By: DaiyForex.com

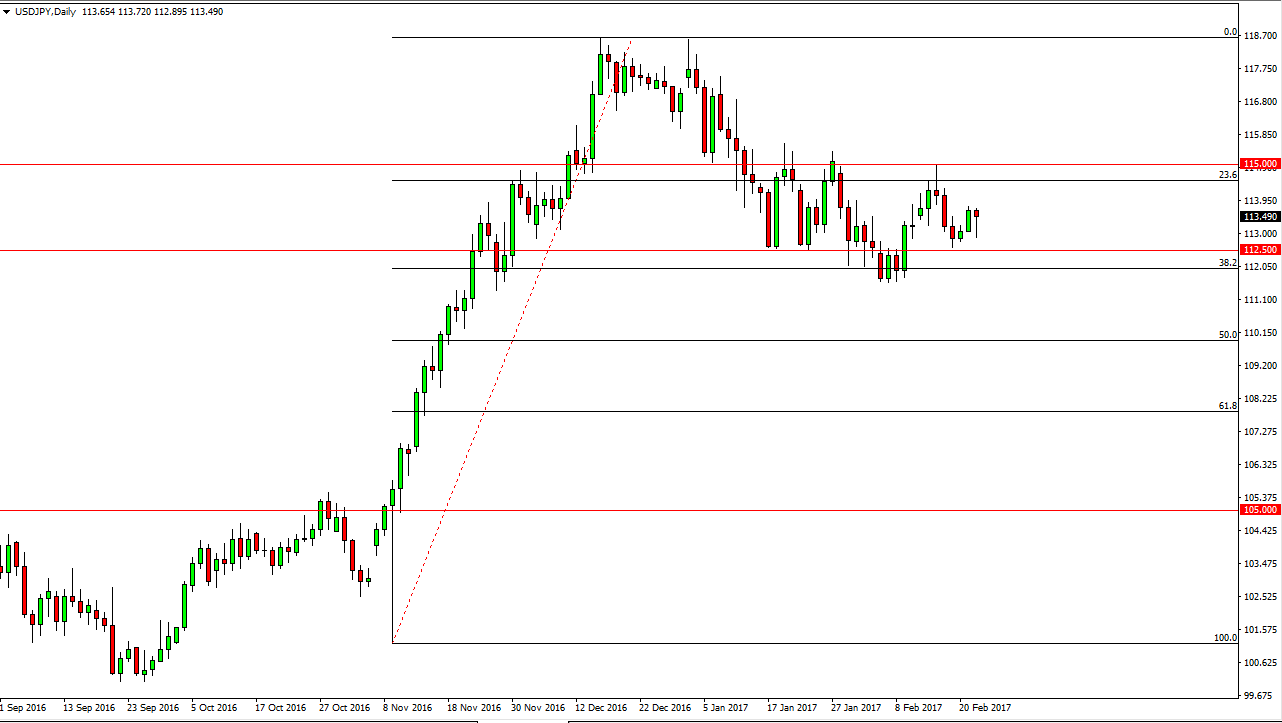

USD/JPY

The USD/JPY pair fell initially during the day on Wednesday, but found enough support near the 112.50 level to turn things around and form a hammer. Because of this bounce, I believe that the market will then reach towards the 115 level above, which should be resistive. If we can break above there, then the market can reach towards the 118.50 level as well. The 38.2% Fibonacci retracement level offers support, and I believe it’s only a matter of time before we continue to go higher. The Bank of Japan continues to be very loose with this monetary policy, so it’s hard to imagine any negative selling pressure picking up over the longer term.

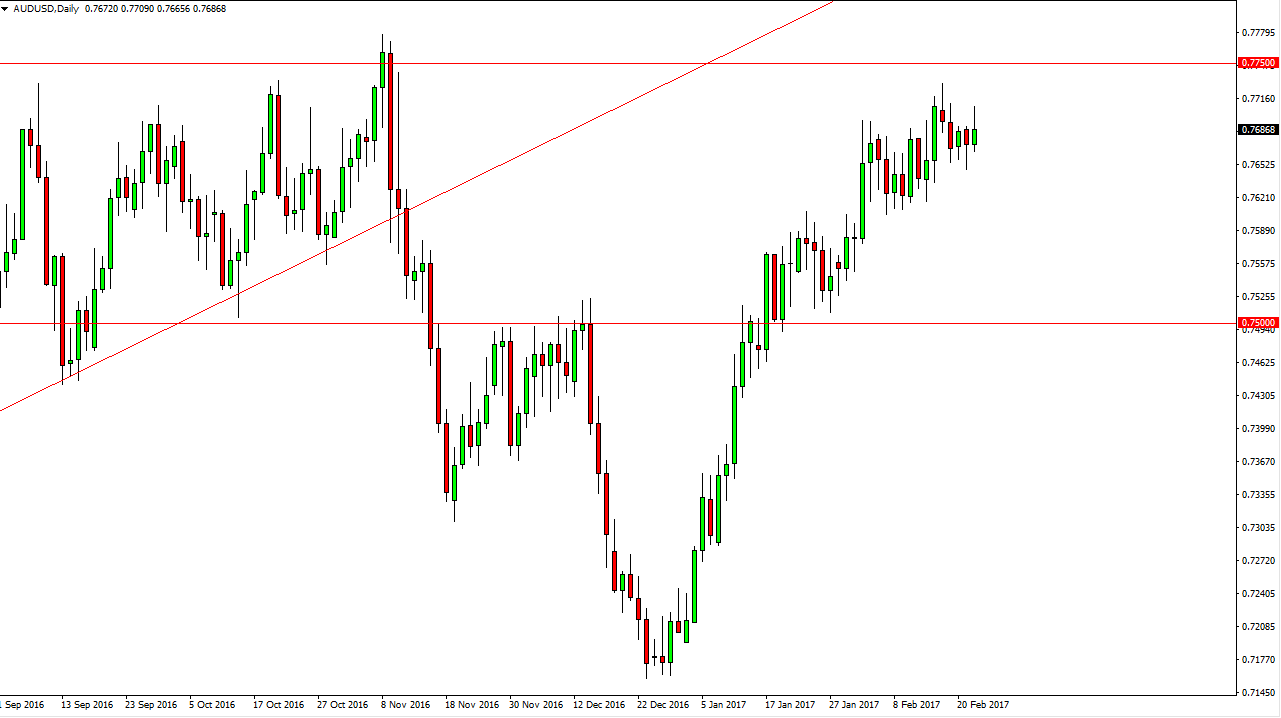

AUD/USD

The Australian dollar tried to rally during the day but turned back around as we ran into a bit of resistance at the 0.77 handle. It’s not a huge surprise that we would struggle there, but quite frankly I think it’s only a matter of time before the buyers return as the 0.76 level underneath is massively supportive. Pay attention to the gold markets, they have a significant amount of influence on this pair, and they look as if they’re trying to build up enough momentum to break out to the upside eventually. Because of this, I don’t have any interest in shorting and I believe that every time this market pulls back, is can be a nice buying opportunity given enough time.

The 0.75 level seems to be the “floor” in the market, and thus I think that if we can stay above there, the buyers will remain a significant force in this market as we have seen so much buying pressure over the last couple of months. Ultimately, I think we do reach towards the 0.80 level, which is a major level on longer-term charts as well.