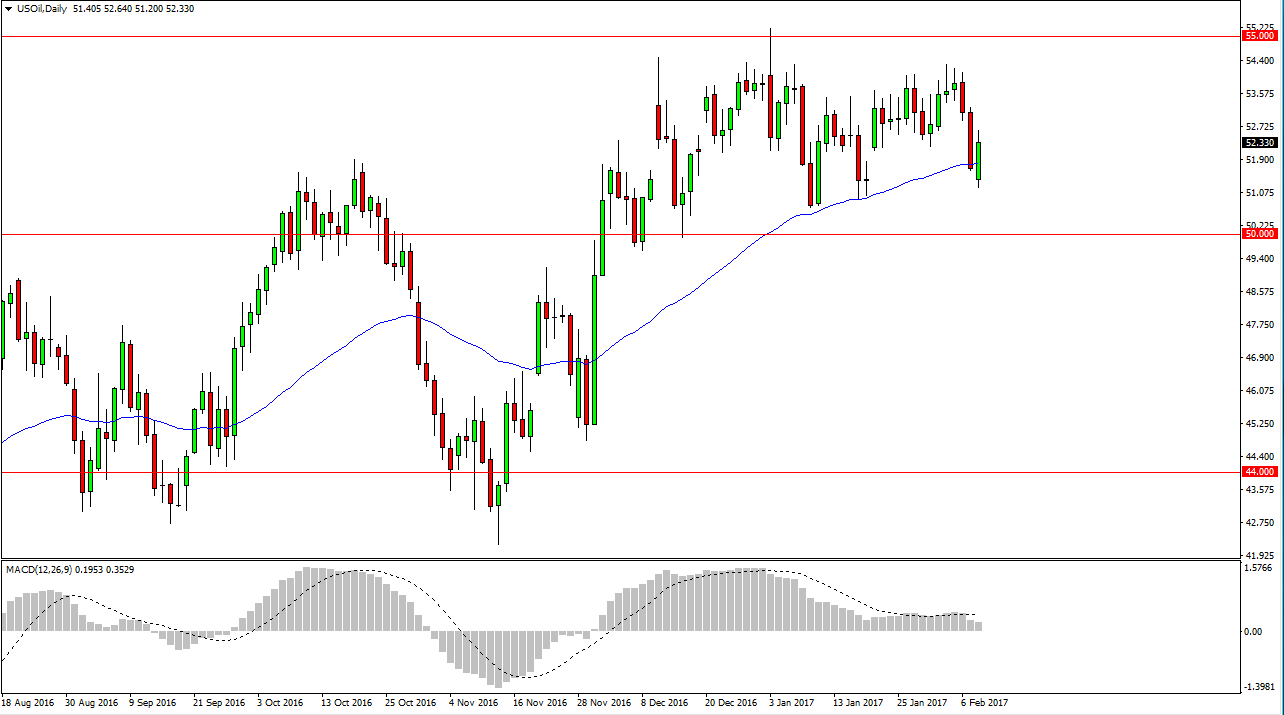

WTI Crude Oil

The WTI Crude Oil market rally during the day on Wednesday, even after we get a very bearish announcement coming out of the inventories indicator. However, the market continues to have a lot of bearish pressure in it, so I believe it’s only a matter of time before we roll over and start selling off again. The candle is reasonably strong, but I believe that we will eventually reach towards the $51 level and then the $50 level. Because of this, I’m waiting for exhaustive candles on short-term rallies to take advantage of shorting. The $54 level above continues to be resistive, and I believe that resistance extends all the way to the $55 level. On the bottom part of the chart, you can see I have the MACD shown, and it is starting to show a drop in upward momentum, so I believe it’s only a matter of time for the sellers get involved.

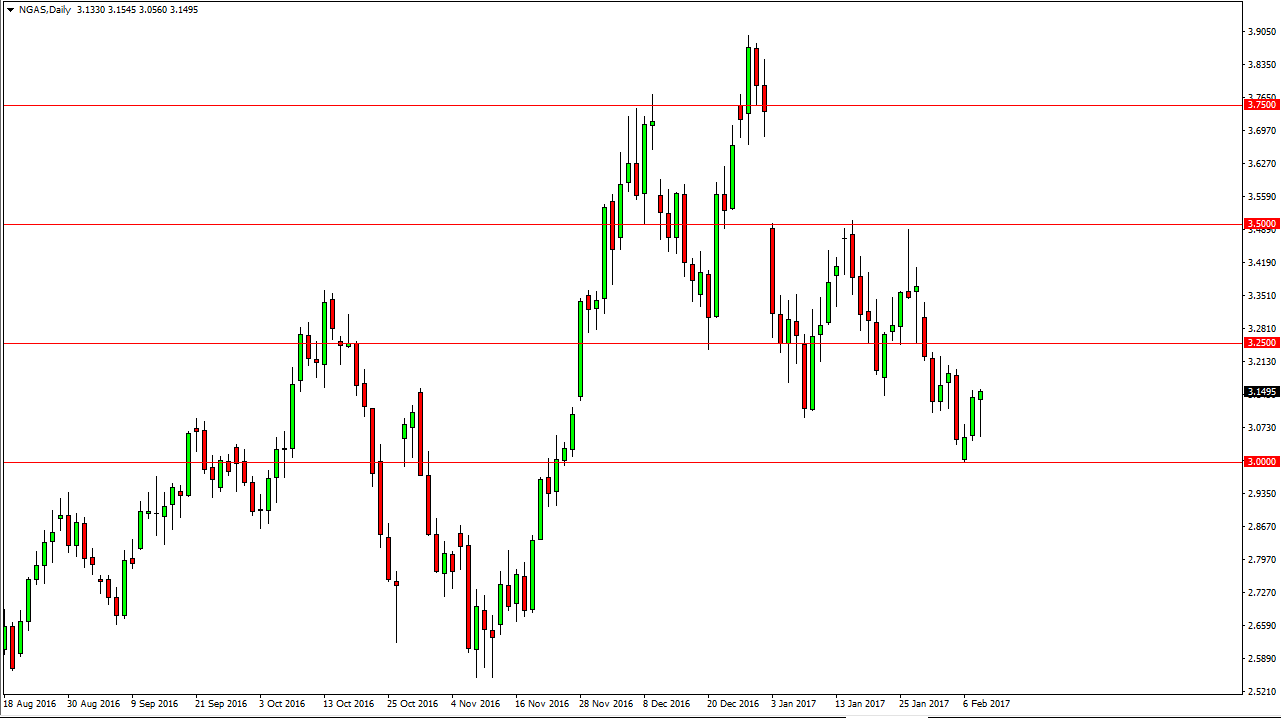

Natural Gas

Natural gas markets initially fell during the session on Wednesday, but turned around to form a hammer. The hammer of course is a bullish sign but I recognize that there is a lot of resistance above, and we certainly have a lot of bearish fundamentals out there. Because of this, I’m waiting to see whether the $3.25 level above offers enough resistance to turn the market back around. If we get an exhaustive candle in that region, I will not hesitate to start selling. Even if we break above there, I see even more resistance above there, and extending all the way to the $3.75 level, which of course is a long distance from here. In other words, this is a “so only” market as far as I can see, now I just must wait for the right trading signal.