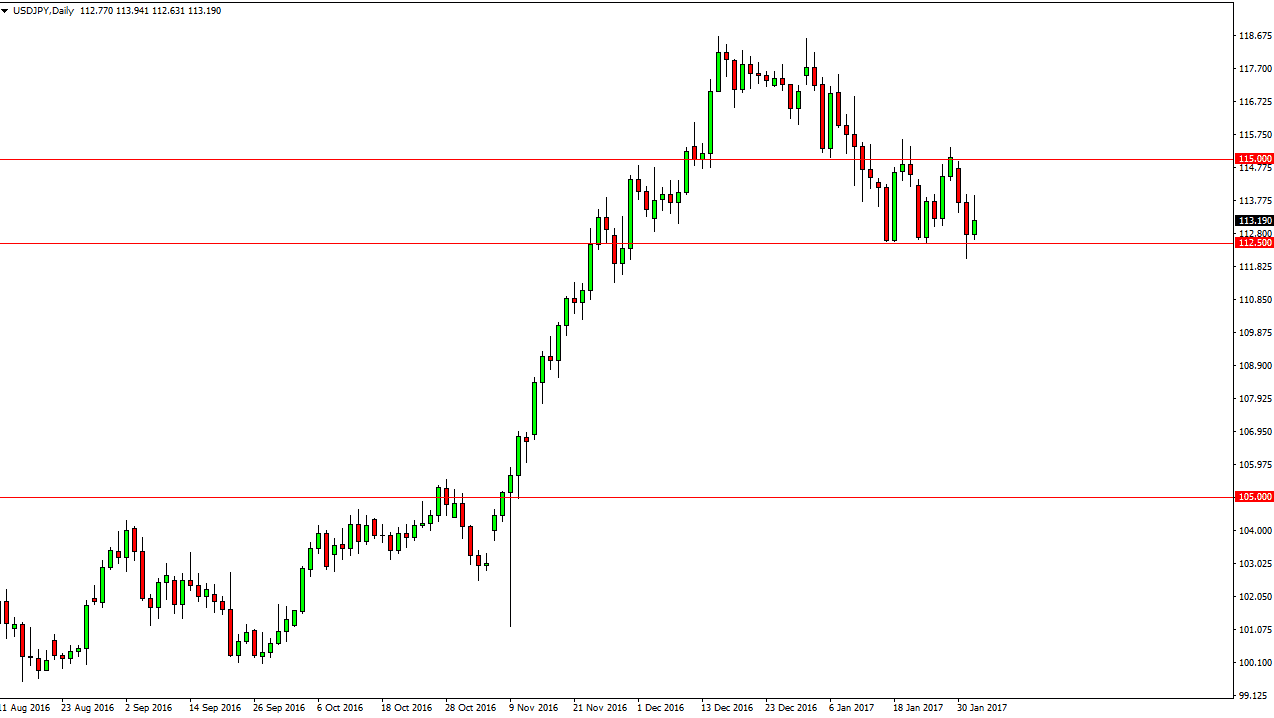

USD/JPY

The US dollar rallied against the Japanese yen initially on Wednesday, but ran into quite a bit of resistance above. It now looks as if we are going to firmly test the 112.50 level for support, which should be rather crucial. I believe that the support extends down to the 111.50 level, so I’m still expecting to see this market bounce, but it’s going to be very choppy. On a break above the top of the candle from the Wednesday session though, I believe that would be a very bullish sign, and more than likely have the market reaching towards the 115 level above. Once we get above there, the market could then go to the 118.50 level. Even with all the negativity and consolidation over the last several weeks, this market is still very much in an uptrend.

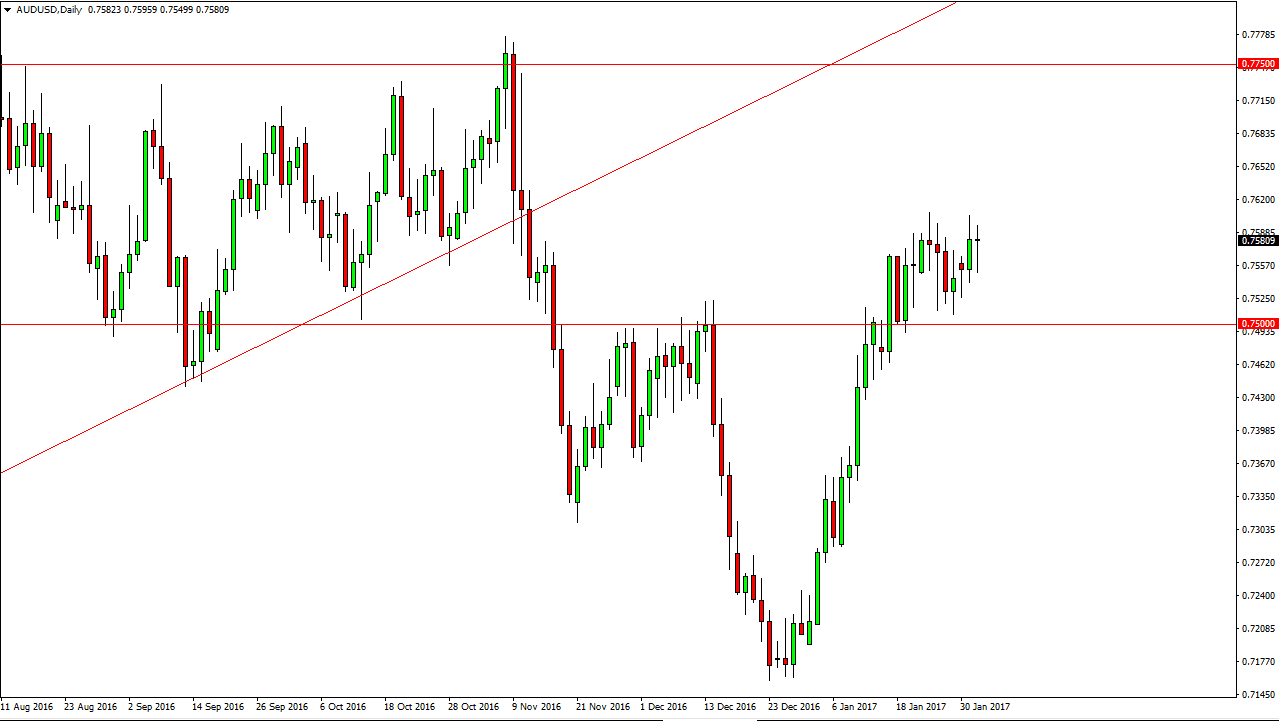

AUD/USD

The AUD/USD pair initially fell on Wednesday, but found enough support to turn things around and form a slightly positive looking candle. The gold markets course will help and they do look like they are trying to break out, so I believe it’s only a matter of time before we can clear the 0.76 handle and reach towards the 0.7750 level. The 0.75 handle underneath is massively supportive and I think it extends about 100 pips below. In other words, I feel much more comfortable buying this pair now than selling it, but I recognize that it will probably need help in the form of the gold markets rallying.

Given enough time, I think that the strengthening US dollar is starting to roll over a little bit, and that could be good for precious metals. By extension, that should be good for the Australian dollar. We are still very much in the realm of thin ice here though, so expect quite a bit of volatility going forward. A breakdown below the 0.74 level would negate all this analysis.