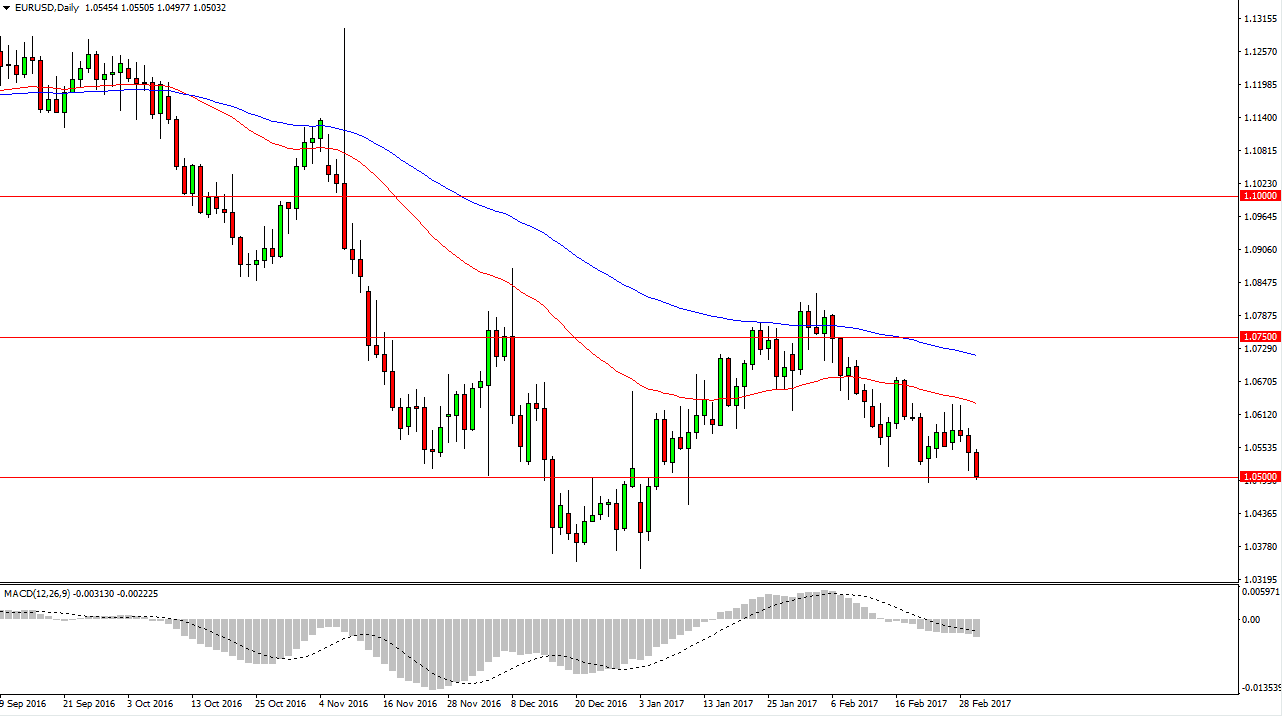

EUR/USD

The EUR/USD pair fell hard during the day on Thursday, as a continues to test the 1.05 level for support. So far, it has found buyers in that area, but it appears that it is only a matter of time before we break down below there. Once we do, the market should then reach towards the 1.035 level, but it won’t necessarily be an easy move. It is with the longer-term downtrend though, so I believe that the only then you can do in this pair is continue to sell. I prefer to sell on rallies when they appear, but right now it looks as if we are going to make a serious attempt to break down.

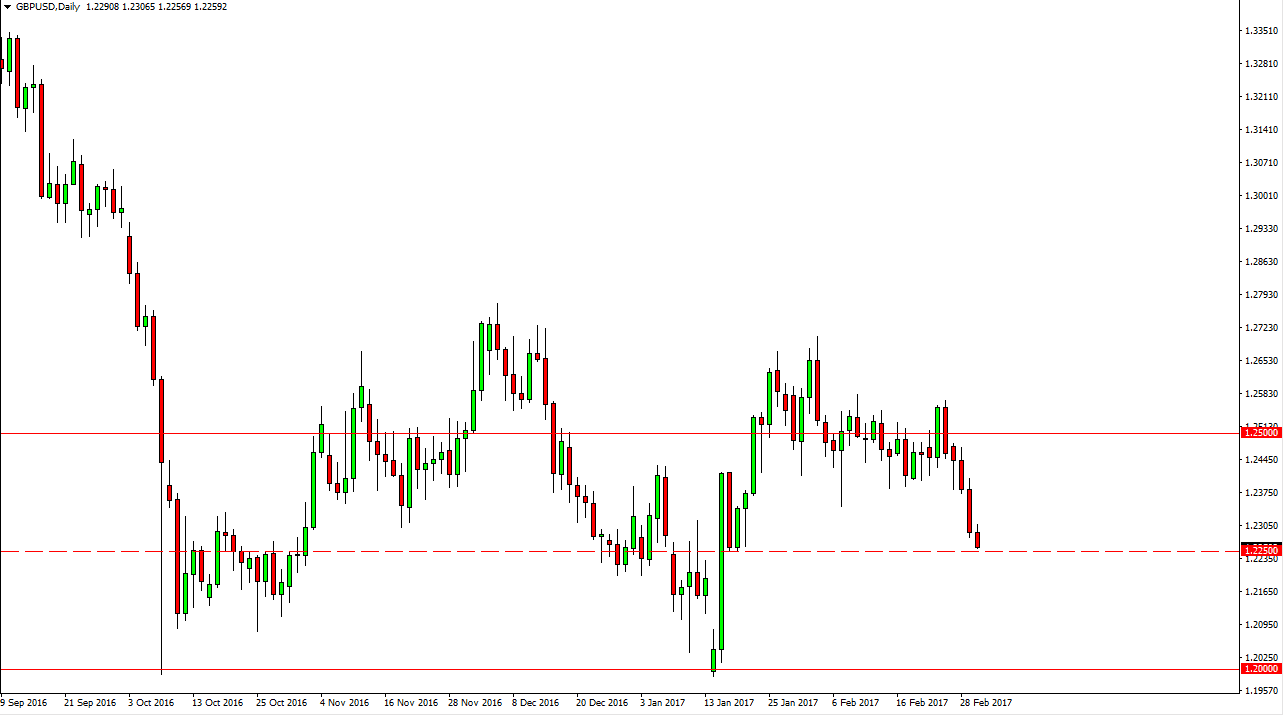

GBP/USD

The British pound fell a bit during the day on Thursday as well, as we continue to fall in general. The 1.2250 level is supportive though, so I think it’s not until we breakdown well below there that we can really start selling with any type of gusto. Alternately though, if we can break above the top of the session for the Thursday trade, the market could find itself bouncing towards the 1.240 level. The market obviously is negative, but I don’t necessarily think that this has a lot to do with the British pound, but may have more to do with the US dollar as interest rate hikes seem to be a little bit more on the table for March than they were previously. Because of this, I believe in US dollar strength but eventually the British pound may turn around. Once the Article 50 is triggered, it’s likely that we will get one more very massive move lower, but that should be about the end of it. Once we do bounce, I think the 1.24 level is a barrier, as well as the 1.25 level. Alternately though, I think longer-term we are trying to make a bit of the bottom.