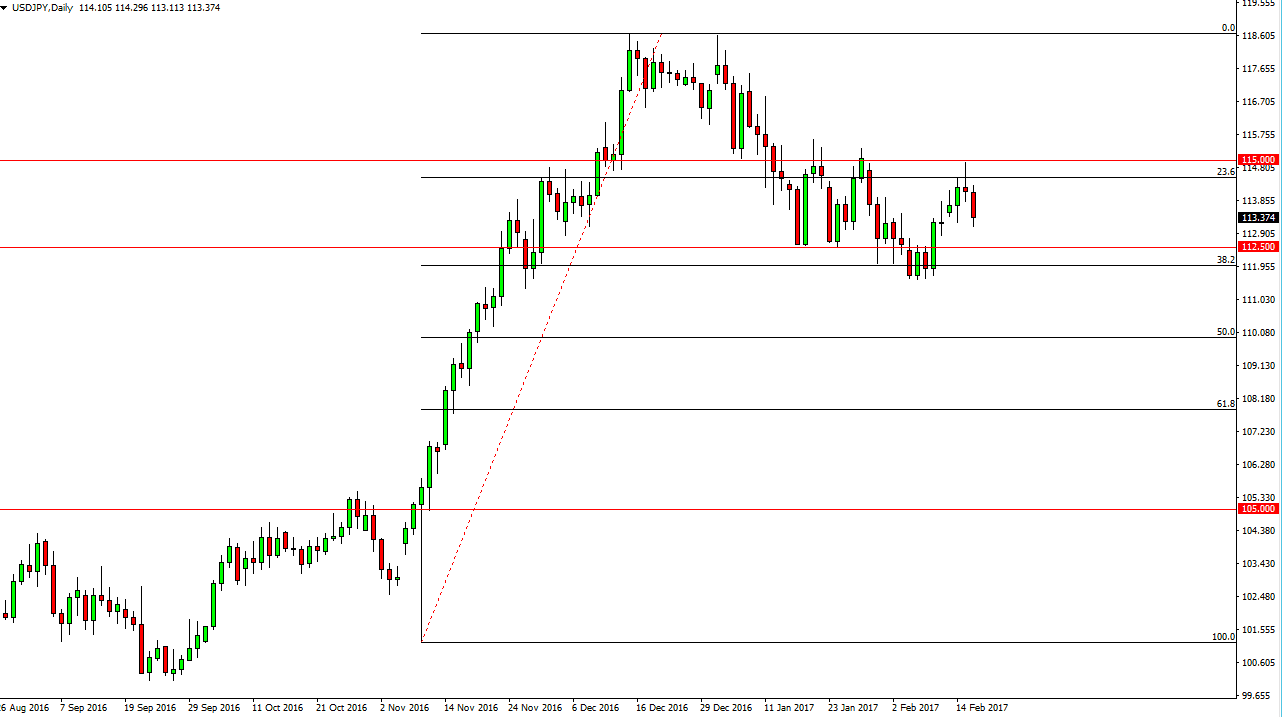

USD/JPY

The USD/JPY pair broke down during the day on Thursday, clearing the bottom of the shooting star from Wednesday. This of course is a common selling opportunity and signal, but given enough time I believe that the buyers are going to return. Because of this, I am waiting for a supportive candle in order to take advantage of what I think is the beginning of the next leg higher. If we can break above the 115 level, the market should then go to the 118.50 level. That level being broken to the upside continues a longer-term uptrend. I have no interest in selling, and believe that the 38.2% Fibonacci retracement level will continue to be supportive. However, expect a lot of volatility and because of this it will take quite a bit of wherewithal and confidence to hang on to a position.

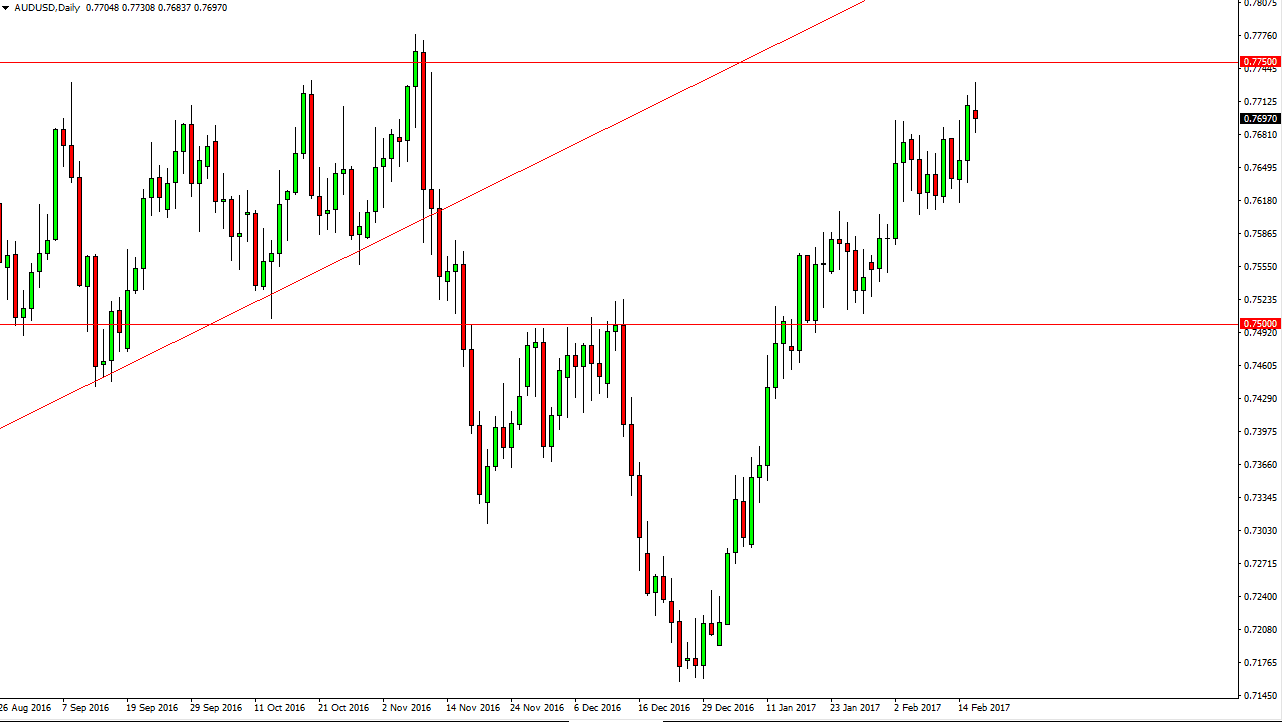

AUD/USD

The Australian dollar broke higher during the course of the day on Thursday, but continues to find resistance near the 0.7750 level. A pull back from here would make a lot of sense, but ultimately I think that it’s only a matter of time before the buyers get involved on a pull back that show signs of support. Given enough time, I would not be surprised at all to see the 0.7750 level get broken to the upside and extend the longer-term uptrend, but I also believe that the 0.76 level could be targeted for a buying opportunity as well.

Pay attention to the gold markets, they have a large effect on the Australian dollar in general, and because of this it’s difficult to imagine that this pair is going to go too much higher without help from the commodity. This pullback should only end up being a buying opportunity, as we have been so bullish over the last several months.