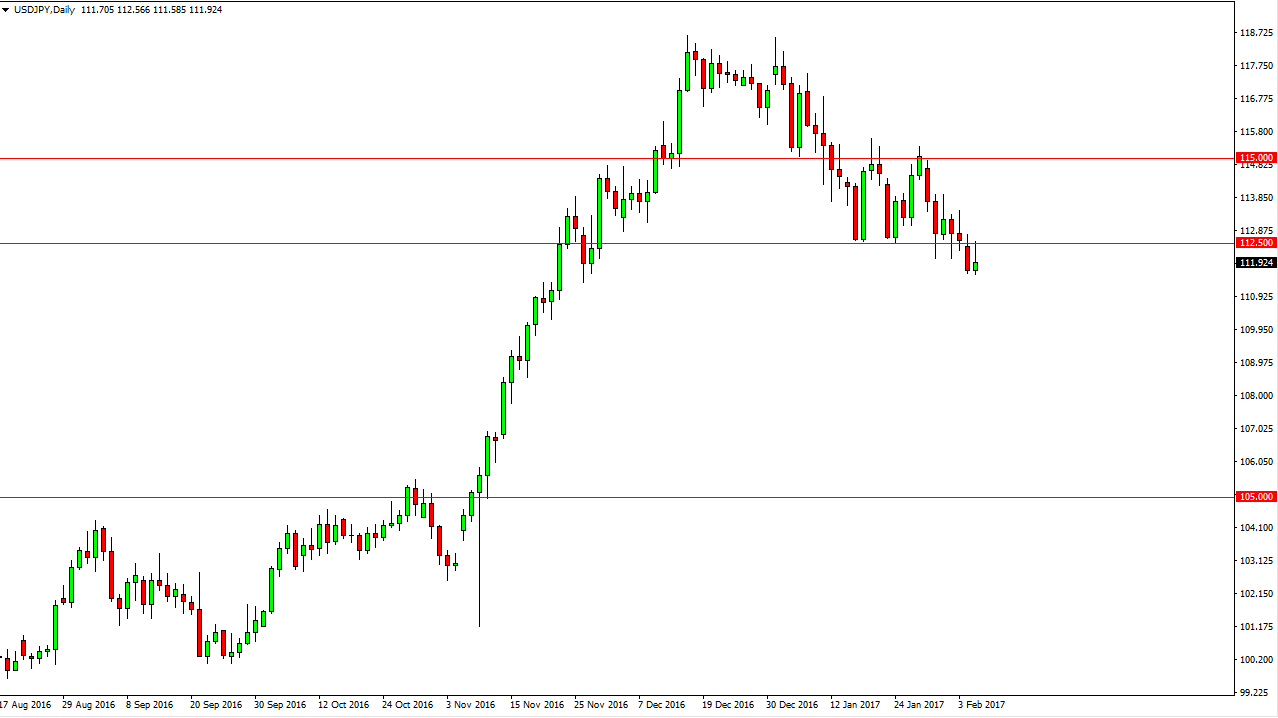

USD/JPY

The US dollar rallied during the day on Tuesday, but found resistance at the 112.50 level. Because of this, we turned around to form a relatively negative looking candle, as we gave back quite a bit of the gains. With this in mind, I believe that the market is trying to break down below the 111.50 level, which I see as massively supportive. because of this, I believe it’s only a matter of time before we have to make some type of decision. That decision could be in the form of an impulsive candle in either direction to be honest. Because of this, I will more than likely wait for daily close that is either above the 112.50 level to start buying, or a daily close that is below the 111.50 level to start selling. If we do sell off, I believe that the market will then reach towards the 110 handle, and conversely if we rally I believe that the market will try to reach the 115 handle.

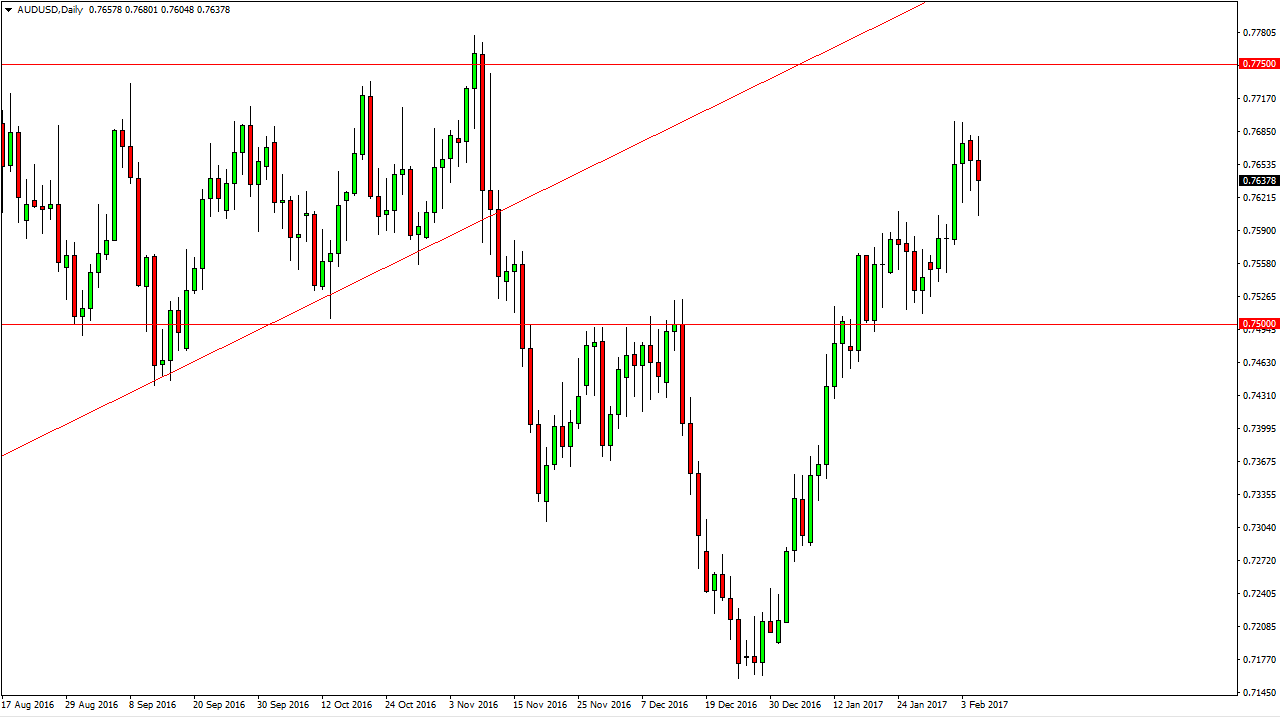

AUD/USD

The Australian dollar initially fell during the session on Tuesday, but found enough support to turn things around and form a relatively supportive looking candle. The 0.76 level offered enough support to turn things around as I thought it might, and with that being the case I think we will eventually see a return to the bullish move. The 0.7750 level above will be resistance, but also is a target and the short-term as far as I can see.

If we break down from here, and by that, I mean below the 0.76 handle, the market should then reach towards the 0.75 handle. That is a massive support level as far as I can see, and I think will keep the market afloat. There is a lot of noise underneath, and with that being the case it’s likely that it is still going to be easier to go higher rather than lower.