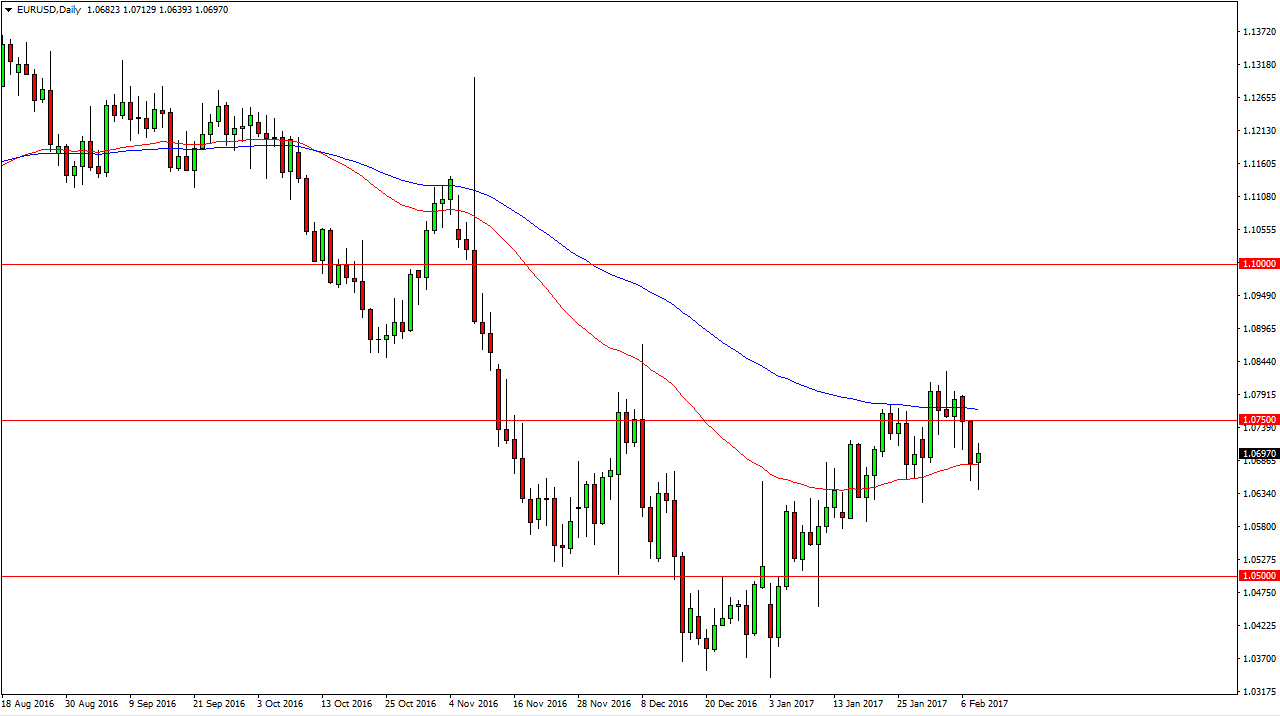

EUR/USD

The EUR/USD pair fell initially on Tuesday, breaking below the 50-day exponential moving average at one point. However, we bounced enough towards the end of the day to suggest of the market is and quite ready to break down yet. However, even with that move I still am concerned about all the noise above the 1.0750 handle, so it’s not until we break above the top of the shooting star from last week that I would be comfortable buying. Alternately, if we can break down below the bottom of the range for the session on Tuesday, that could be a selling opportunity down to roughly 1.06 or so. Either way, it’s going to be a very volatile market, and it’s likely that the French elections will continue to weigh upon this currency pair.

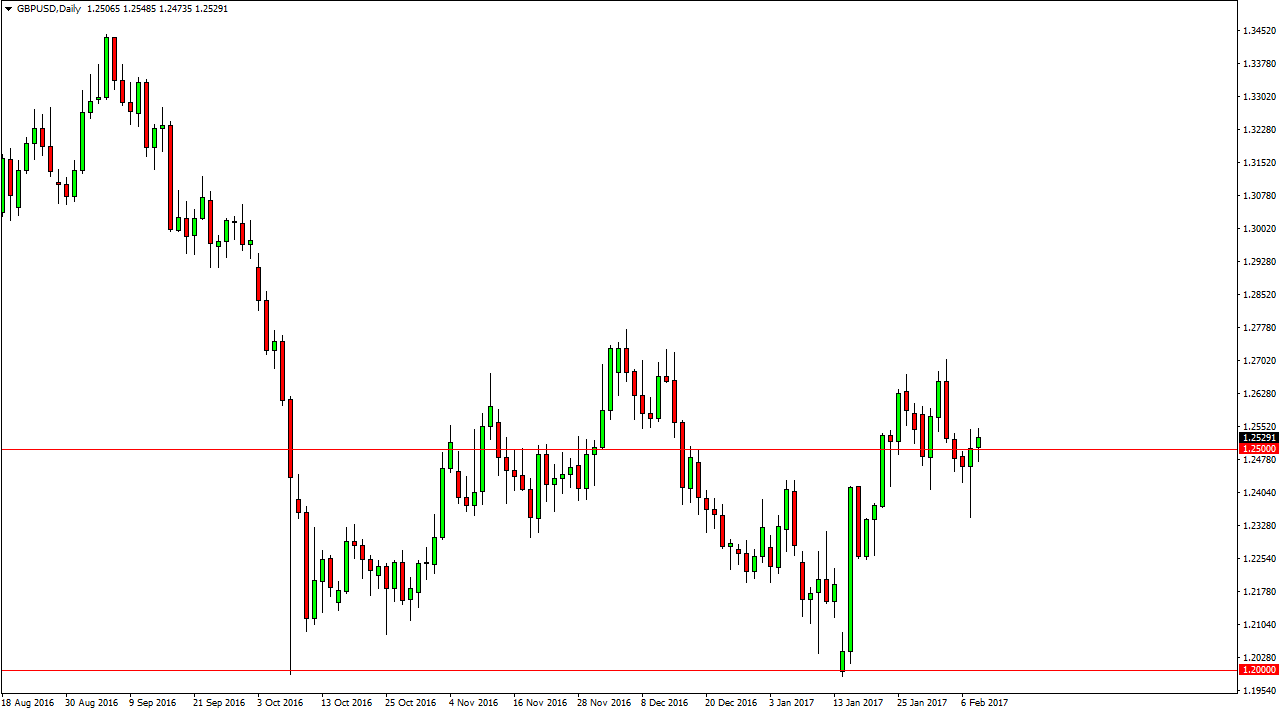

GBP/USD

The British pound initially fell off during the day on Tuesday but found enough support below the 1.24 level to turn things around and form a hammer. The hammer is a very bullish candle, and because of this I believe we are going to bounce and try to reach towards the 1.27 level above. I think that resistance barrier extends all the way to the 1.2750 level above. Ultimately, this is a market that will remain volatile but it looks as if the buyers are certainly in control as we get towards the end of the day.

If we managed to breakdown below the bottom of the candle for the day that would be extraordinarily bearish, but at this point I don’t think it’s going to happen. I believe that the upside is more likely than that down, and longer-term I’m starting to believe in the possibility of a trend change when it comes to the GBP/USD pair. Those are always extraordinarily ugly and volatile times in the market.