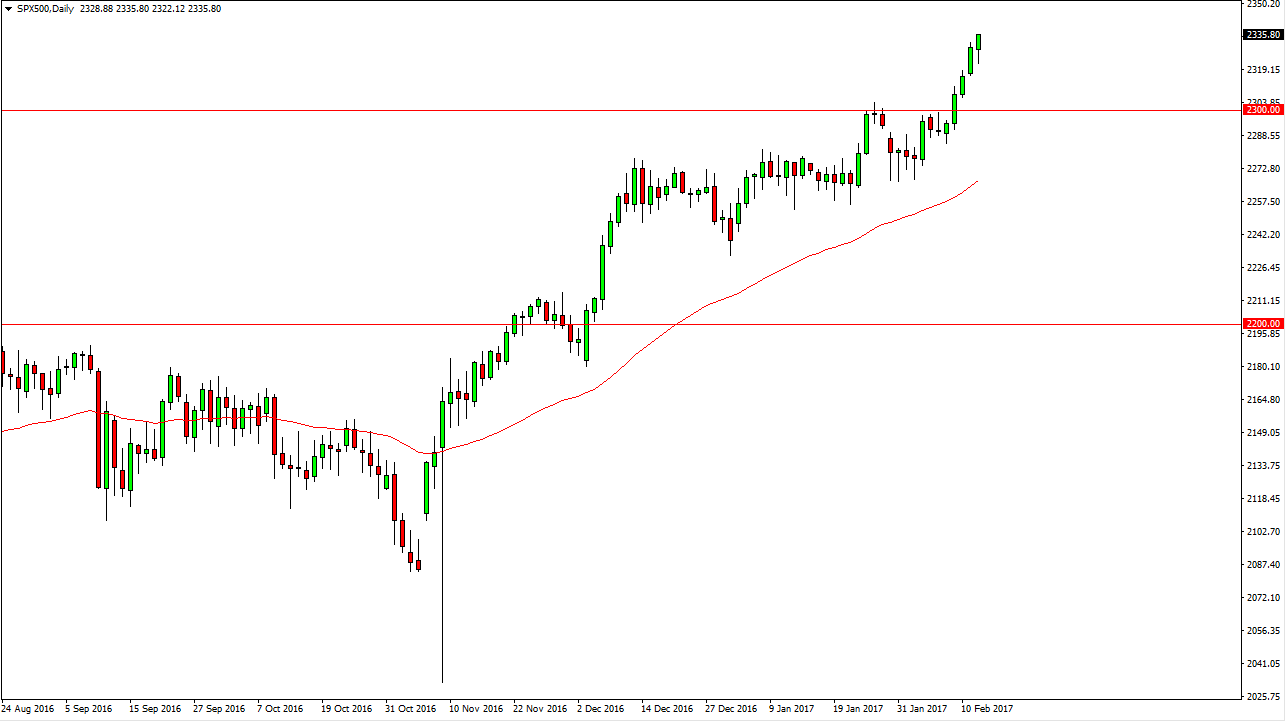

S&P 500

The S&P 500 initially fell on Tuesday, but turned around to form a very positive candle. I believe that this market should continue to go much higher, and pullbacks will only offer value. I believe that the 2300 level below should be massively supportive and essentially the “floor” in this market. I think that we are targeting the 2500 level above, and it’s only a matter of time before we get there. We are overextended, so it doesn’t surprise me at all that we may get pullbacks from time to time. Because of this, it’s only a matter of time before we get long, and therefore selling is all but impossible. The 50-day exponential moving average has been dynamic support, and should continue to be longer-term as well.

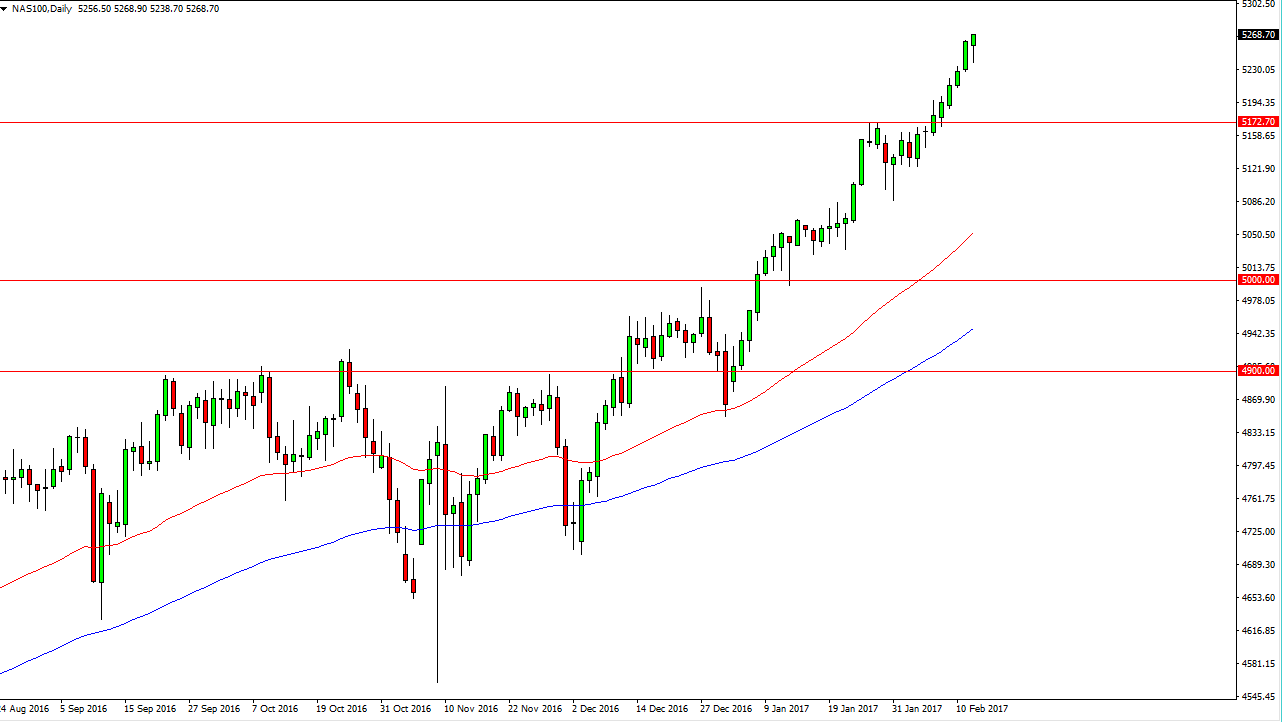

NASDAQ 100

The NASDAQ 100 initially fell on Tuesday as well, but bounced enough to form a hammer. The hammer sits at the very top of the trend, but I think we are starting to get a little bit “long in the tooth” when it comes to the uptrend. I’d love to see some type of pullback that offers value, and perhaps gives us an opportunity to build up more momentum and start reaching towards the 5500 level on the longer-term. The 5172 level below is the previous resistance, and then should now be massive support. I believe that the level will be the “floor” in this market.

Ultimately, I have no interest in selling this market, as the NASDAQ 100 has been so bullish and of course has lead the rest of the US indices higher. By extension, the US has been leading the rest of the world higher. In other words, the NASDAQ 100 is one of the leading indicators when it comes to the world markets overall, so watching this index will be crucial for traders in general.