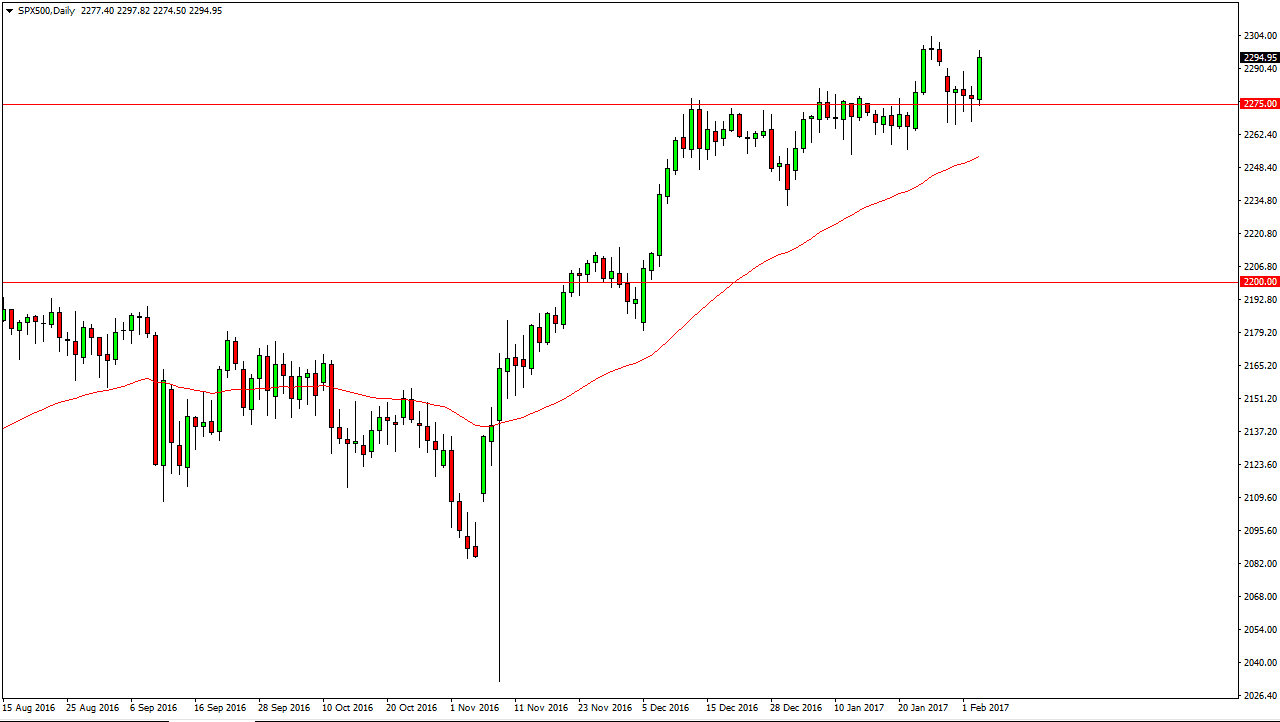

S&P 500

The S&P 500 broke above the hammer from the Thursday session during the Friday session after the jobs number came out. This is a market that should continue to go higher, as the US indices and US economy continue to look very impressive. The 50-day exponential moving average underneath continues to look like dynamic support, and thus I believe that the market should reach towards the 2300 level, and then eventually reach towards the 2500 level beyond that. I have no interest in selling the S&P 500, I believe that the US indices in general should continue to rise, and the S&P 500 of course will be no different than the others.

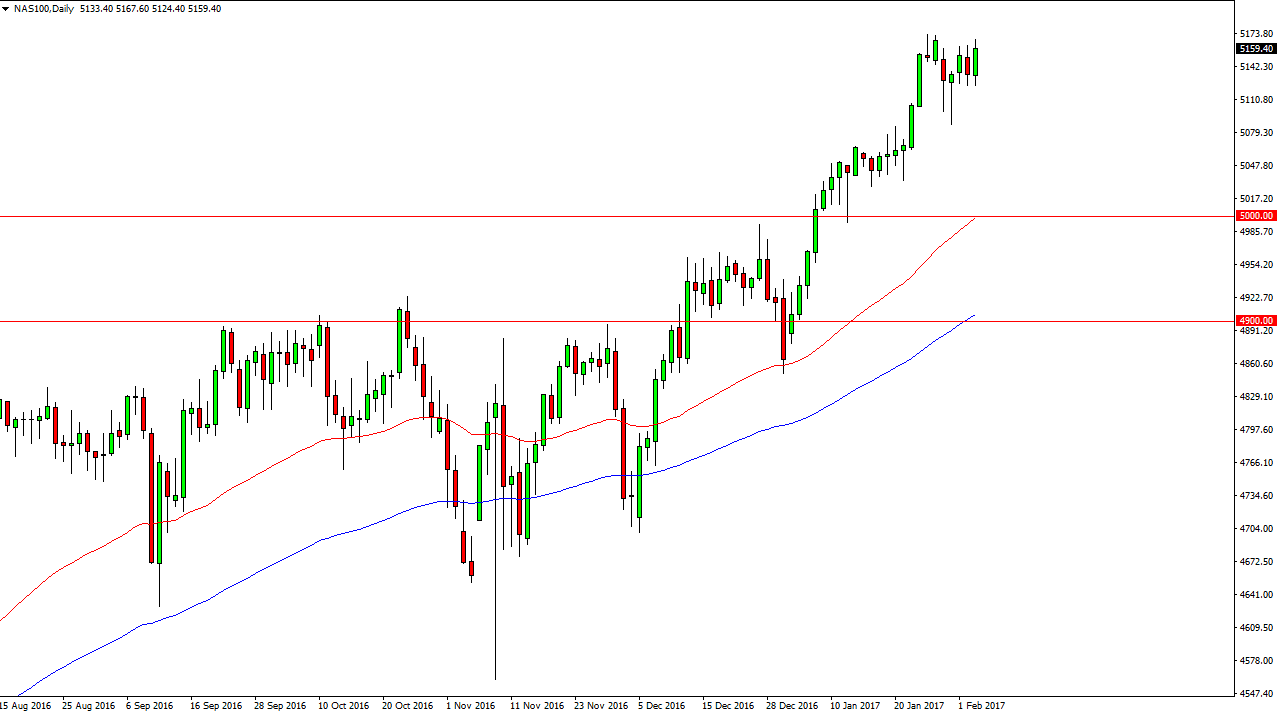

NASDAQ 100

The NASDAQ 100 rose during the day, the market should then go even higher. The 5100 level below is massively supportive, and with this being the case it’s likely that the longer-term uptrend should continue. I believe that there is massive support at the 5050 level, as well as the 5000 handle which I see as the “floor” in the market. Longer-term, I believe that the market should then go to the 5250 handle, and then even higher than that. I have no interest in selling the NASDAQ 100 because the market is leading the other US indices overall, which have been leading the world’s indices in general.

Pullbacks continue to offer value, as the NASDAQ 100 should continue to find plenty of people willing to jump on board. Given enough time, I think the NASDAQ 100 will not only pull the American indices higher, but also many of the rest of the world. That should continue to see the buyers enter the market and if the NASDAQ 100 continues to go higher, the other indices should as well. Is not until we breakdown below the 5000 level that I would consider selling, and even then, I would have to think about it.