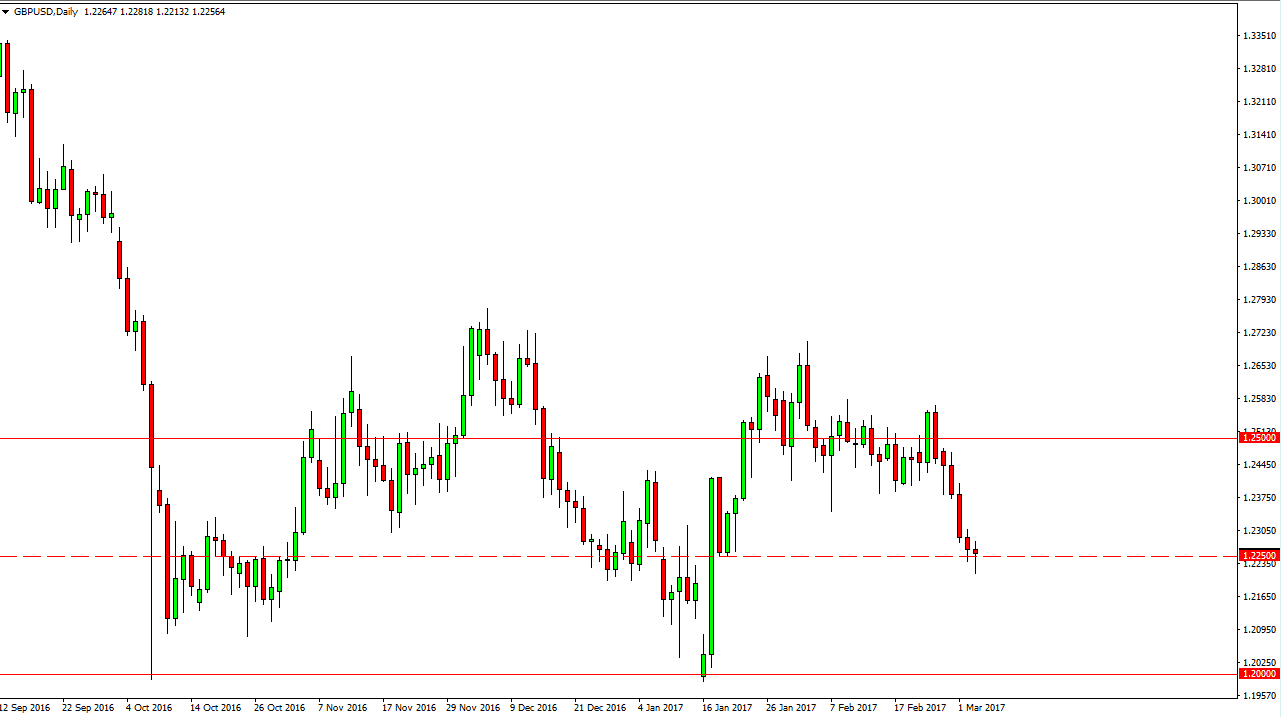

GBP/USD

The British pound fell during the day on Friday, but turned around to form a bit of a hammer. That being the case, looks as if the 1.2250 level will continue to be of interest when it comes to traders. If we can break above the top of the candle for the day, I feel that we will then bounce towards the 1.24 handle. A breakdown below the bottom of the candle would be rather negative though, and could send this market looking for the 1.20 level underneath. Ultimately, this is a market that should face quite a bit of volatility ahead, and I recognize that the Article 50 being targeted and triggered going forward could be a catalyst for negative momentum in the British pound. However, I believe that’s the absolute low just waiting to happen.

In the meantime, I’m a buyer of short-term pullbacks that show signs of support as they offer nice short-term scalping opportunities. A breakdown below the bottom of the candle for the session on Friday would be a little bit more of a longer-term move in my estimation.