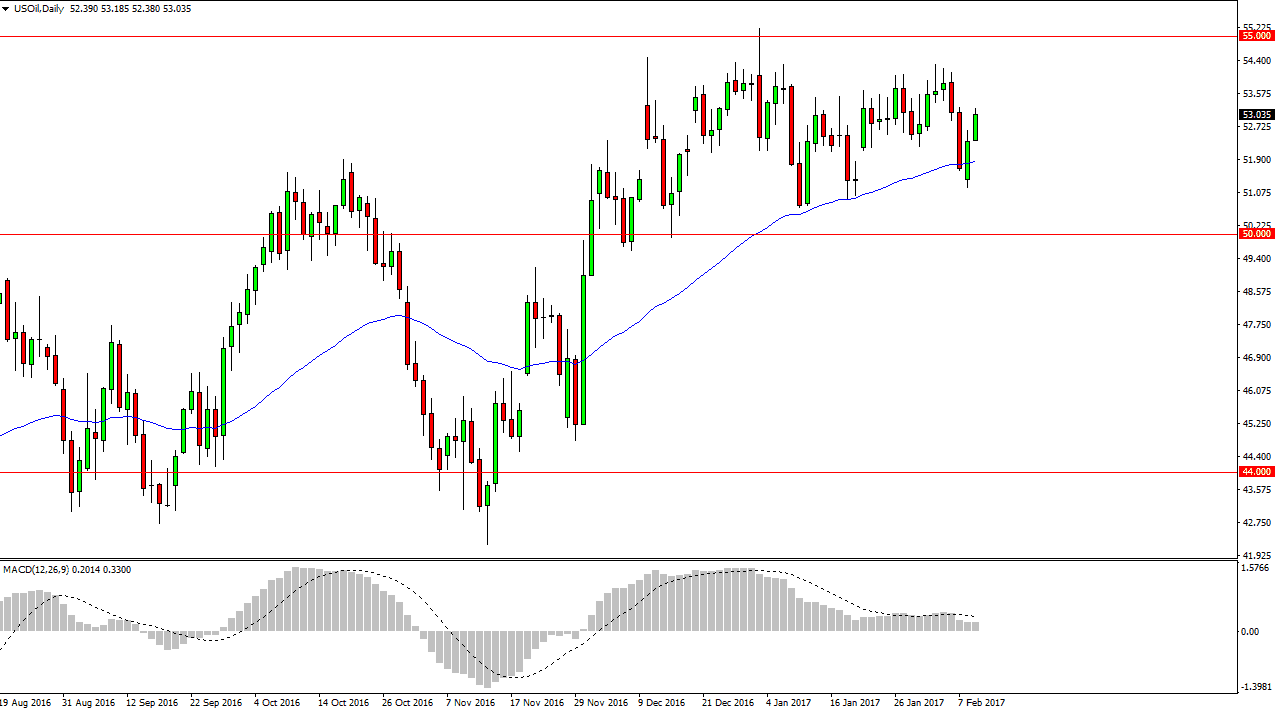

WTI Crude Oil

The WTI Crude Oil market rally during the day on Thursday, showing signs of support yet again. The market has been consolidating for some time though, so I feel that the markets could rise from here but I don’t think it’s going to be a longer-term move or with any type of strength. In fact, most of the indicators that I put on a chart suggests that we are running out of momentum, and with this I think that once we hit the $54 region, the sellers will come out in force and start selling again. The 50-day exponential moving average has authored support, but the $54 level above has been massively resistive and extends all the way to the $55 handle. It’s not until we can clear that area that the longer-term buyers will have any chance of moving this market.

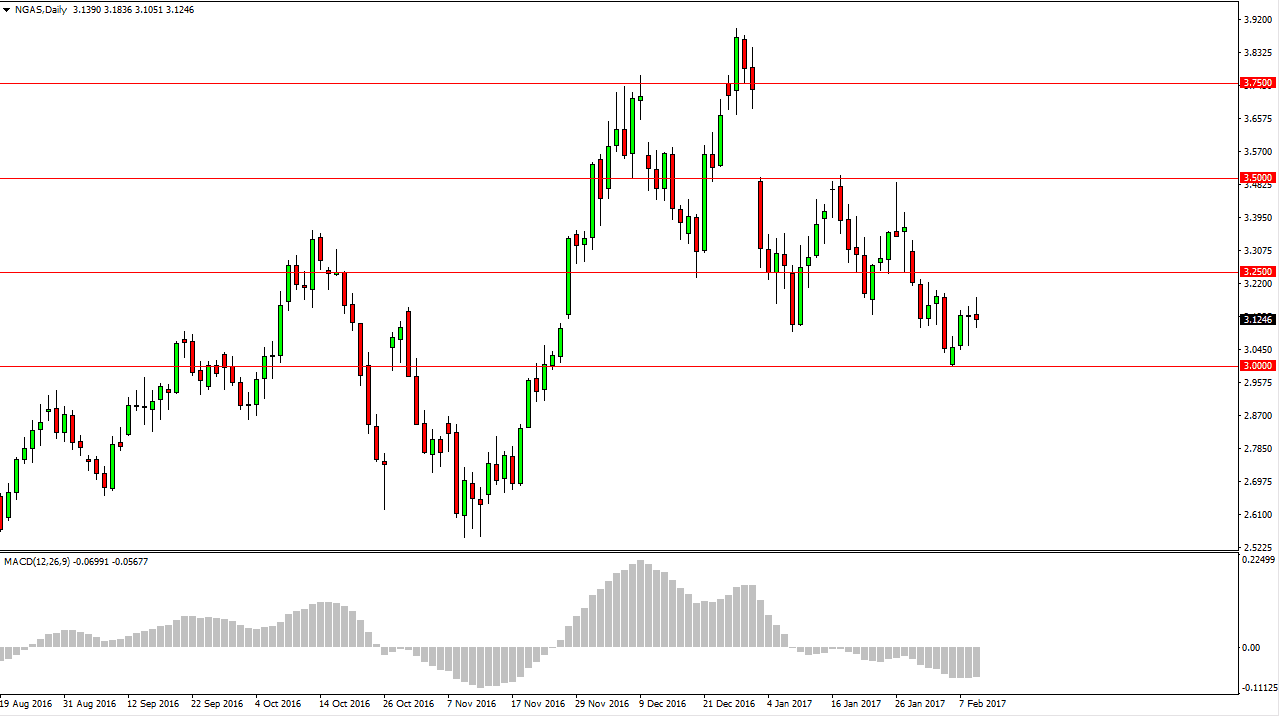

Natural Gas

The natural gas markets initially tried to rally during the day on Thursday, but turned around to form a shooting star. The shooting star of course is a negative sign, and the hammer that preceded it shows signs of struggle. However, if we can continue to drop from here the market should then reach towards the $3 level. Natural gas markets continue to struggle with warmer temperatures in the United States, and because of this I believe that the market should continue to drop significantly. The $3.25 level above is massively resistive, so I don’t think there’s any opportunity to start going long. Eventually, I expect the market to drop down below the $3.00 level, and then reach towards the $2.60 level underneath. I have been bearish on natural gas for quite some time, and I believe that the bearish pressure will continue over the longer term and have no interest whatsoever and trying to buy this market.