S&P 500

The S&P 500 markets will be closed on Monday due to the President's Day holiday. The markets fell a bit during the day on Friday, but turned around and showed signs of support, forming a hammer. The hammer of course is a bullish sign, so it’s likely that the market will continue to go higher over the longer term, but obviously today won’t be anything to trade, even if you can trade the CFD markets. Longer-term, I believe we are reaching towards the 2500 level, and that the 2300 level below is massively supportive. US indices overall have been very strong, and I think that the S&P 500 won’t be any different than the others.

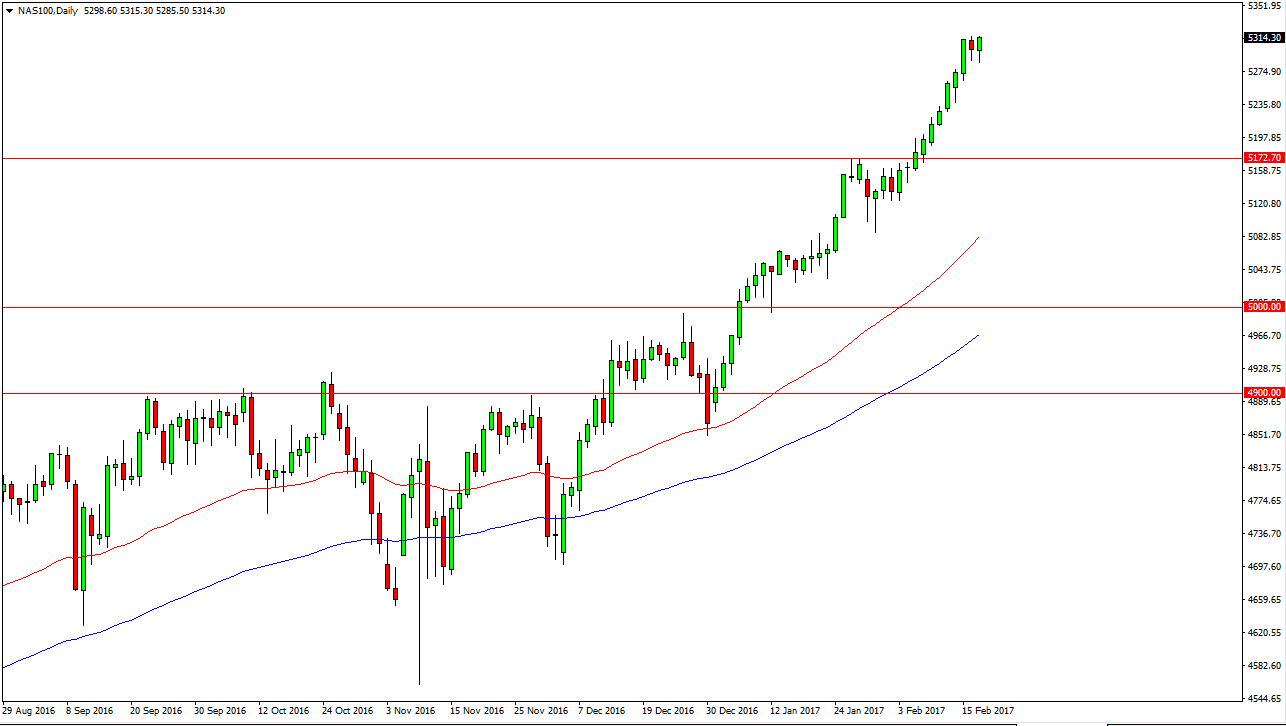

NASDAQ 100

The NASDAQ 100 not only bounced during the day on Friday, but it also formed a fresh, new high. Now that we are well above the 5300 level, looks as if the markets can continue to go higher, perhaps reaching towards 5500 over the longer term. We are bit overextended, but needless to say with a holiday today, there will be much in the way of action. The CFD markets might be open depending on your broker, but really there’s not a lot you can do. Longer-term, I believe that the 5172 level should be supportive and essentially the “floor”, but I would be surprised if we even got that far to the downside. Ultimately, this is a market that should continue to be a “buy on the dips” scenario, and with that I think that the markets offer value every time they drop. The NASDAQ 100 has led the other US indices higher, which by extension have been leading the rest of the world higher. Because of this, the NASDAQ 100 might be the most important CFD market that you can pay attention to currently, as it suggests what risk appetite is.