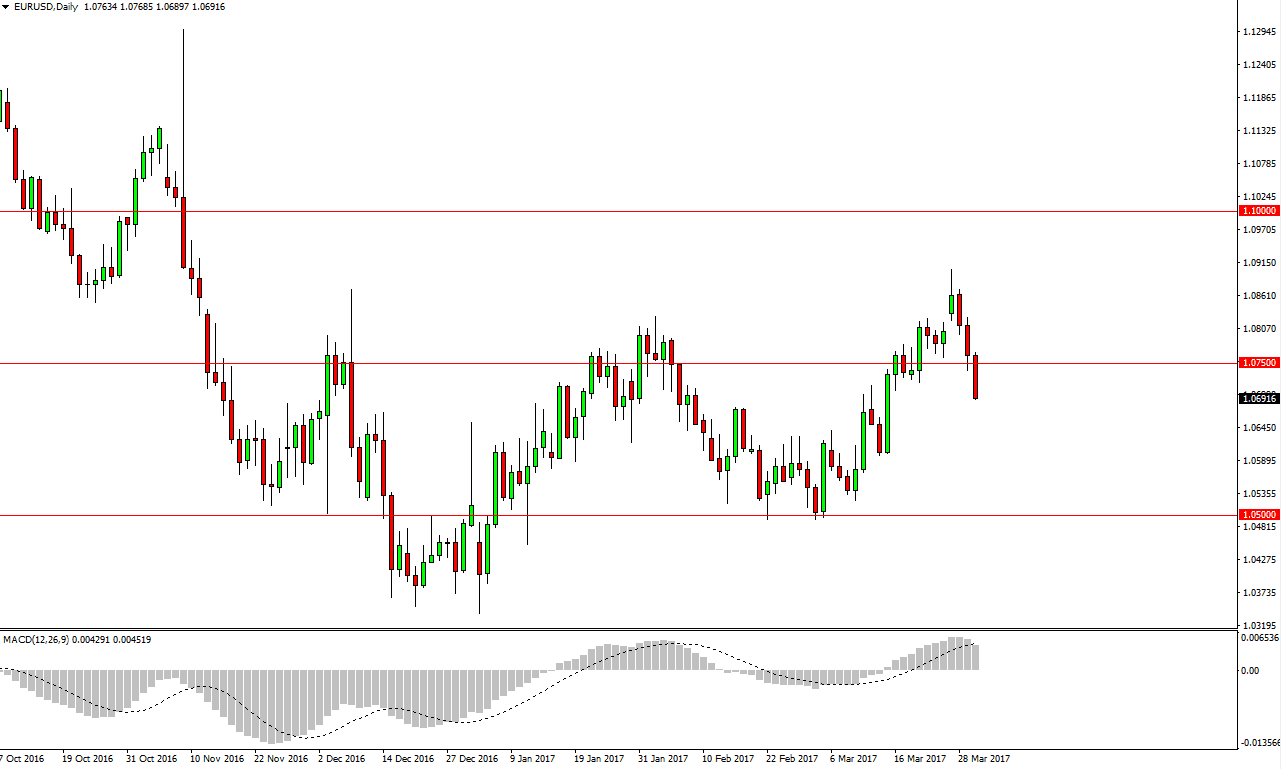

EUR/USD

EUR/USD

The EUR/USD pair fell during the trading session on Thursday, and even broke below the 1.07 level during the day. This is a very sign, and I think that the downward momentum is going to continue now. The next serious support I see as near the 1.06 handle, so I think short-term sellers will come into the market from time to time. Given enough time, I do think the buyers come back but currently it looks as if the sellers are in control. The market continues to be very volatile and I suspect that this has a lot to do with Great Britain finally triggering the Article 50, and concerns that the effect will be negative for the European Union. German economic numbers were a little light during the session so that of course didn’t help either.

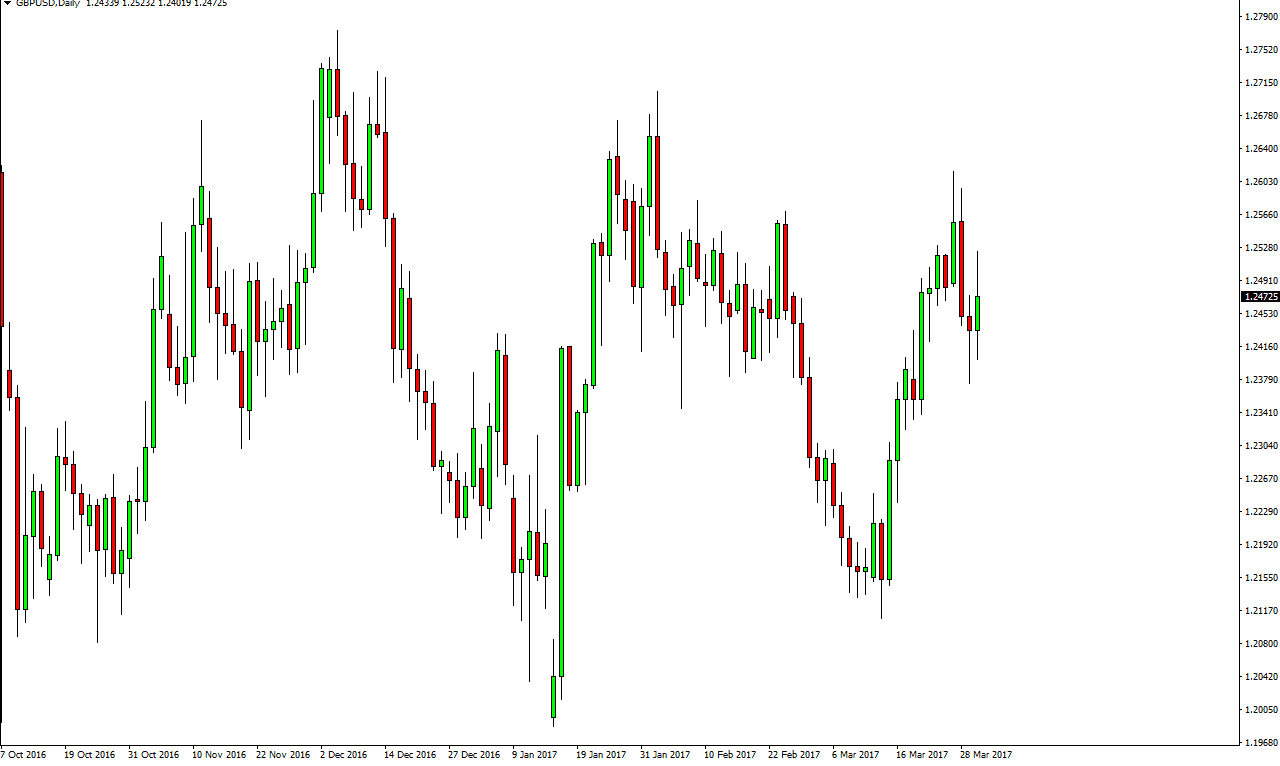

GBP/USD

The British pound has a lot of different fundamental issues facing it now. While some people think that the worst is over, myself included, there cannot be a serious discussion about this currency without the downward risks being ever present. In other words, I think that no matter what happens it’s going to be choppy and this is something that you must be prepared to deal with. I still believe in the longer-term uptrend going forward, but I recognize there are going to be setbacks. The setbacks will probably be driven by headlines, so expect the volatility to pick up from time to time. When it does, it can be somewhat dangerous.

I still believe that the real fight is somewhere near the 1.27 handle, and that region will more than likely determine the longer-term direction of this pair going forward. The fact that we formed a hammer during the Wednesday session of the 1.24 level is encouraging, but I recognize that we are going to have a lot of work to do to break out to the upside.