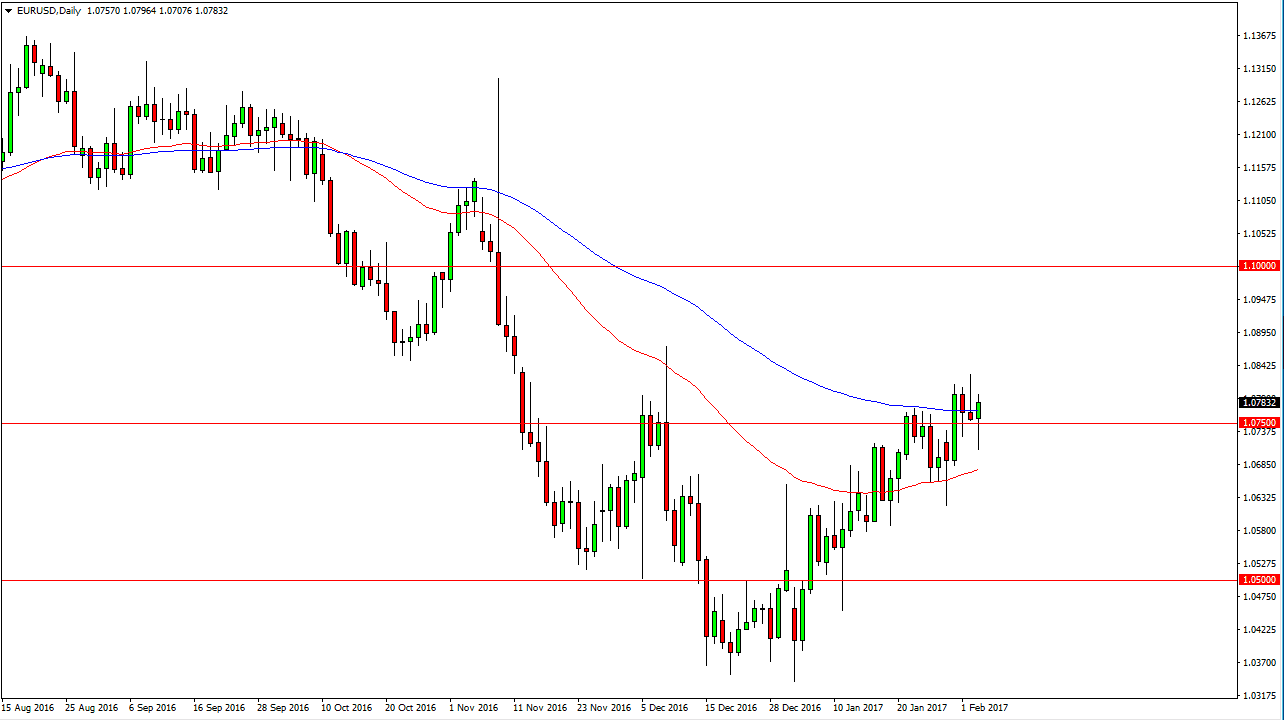

EUR/USD

The EUR/USD pair initially fell during the day on Friday, but turned around to form a hammer. The 1.0750 level continues to offer support, and with the hammer that were formed during the day, looks as if the EUR is and quite ready to give up the uptrend. The shooting star from the Thursday session of course suggests that were going to have issues but I also recognize that the hammer is formed not only on support, but the 100-day exponential moving average. A break above the top of the shooting star should send this market to the 1.09 handle, and then eventually the 1.10 level after that. Alternately, if we breakdown below the 50-day exponential moving average, pictured in red, it could be a nice selling opportunity back down to the 1.06 level, perhaps even the 1.05 handle. No matter what happens, expect a lot of volatility.

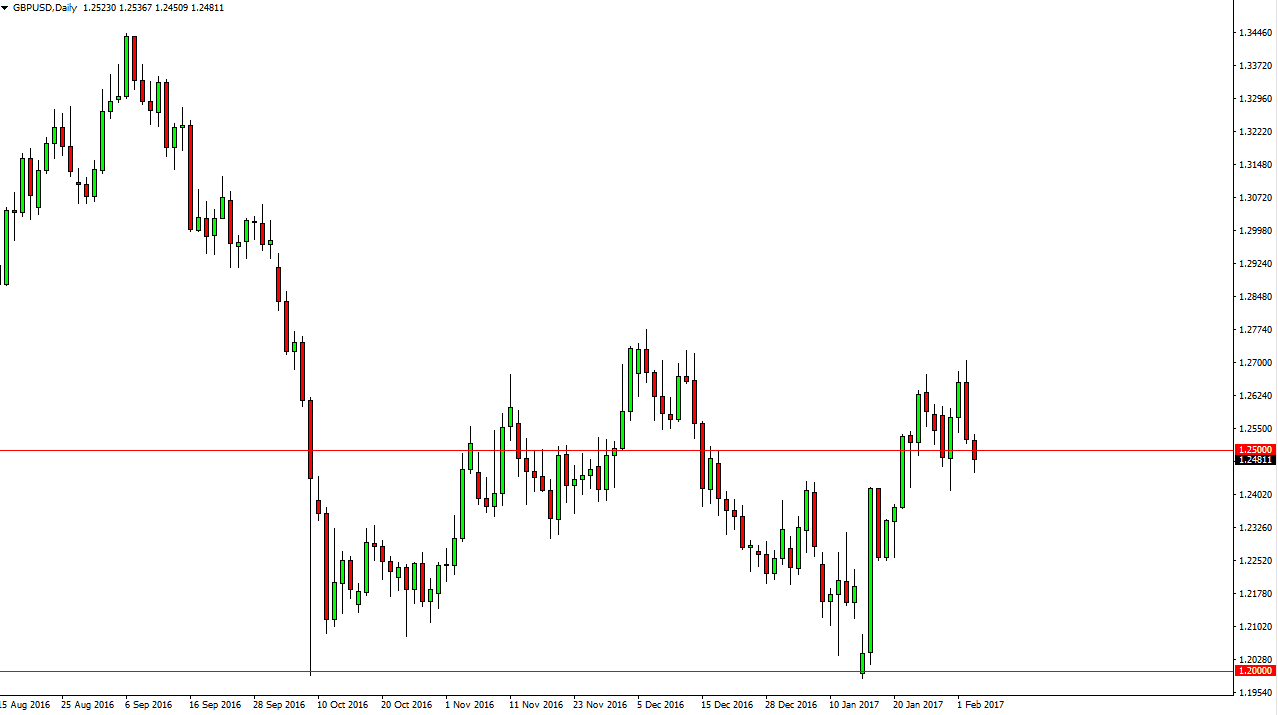

GBP/USD

The British pound fell during the day on Friday, reaching below the 1.25 handle. However, we have seen a little bit of a push back, so I think given enough time the British pound should continue to go higher. A break above the top of the candle for the Friday session is reason enough to expect this market to reach towards the 1.27 handle. Alternately, if we breakdown below the 1.24 handle, the market will probably reach towards the 1.2250 level. I’m not positive yet, but I do suspect that the British pound is trying to change the longer-term trend. If that’s the case, then we will have a lot of volatility going forward, and this will more than likely give us plenty of opportunities to go long.

Every time we pull back, it should be a nice opportunity to continue to go long and pick up the value that the market is offering.