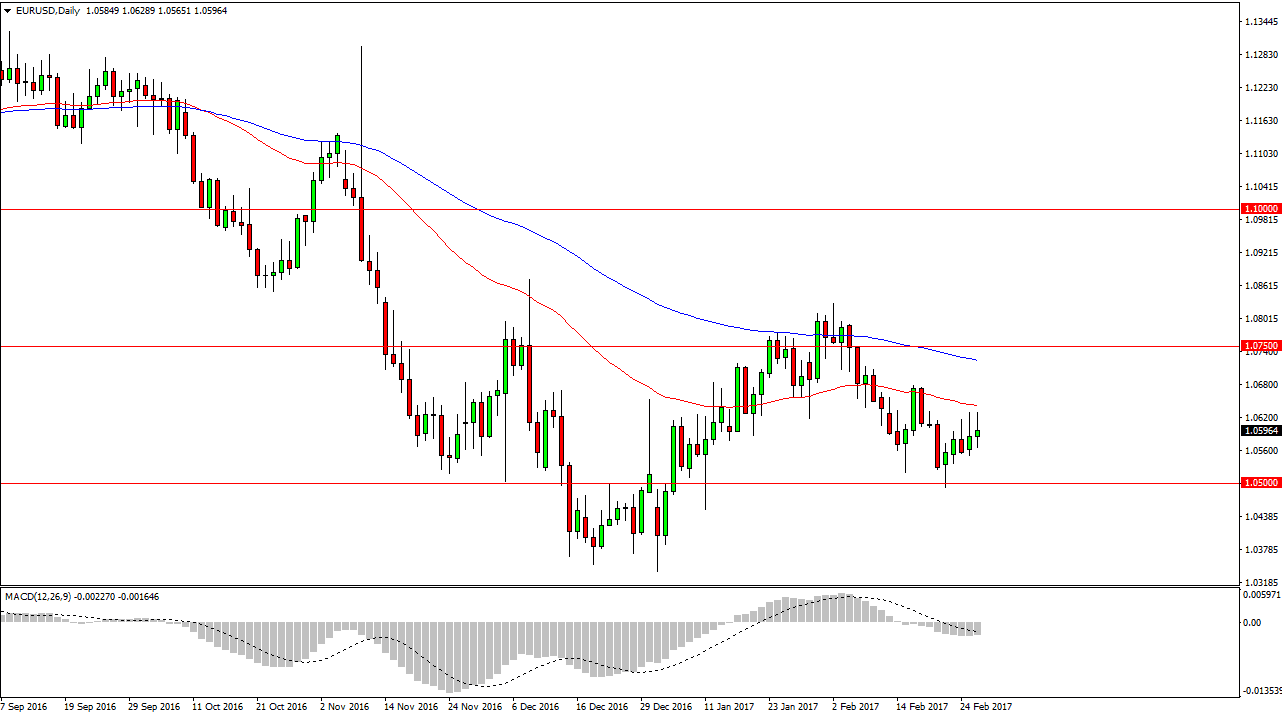

EUR/USD

The EUR/USD pair initially rallied during the day on Tuesday, but the 50-day exponential moving average has yet again offered resistance. It looks now that every time this market rallies, the sellers are willing to jump in. I believe we are going to reach towards the 1.05 handle underneath, but that is a massive barrier to overcome. Because of this, I think short-term scalping to the downside will more than likely be the best way to trade this market, and therefore short-term rallies offer value in the US dollar. If we can break down below the 1.05 handle, we should then reach towards the 1.0350 level. The downtrend continues, so therefore I have no interest in buying.

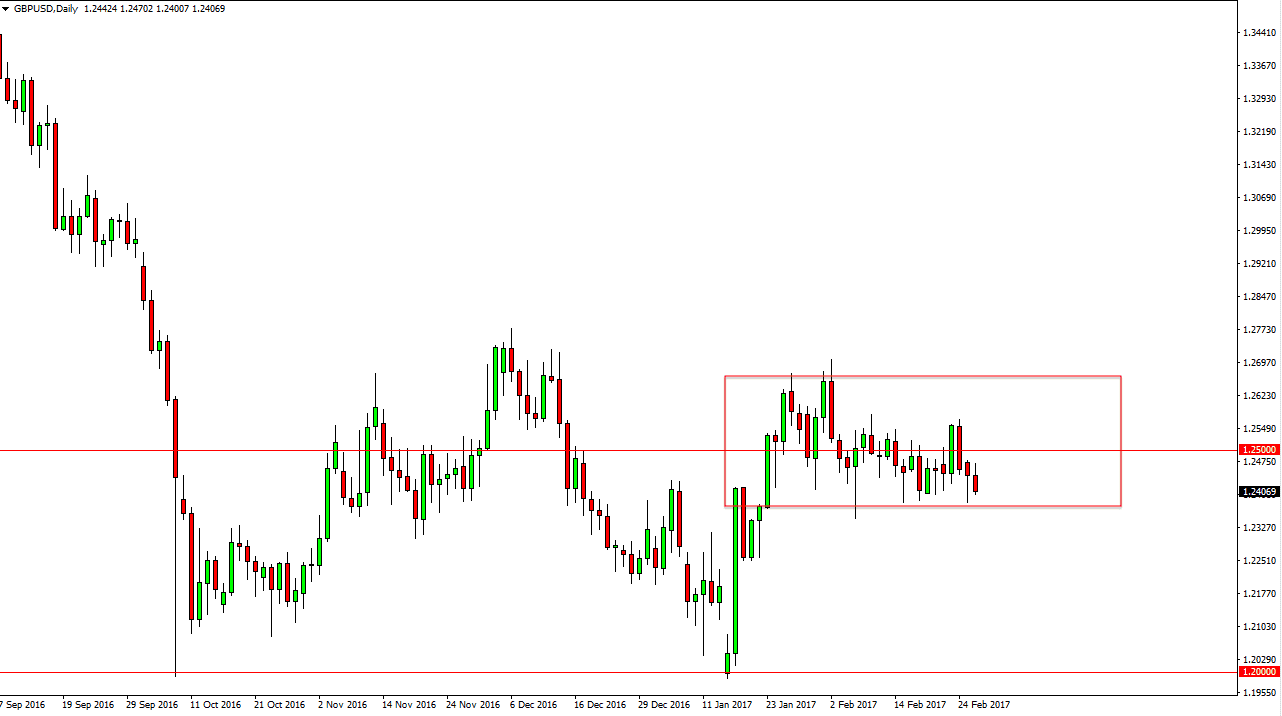

GBP/USD

The British pound initially rallied on Tuesday, but turned around to test the 1.24 region. There is a significant amount of support just below, some not quite ready to start selling but I honestly don’t have the balance am looking for to go long. Because of this, a supportive candle should be a nice buying opportunity and then send the British pound to the 1.2550 level above. If we can break above there, the market should then reach towards the 1.27 handle, and then even higher than that.

Ultimately, I think there is going to be a lot of volatility in this market, and it appears that people are starting to speculate that Scotland may start another referendum due to the Article 50 being triggered soon, but quite frankly I think this is just noise. I still believe that we are going to go higher over the longer term but we could see an exhaustive moved to the downside once the Article 50 gets fired off, but that should be the absolute bottom of this market. In the meantime, I believe that a short-term pullback is simply going to be a short-term buying opportunity.