The British pound has been an interesting currency to follow, because there are so many moving pieces at one time. There are a lot of concerns when it comes to the United Kingdom leaving the European Union, but quite frankly the European Union may be the worst place to be by the time it’s all said and done. I think traders are starting to understand that perhaps the British are going to miss a serious problem by leaving, and therefore it’s possible that the British pound is undervalued. That’s essentially what I think now, so I have been looking for buying opportunities.

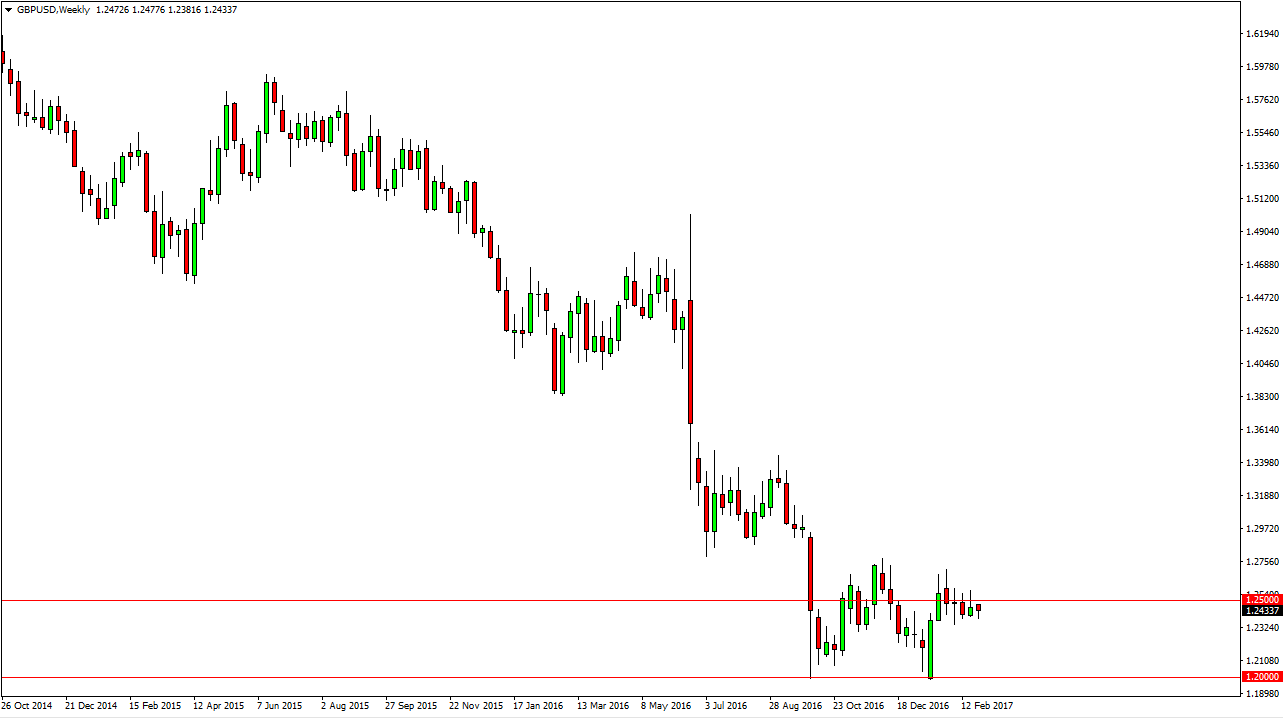

Obviously, the 1.25 level remains important, as it is a bit of a fulcrum for price over the last month or so. However, once we break above the 1.2750 level the market can really take off, as it will have cleared a major barrier. I believe that the 1.24 level underneath continues to offer support, but ultimately, I expect to see a breakout. There is one thing that will cause a serious pullback, and that’s going to be when the British finally invoke the Article 50, which is the actual beginning of the process of leaving the EU.

Given enough time, the market should break above the 1.30 level and then start looking more like a “buy-and-hold” type of market. I think that over the course of the next several months, this pair will continue to grind higher, but that Article 50 being invoked might be an opportunity to pick up the British pound at cheaper levels. Until that happens, I expect this market to be very consolidated with a slightly upward bias. However, the real move comes after written reclaims its sovereignty from the European Union.

If we did breakdown below the 1.24 level, the market will find plenty of support down at the 1.20 level, which might be exactly where we end up after the Article 50 triggers, and I would not hesitate to start buying in that general vicinity.