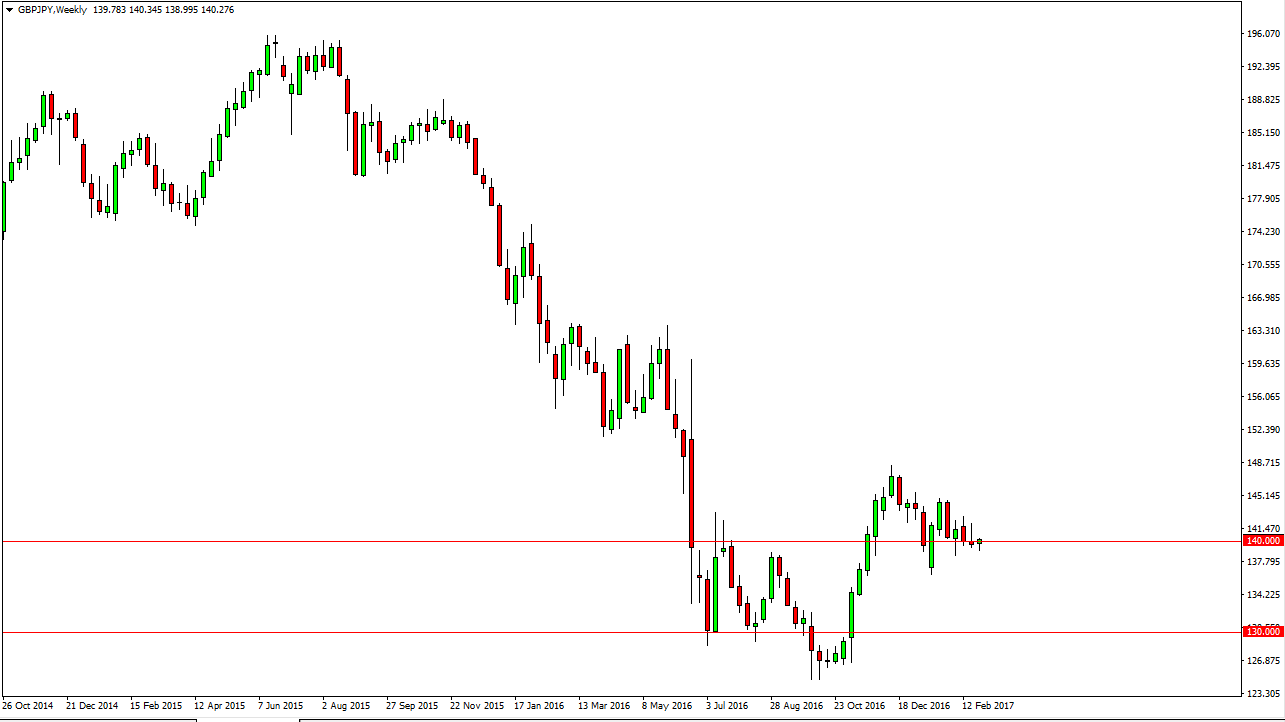

The GBP/JPY pair has been very volatile during February, but quite frankly I think the Forex markets in general have been choppy. Because of this, it’s no surprise that one of the most volatile pairs was also one of the choppiness. I believe that the 140 level is very important, and thus the action in this area should determine where we go for the next several months. If we can break above the 143 level, I think that the GBP/JPY pair can reach all the way to the 148 handle this month. I believe that pullbacks continue to offer buying opportunities on short-term charts, if we can stay above the 138 handle. A breakdown below there should send this market looking for the 135 handle.

Keep in mind that this is a very risk sensitive pair, and of course you must pay attention to the Japanese yen in general. In general, the Japanese Yen has been strengthening over the last several weeks, but longer term it looks as if it is trying to turn over and start softening longer-term. If we can do that, then this pair can go to much higher levels. Over the course of the next couple of years, I believe that the British pound will continue to strengthen against most currencies, as it has been so oversold. This will be especially true in this pair, and we could be looking at a 150 reading it sometime this summer, and then possibly 195 at the end of next year. I still work with this thesis and recognize that although it will be choppy and volatile, pullbacks should continue to be buying opportunities overall. Remember, just as I said in the GBP/USD forecast, we could get the Article 50, and that could cause a significant pullback. However, I believe that the short-term negative move and only offers a better buying entry.