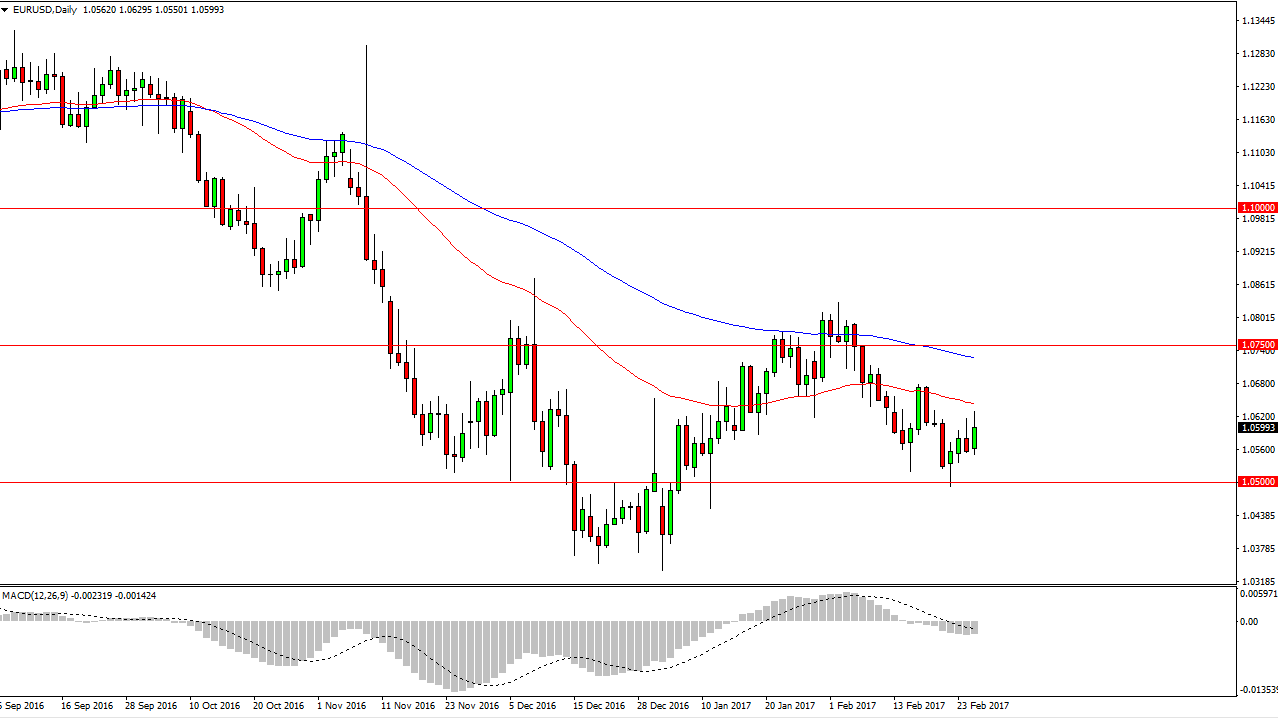

EUR/USD

The EUR/USD pair rallied at the open on Monday, but started to run into a significant resistance at the 50-day exponential moving average. This is an area that has caused resistance in the past, and therefore I’m looking for exhaustive candles to start selling. I believe that currency traders will continue to punish the EUR in general, because quite frankly there is a lot of concern when it comes to French and Dutch elections. The rising anti-EU sentiment in the populace has bond traders thinking that perhaps the EU won’t last. I must agree, but I don’t think it’s going to happen tomorrow. Short-term rallies should continue to be selling opportunities, but I think that the 1.05 level underneath will continue to be difficult for the sellers to overcome.

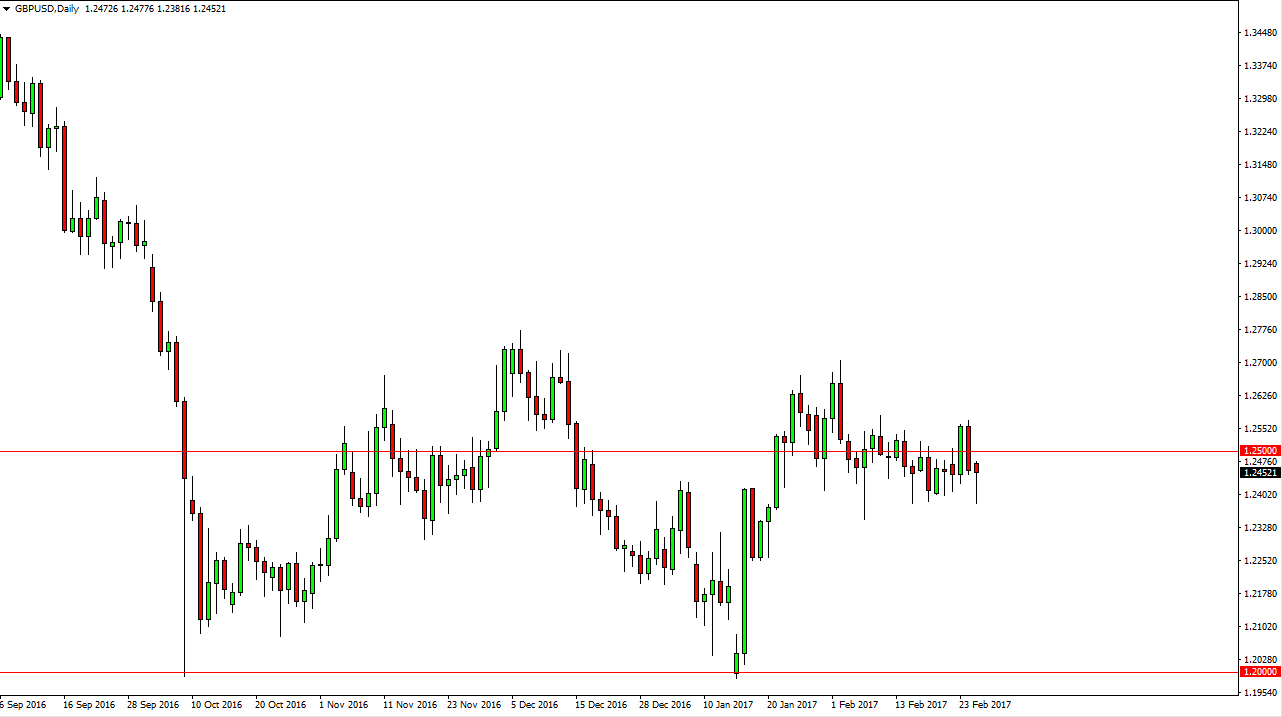

GBP/USD

The British pound initially fell against the US dollar, but found enough support near the 1.24 level to turn things around and form a hammer. That’s a very bullish sign, and I believe that we will eventually break out to the upside and reach towards the 1.27 level. Ultimately, I think that the market is essentially consolidated with an upward bias, so I think pullbacks are buying opportunities, such as the one we have just seen. I believe that we will eventually break out to the upside, but I don’t think were ready to do it quite yet. After all, there will be a “knee-jerk reaction” to the triggering of Article 50, but I think that will be the last of the massive selling pressure. In the meantime, buyers continue to jump into this market but if we break above the 1.27 level, we should then reach towards the 1.28 level.

The 1.24 level underneath should continue to be supported, and I think that every time we pull back towards that area it’s an opportunity to pick up value in the British pound.