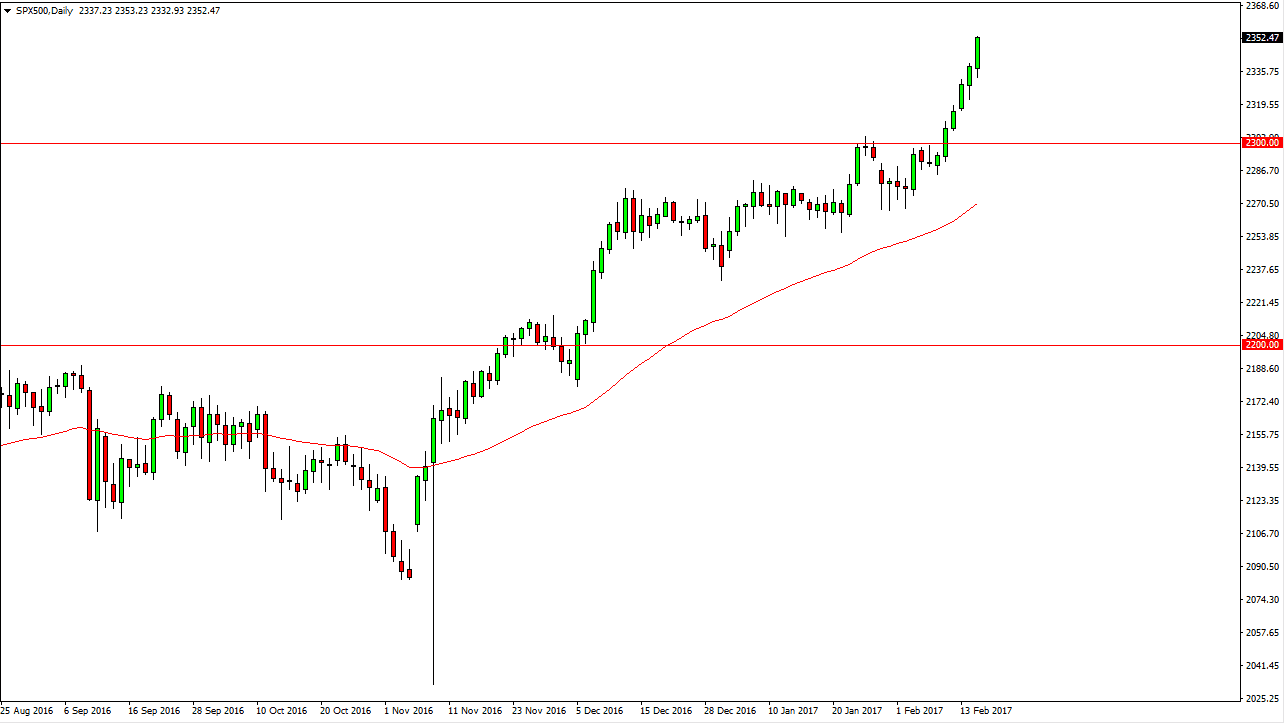

S&P 500

The S&P 500 initially fell during the day on Wednesday, but as Janet Yellen testified front of Congress, the market took off to the upside. Because of this, looks as if the markets are continuing the massive bullish pressure that we have seen. I’m the first person to admit that we are overbought though, so a pullback is necessary. If you are not involved in this market currently, now is not going to be the time to be jumping in. However, we pull back from here and form a supportive candle, I would be more than willing to jump all over that set up. I think that the 2300 level below is the “floor” in the market, and given enough time I think we reach towards the 2500 level, which of course is my longer-term target.

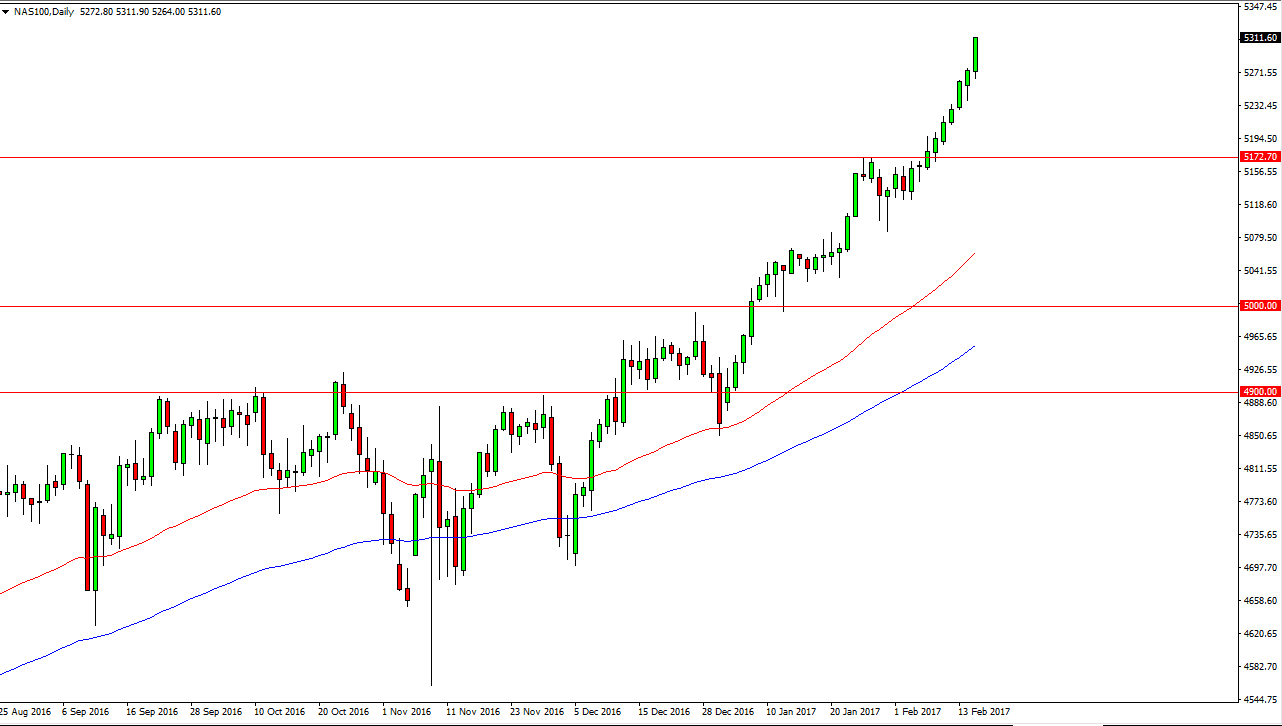

NASDAQ 100

The NASDAQ 100 initially dipped as well, but just like the S&P 500, and it up going much higher. I think the market clearing the 5300 level is a very strong sign, and that we will eventually reach towards the 5500 level above. The 5172 level below is the resistance that the market had been fighting with previously, so I think a pull back to that area should find it being the floor. However, I think that we won’t pull back that far, but nonetheless we are overbought. Again, if you are not involved in this market already, it’s probably best to wait for value.

The NASDAQ 100 has been leading the other US indices higher, Wednesday wasn’t any different. In fact, I have been making an argument for a while that the NASDAQ 100 has been leading the rest of the world higher as well. This may be the most important stock index that we follow, so by paying attention to the NASDAQ 100, you can get an idea of what risk appetite is around the world.