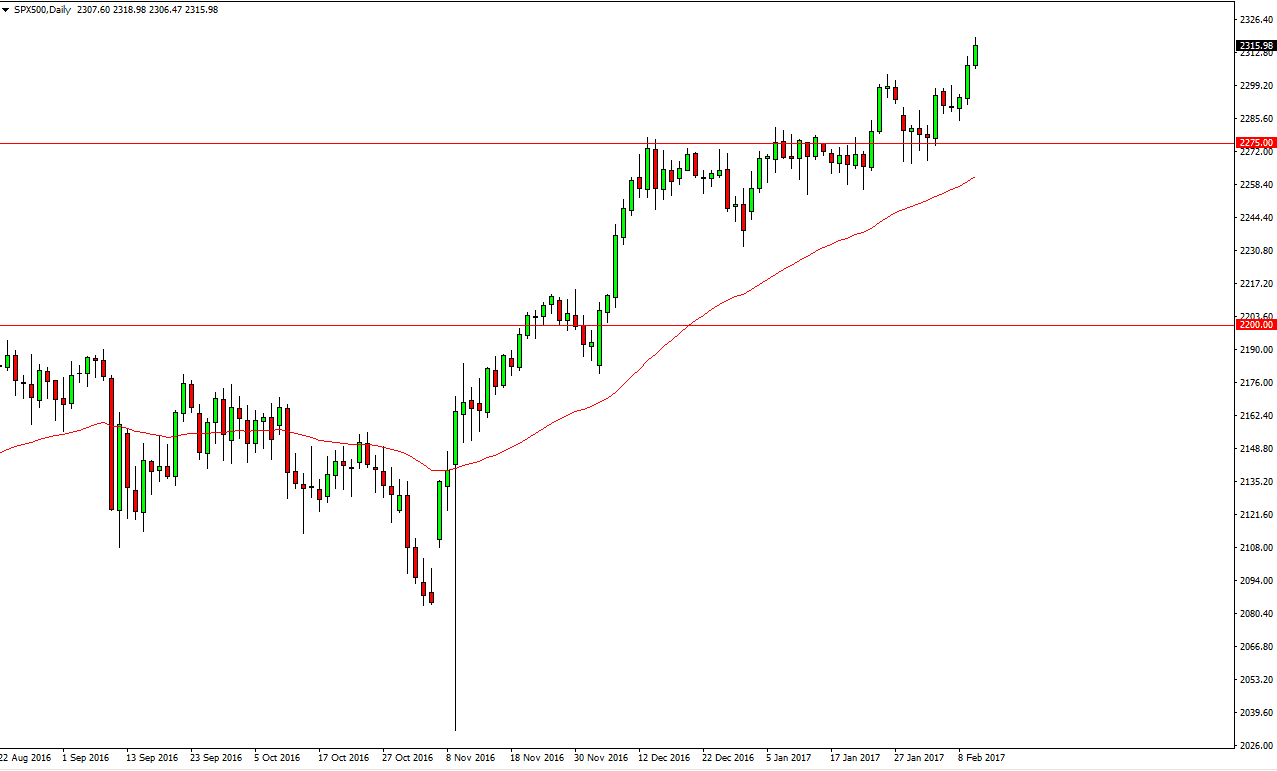

S&P 500

The S&P 500 rallied on Friday as we continue to see strong bullish pressure in this market. We have broken above the 2300 level now, and that of course is a very bullish sign. Because of this, I believe that every time this market pulls back, you must be thinking about buying. It should be thought of as value, as this market looks set to go to much higher levels, and quite frankly levels that could reach as high as 2500 over the next couple of months. I believe that the 2275 below continues to offer a floor, and that floor will of course continue to move higher. The 50-day exponential moving average shows significant bullish pressure as well, and US stock markets should continue to lead the rest of the world’s indices higher.

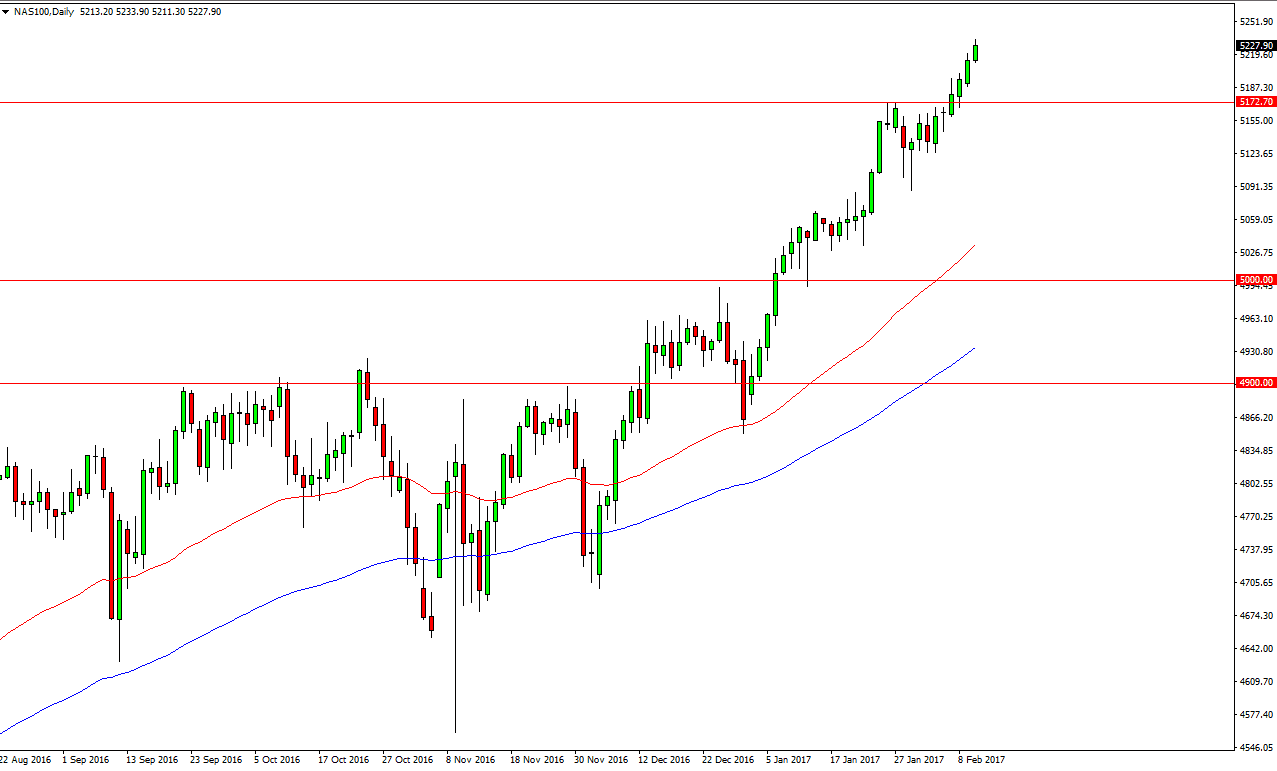

NASDAQ 100

NASDAQ 100 traders pushed higher yet again during the day on Friday, as we have now broken above the 5200 level. I believe it’s only a matter of time before we reach towards the 5500 level. I think that a pullback from here should send this market reaching towards the “floor” at the 5172 level which was the previous resistance. I like this market alive, and it has been a leader when it comes to indices in the United States, and the rest of the world. Quite frankly, as long as the NASDAQ 100 market continues to show strength, all US indices should.

I think that there is a massive amount of support at the 5100 level below, and of course a major psychological support level at the 5000 level. In other words, there’s no way to sell this market as we will continue to find buyers again and again. Every time this market dips, I believe it is a “buy on the pullbacks” type of scenario.