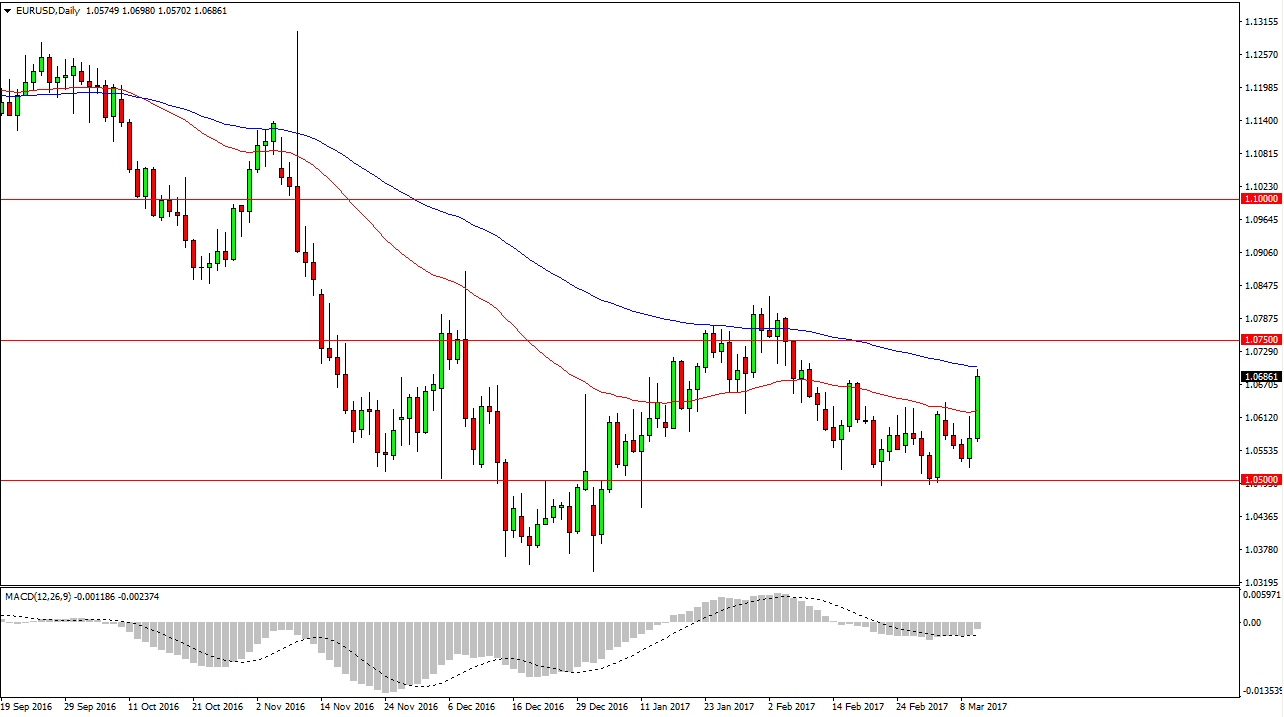

EUR/USD

The EUR/USD pair broke higher during the session on Friday, as the 1.07 level has been tested. The 100-exponential moving average is just above, and I think that it’s only a matter of time before we will start to see some resistance. However, I think that the market should continue to find bullish pressure in the short-term, and as a result I think in the interim, you have to be buyers but somewhere near the 1.0750 level I think that the sellers will come back into play. If we can break above the 1.08 handle, and then I think the EUR is free to go to the 1.10 level. Either way, expect a lot of volatility which is typical for this pair.

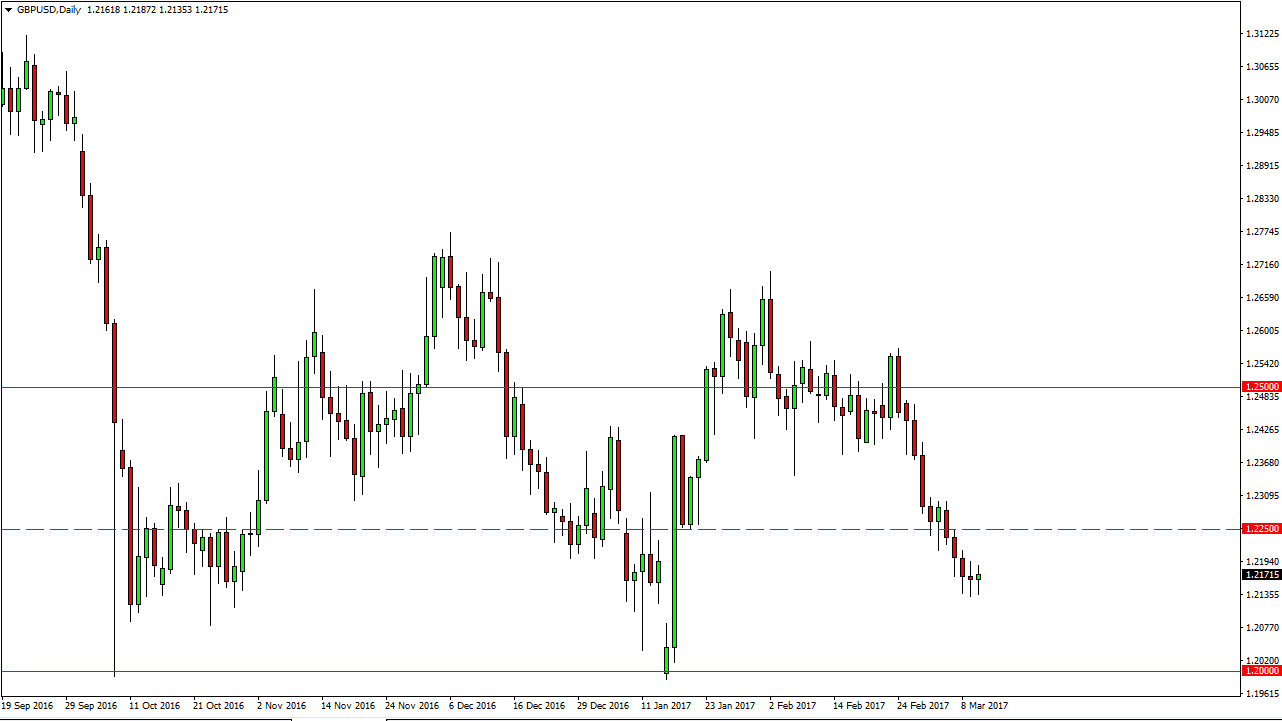

GBP/USD

The GBP/USD pair fell initially during the day on Friday, but found enough support underneath to turn things back around. This is a significant support area, as it was the top of the gap from January. The 1.2250 level above could be resistive though, so if we can find some type of exhaustive candle in that area, the sellers will more than likely come out and start shorting again. If we broke above the 1.23 level, the market could go much higher. However, the market looks as if it is trying to reach towards lower levels, perhaps of the 1.2050 level underneath. The British pound should continue to be very volatile overall, and I think that we are going to see more selling pressure, as the Article 50 comes out. Once that happens, the market looks as if going to have a moving it is going to have a strong move lower, which should be the end of the selling pressure. I think that eventually will get the grand a “flush” that is needed to get the market thinking about longer-term buy-and-hold trading.