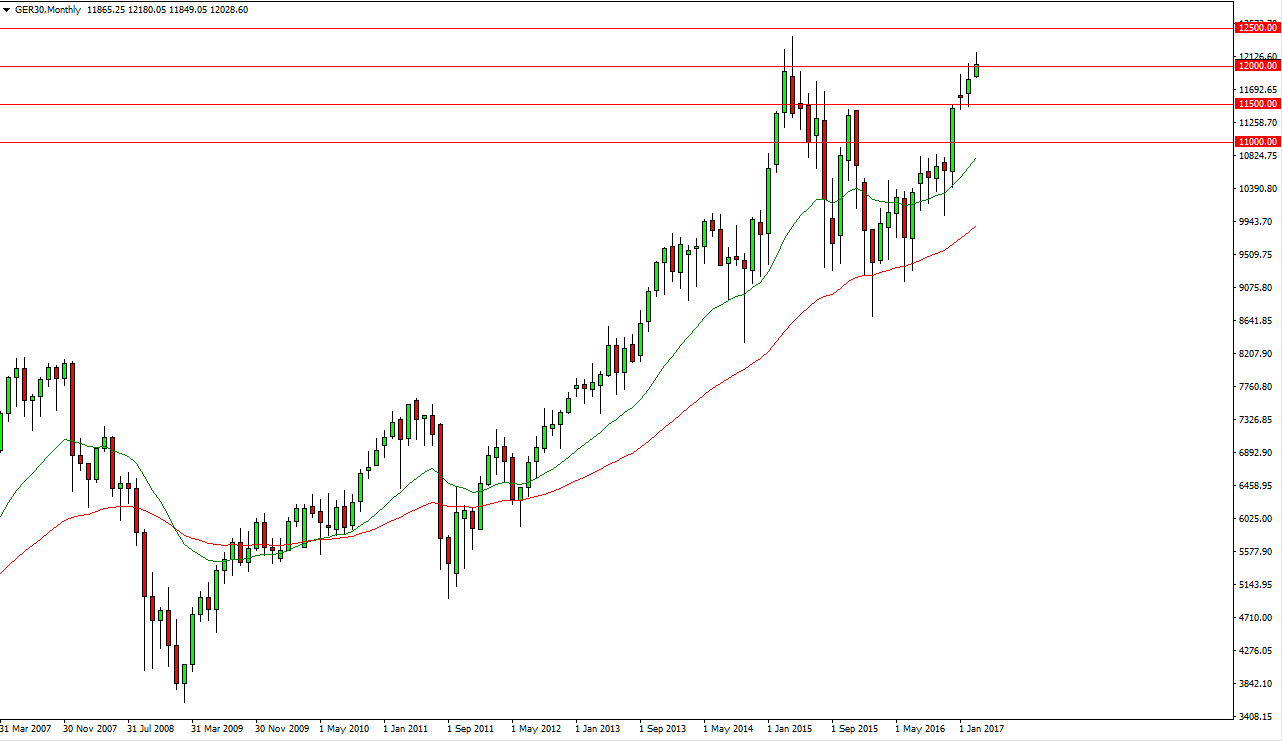

The German index has been rather bullish over the last several months, as we have broken above the €12,000 level. By doing so, the market looks as if it is rather healthy and there is still a significant amount of buying pressure underneath. I’m still very bullish of the DAX, as it tends to lead the rest of the European Union higher. After all, most of the strongest companies in the European Union are based in Germany, so it tends to be more or less the “blue-chip stocks” of the continent.

With all of the uncertainty around the European Union right now, it makes sense that most traders will be looking for some type of safety. This can be found in Germany in contrast to places like Italy and Spain. That gives us a little bit of a built-in bid, and the price action backs up that theory. Because of this, I am a buyer of dips and realize that we will more than likely not only breakout, but continue to go much higher over the longer term.

Healthy pullback

The healthy pullback that we have seen recently only offers more value in a market that clearly has been bullish. I believe that given enough time we will reach towards the €15,000 level, but it is obviously going to take some time to get there. Because of this, I am a bit hesitant to go “all in”, but buying dips going forward might be a viable trading strategy.

The €11,000 level underneath should be the absolute floor, but quite frankly I would be surprised if we reached down towards that area. At that point, you should wonder whether or not the markets will continue to see overall strength. The DAX is probably one of the strongest indices around the world right now, with perhaps maybe the lone exception of the NASDAQ 100.