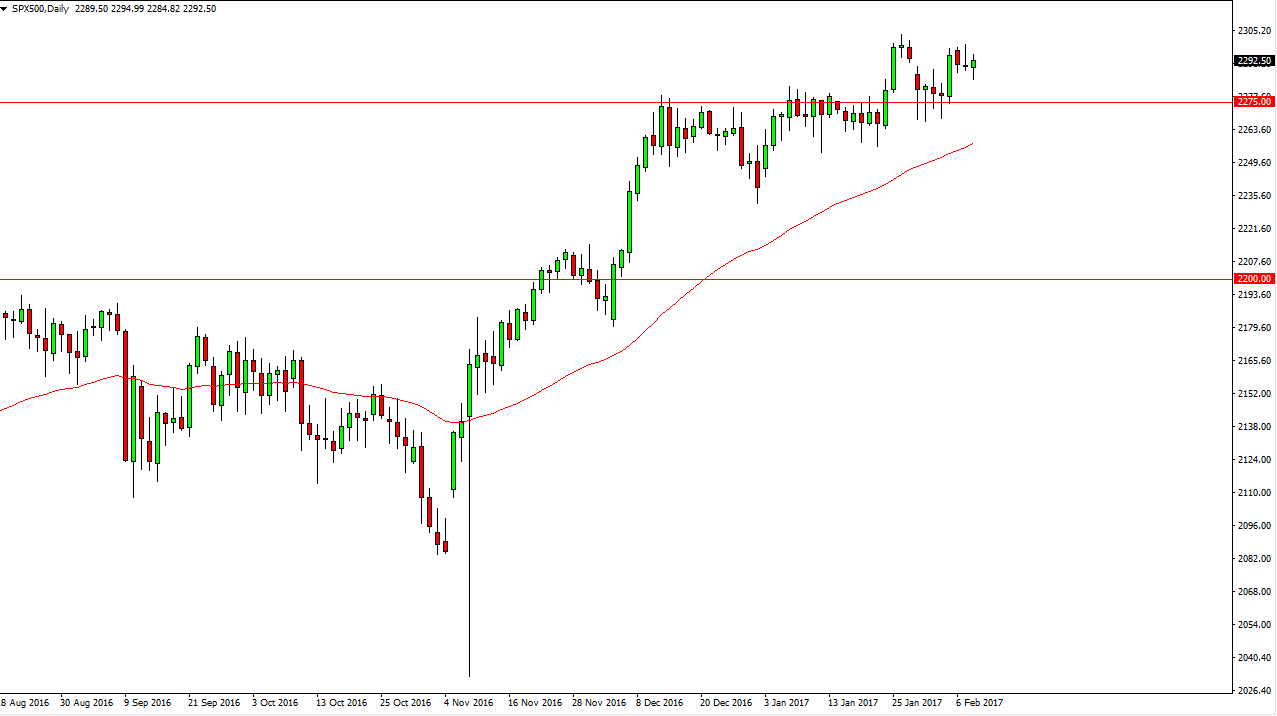

S&P 500

The S&P 500 initially fell on Wednesday but turned around to form a hammer. The hammer is pressing against the shooting star from the previous session, and I believe it’s only a matter of time before we break out. I think pullbacks continue to offer value that we can take advantage of, as the 2275 level should be the “floor” in the market. I think that floor extends all the way down to the 2250 level, so he the way I have no interest in selling. The 50-day exponential moving average continues to offer dynamic support as well, and quite frankly the US indices are where you will be putting your money if you are an international investor. Because of this, I believe that the buyers will continue to run the show.

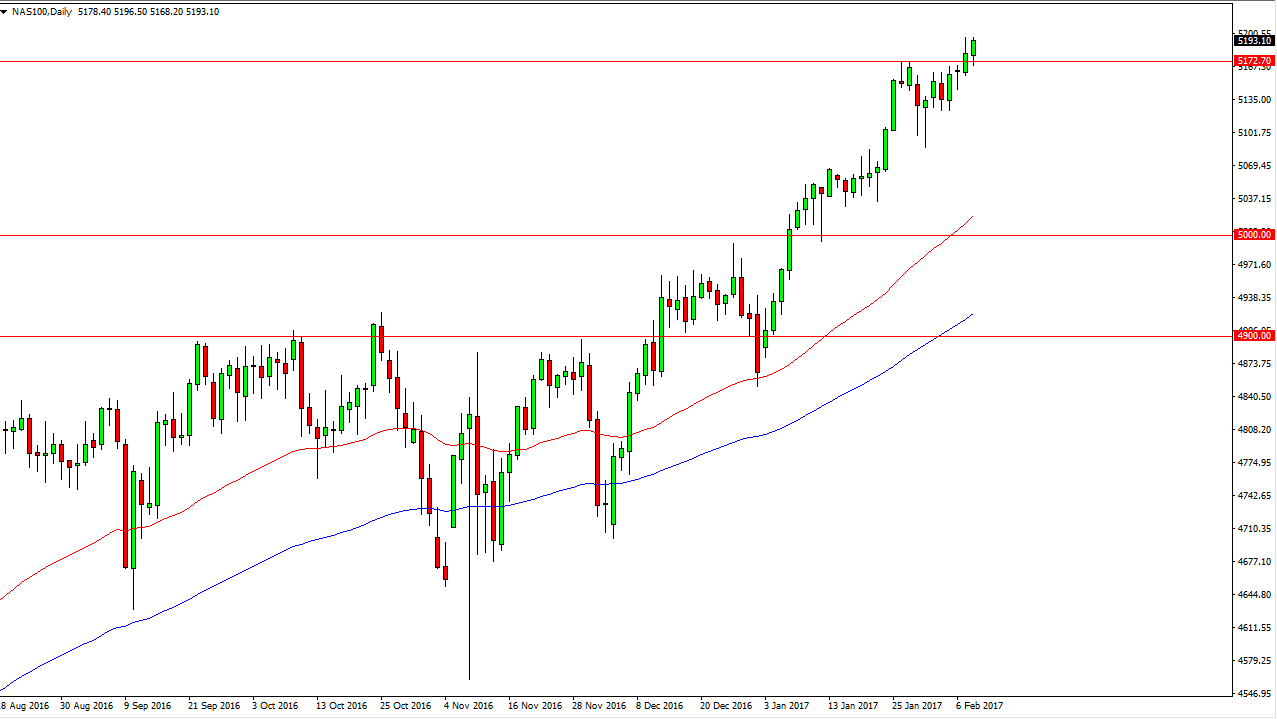

NASDAQ 100

The NASDAQ 100 initially fell on Wednesday but found support at the previous resistance, and it now looks as if we are going to go higher. In fact, were closing in on the 5200 level. If we can get above there, the market should continue the uptrend, but we are more than likely a bit extended at this point. The NASDAQ 100 has been leading the other US indices higher, and I believe that will continue to be what we see going forward.

Pullbacks are value that people will want to take advantage of, and I currently believe that we will break above the 5200 level sooner, rather than later. Once we do, we then go to the 5250 level, and perhaps even as high as 5500 over the longer term. Although we are a bit overbought longer-term, I believe that any rally going forward will be met with a buying frenzy as the NASDAQ 100 has been reacting positively to the new business friendly administration in the United States.