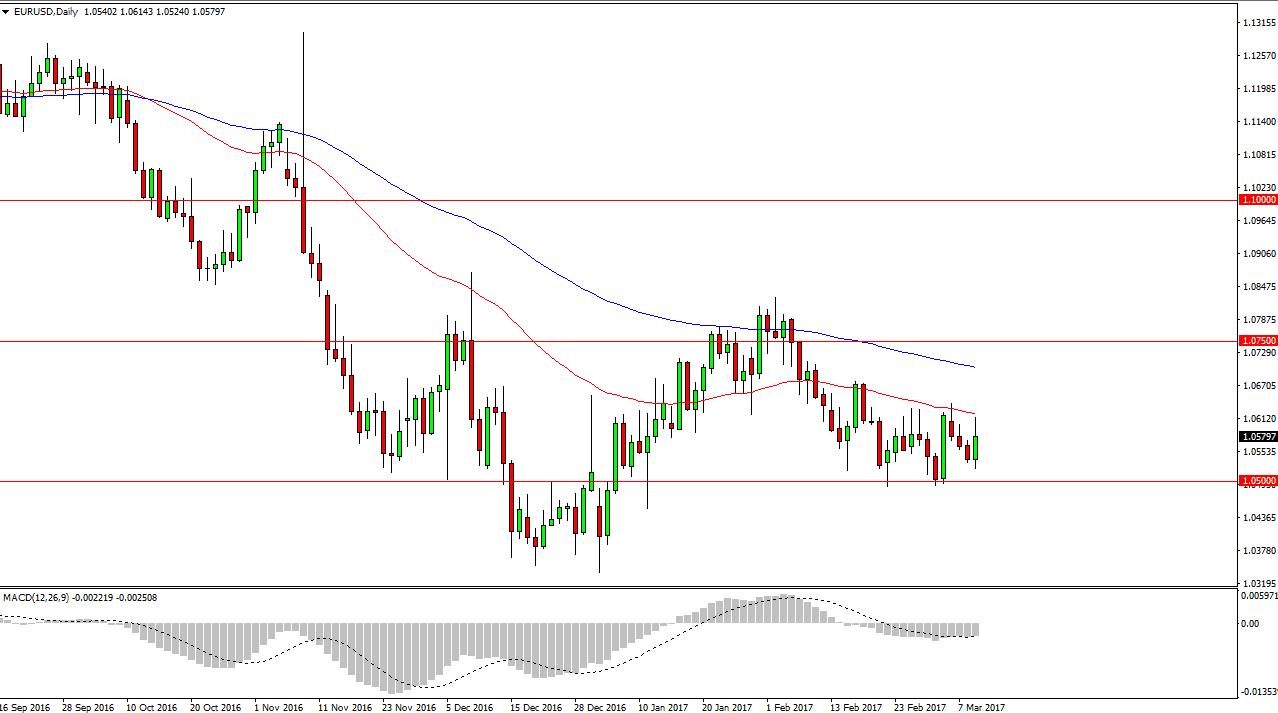

EUR/USD

The EUR/USD pair rallied during the day on Thursday, testing the 50-day exponential moving average yet again. However, we found resistance there as we have in the past, and thus it looks like we are still going to try to grind down to the 1.205 handle. Part of the reaction of course was that the ECB suggests less quantitative easing will be needed, but really the key part of the equation is that the Federal Reserve is not doing the same, and so having said that it’s likely that the US dollar will continue to strengthen. If we can break below the 1.05 level, the market should then go down to the 1.0350 level.

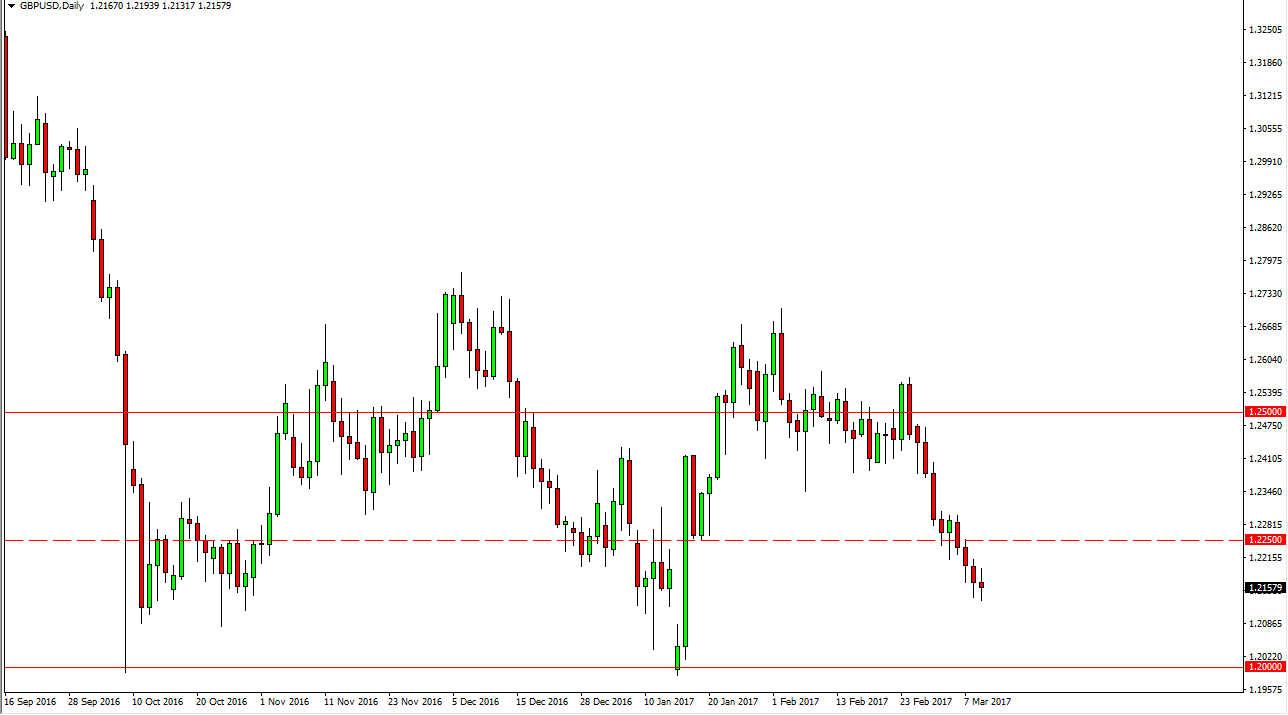

GBP/USD

The British pound of course continues to look soft, but we are bit oversold so it’s possible that we could rally a bit from here, looking for resistance near the 1.2250 level. Ultimately, if we see and exhaustive candle there, I think it’s a selling opportunity. Breaking down below the bottom of the range for the session on Thursday sends this market looking towards the 1.2050 level, which was the gap from the initial move higher. I believe that the Article 50 will be triggered relatively soon, and that could be the beginning of the end for the downtrend in the British pound. Ultimately, I look for selling opportunities and the short-term, but I do recognize that the 1.20 level is massively supportive, and of course on longer-term charts the 1.15 level is even more supportive on the multi-decade charts.

If we do break above the 1.23 level, the market could then start heading back towards the 1.25 level although I think the negative pressure will continue and the short-term, so I believe that it is more likely that a rally will only offer opportunities to pick of value in the US dollar.