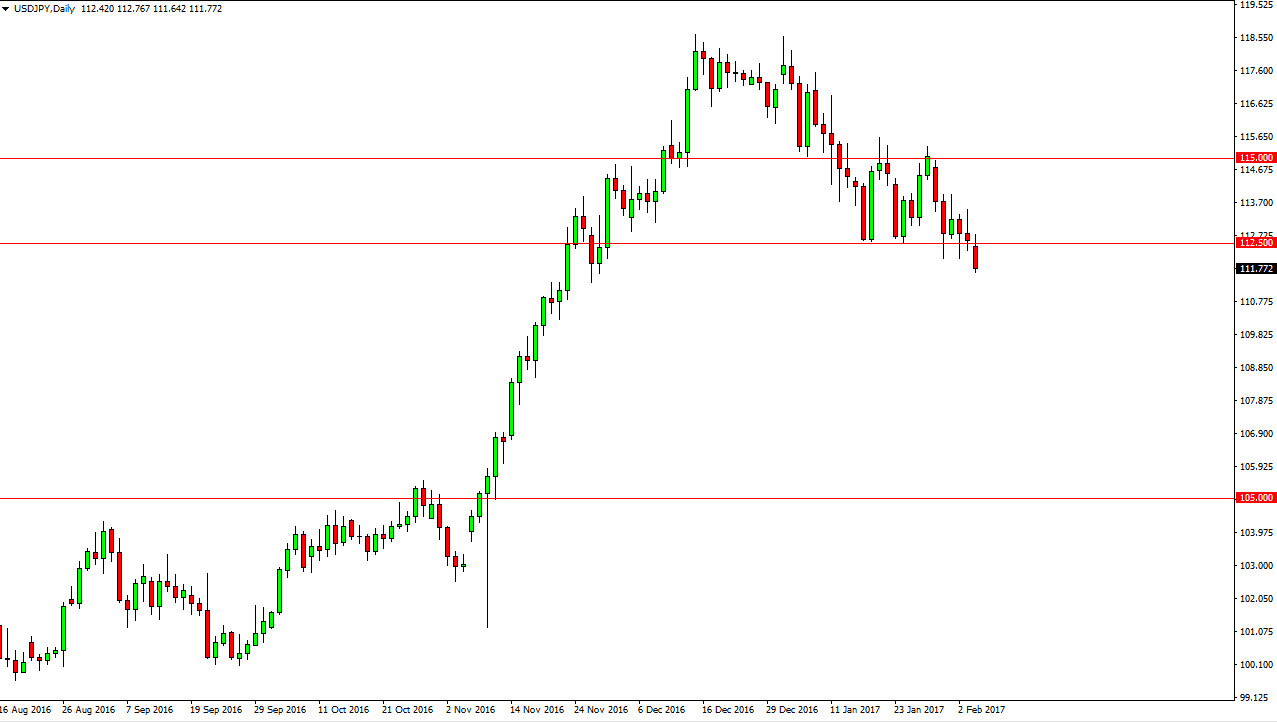

USD/JPY

The US dollar initially tried to rally against the Japanese yen, but started to sell off late in the day. If we can break below the 111.50 level, the market could very well find itself going lower. A rally above the 112.50 level would be bullish though. Expect a lot of noise, as there are a lot of concerns and trepidation when it comes to the US dollar currently. If we do breakdown, I believe there is a significant amount of support at the 110 level below. If we break to the upside, the 115 level would be a massive barrier to overcome. The one thing I think you can count on is that the market will be choppy and volatile over the next several sessions.

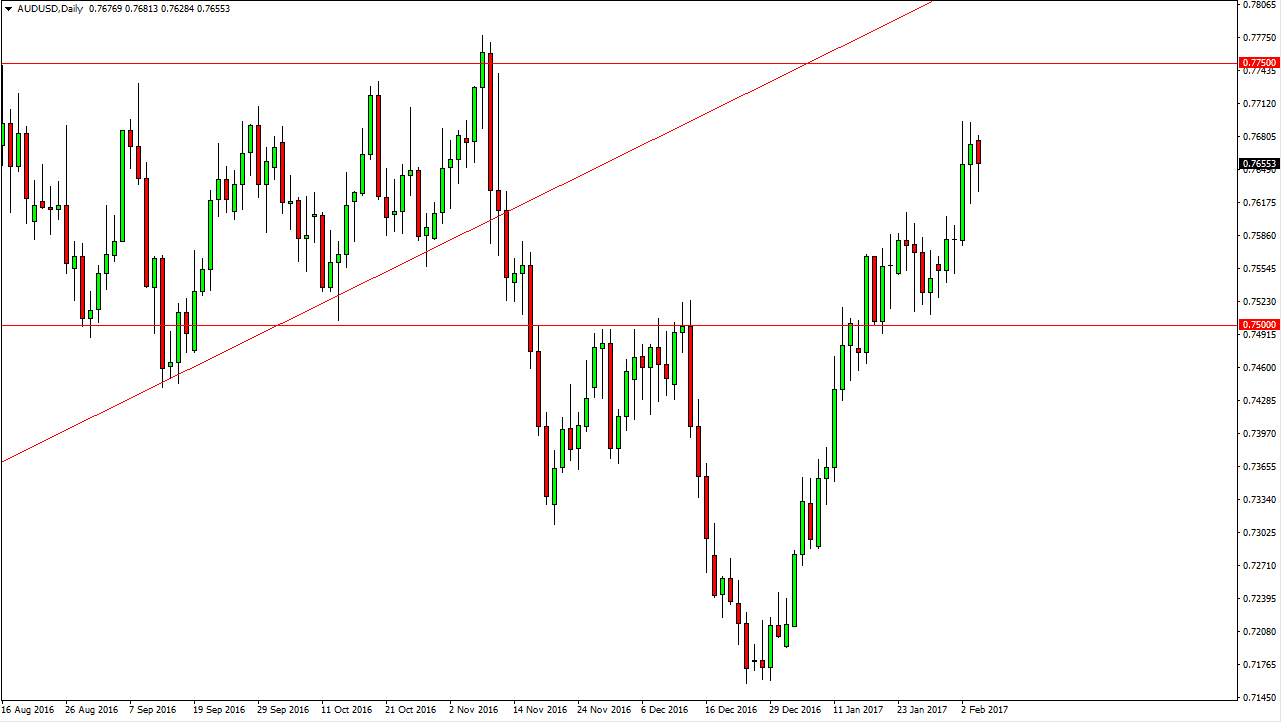

AUD/USD

The Australian dollar initially fell during the day on Monday, but turned around to form a hammer. The hammer is a very bullish sign, and if we can continue to go higher, breaking above the top of the range for the day, the market should then reach towards the 0.7750 level. Breaking down from here should send the market looking for the 0.76 level for support which I believe extends all the way down to the 0.75 handle. Alternately, I believe this is a “buy on the dips” type of scenario, and if the gold markets can break out as well, that should add more power to the Australian dollar going forward. Currently, it looks as if the gold markets are ready to break out so I believe this is probably the base case scenario for the markets.

Ultimately, I look at this is a short-term buying opportunity, not much more than that. The 0.7750 level above will continue to be massively resistive but a break above there send this market towards the 0.80 level over the longer term. This very well could happen, but we are a bit overextended currently.