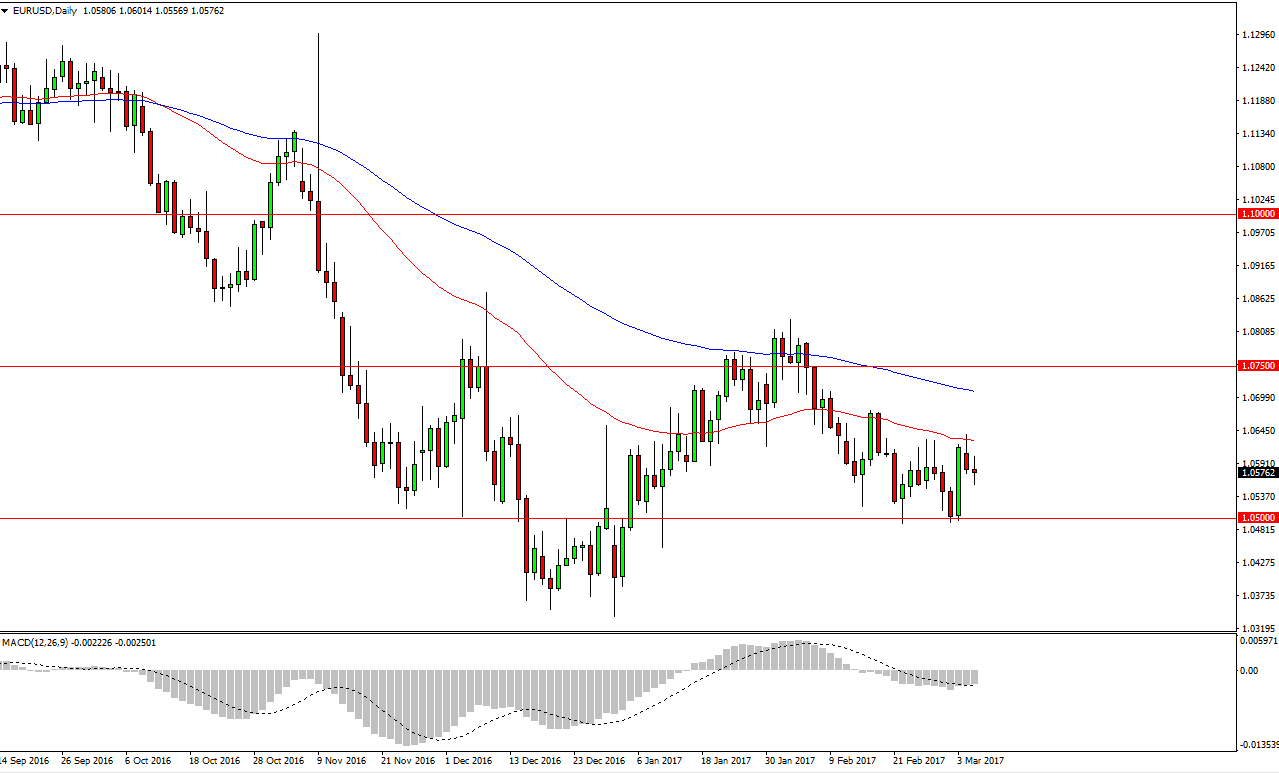

EUR/USD

The EUR had a choppy session during the day on Tuesday, as we continue to see a little bit of a downward bias. I believe ultimately that this market will continue to see quite a bit of volatility but overall, I believe that the sellers are in control. It looks as if the market needs to test the 1.05 level again, and once we break down below there week could see the market reach towards the 1.0350 level below, which of course is massively supportive. Any rally at this point will be a selling opportunity as far as I can see, so waiting to see whether we get and exhaustive candle on short-term charts to take advantage of US dollar strength longer term.

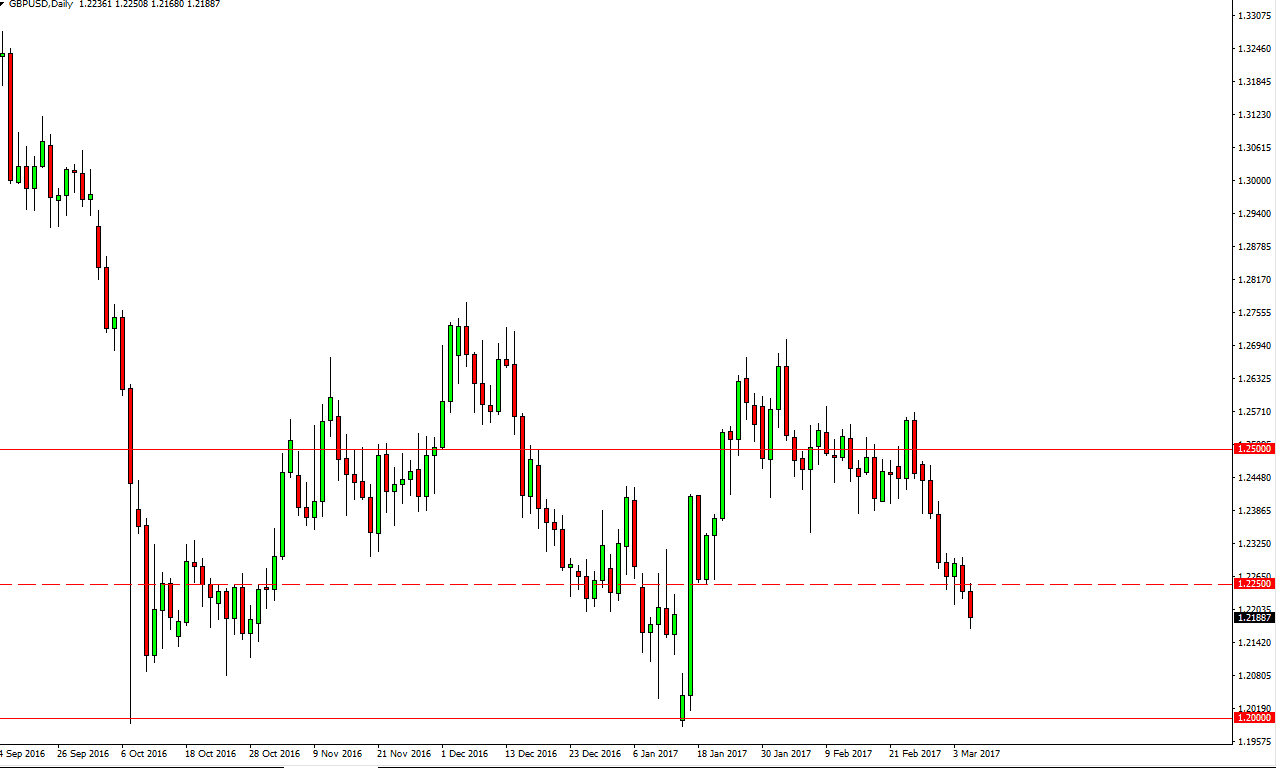

GBP/USD

The British pound fell during Tuesday’s trading action, breaking below the 1.2250 level. By doing so, I believe that the market is now going to make a general move towards the 1.2050 level underneath, and if we can stay below the 1.2275 level, I believe that the sellers will continue to run the market, at least in the short term. We are getting relatively close to the Article 50 being released, and once it is, the market should then sell off drastically. However, I believe that is when you are going to see the bottom of the downtrend. Because of this, I believe that a moved to the 1.20 level is probably reasonable, and looking at the longer-term charts I know that the 1.15 level below there is the absolute bottom over the last several decades. We could see this market drift as low as there, and still be looking for bounces after the Article 50 is triggered.

I believe that the announced death of the United Kingdom was a bit premature, and thus I am willing to buy the British pound longer term, but I recognize that short-term trading will favor the downside due to this most recent breakdown.