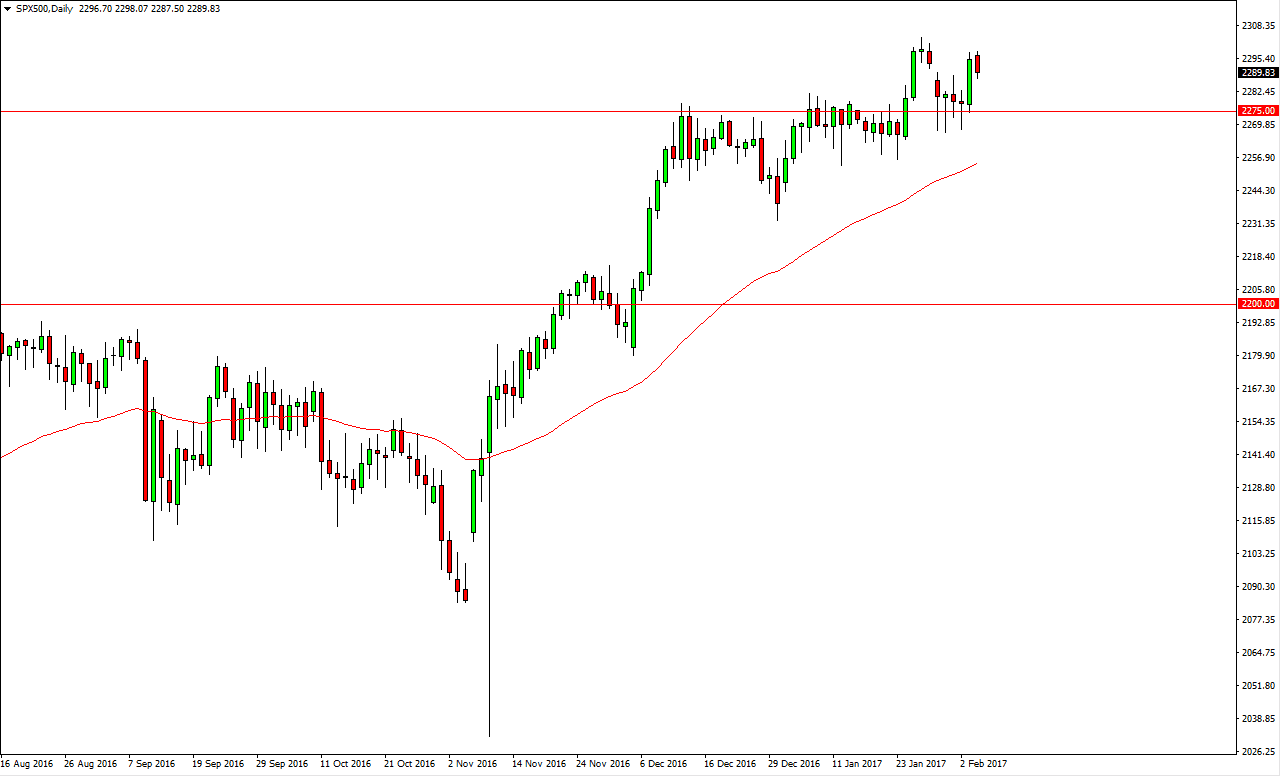

S&P 500

The S&P 500 fell a bit short during the day on Monday, as we continue to grind back and forth in a bid to build up momentum to the upside. Alternately, I believe that the 2275 level will continue to offer support, and of that buyers will return every time we dip. Short-term trading to the upside is probably going to be the best way to approach the S&P 500, but I believe that given enough time we will not only reach the 2300 level again, but we will break above towards the 2500 level. This is a market that will continue to be somewhat volatile, but I still believe that the bullish pressure will when over the longer term as the US economy is outperforming so many others right now.

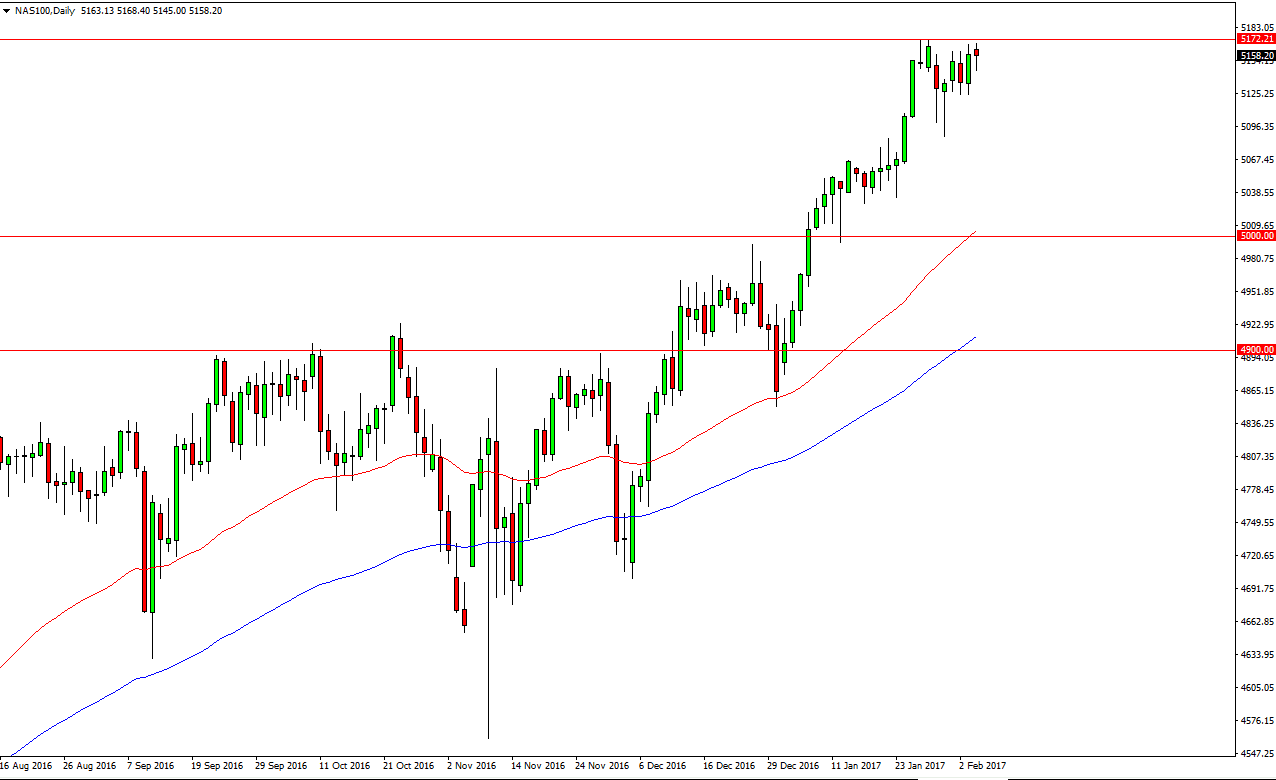

NASDAQ 100

The NASDAQ 100 initially fell on Monday but turned around to form a hammer. The hammer sits just below the recent highs, and I believe that this formation suggests that the buyers are going to become aggressive every time we pull back, as it represents value in a market that’s ready to break out. If we can break out to a fresh, new high, then I believe that the market will reach towards the 5200 level, and then eventually the 5250 level. Longer-term, I have no interest in shorting this market as it is so strong, and this recent dip has formed a couple of nice-looking hammers. The 5100-level underneath there is support as well, and I believe that given enough time buyers will be attracted to what they perceive as value in a market that should continue to reflect the strength of the US economy and technology worldwide.

I see no opportunity to short this market into we break cleanly below the 5000 level, which is something that I do not anticipate seeing anytime soon.