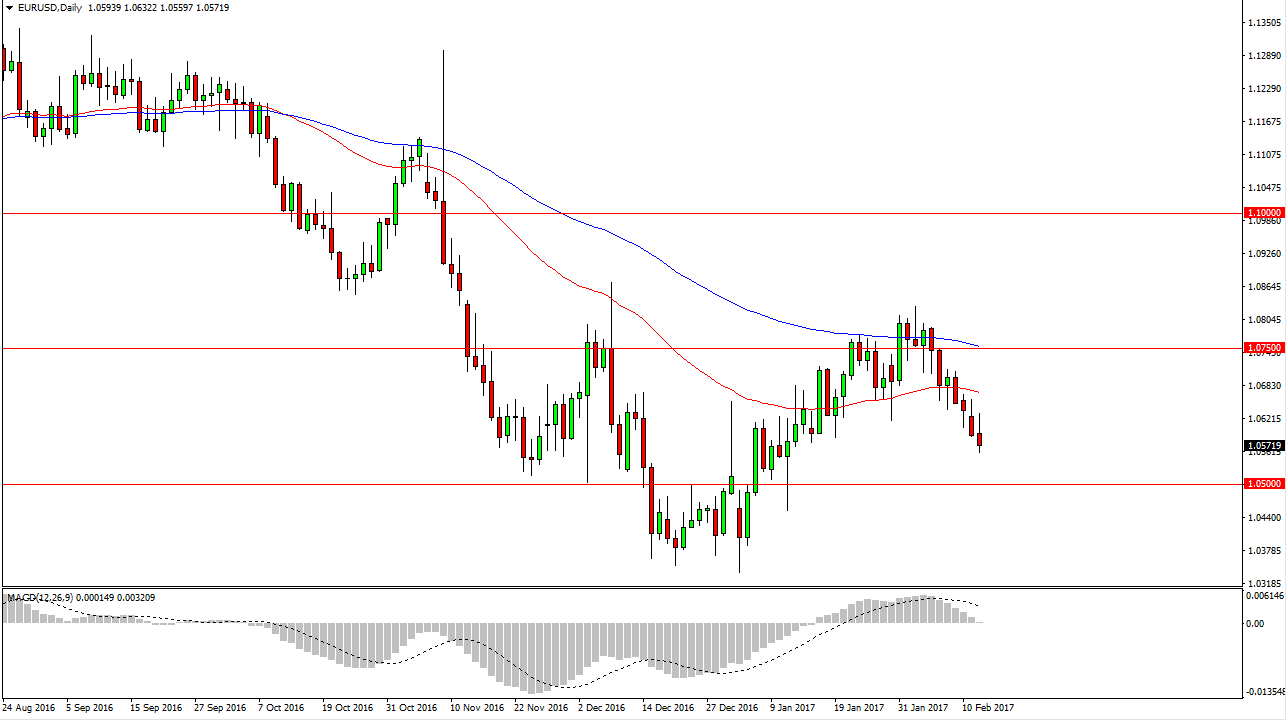

EUR/USD

The EUR/USD pair initially tried to rally during the day on Tuesday, but found enough resistance above the turn things back around and form a shooting star. Breakdown below the bottom of it should send this market down to the 1.05 level, which is a psychologically significant number. That should offer support, so I think a short-term bounce is coming down near that level. However, it’s become obvious to me that the rallies will continue to be selling opportunities, as the US dollar strengthens. Janet Yellen suggested during a speech in front of Congress during the session that interest rate hikes could be coming, especially if the economy keeps going the way it has in America. Because of this, looks like the longer-term downtrend continues.

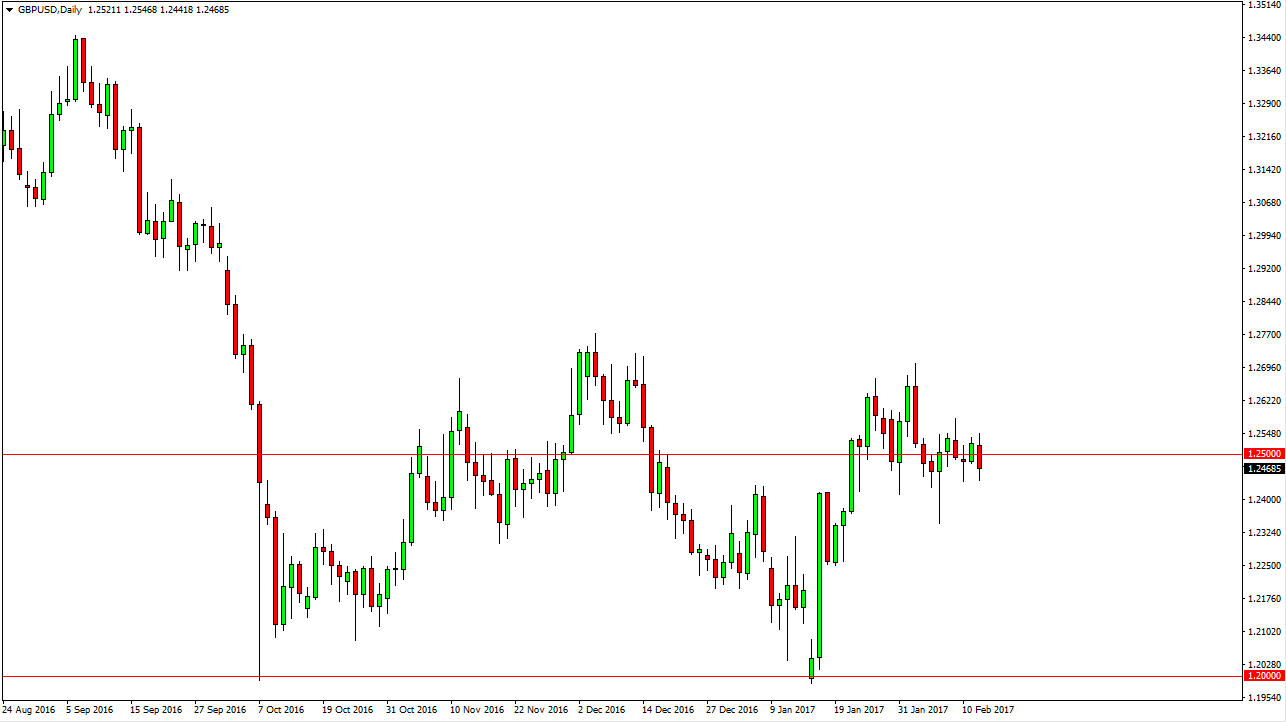

GBP/USD

The British pound fell slightly during the day on Tuesday, as we continue to bounce around the 1.25 level. Ultimately, I think there is a massive amount of support just below, especially considering that we have such a massive hammer during the previous week. I believe that the market will offer is a buying opportunity, but we haven’t quite yet. I think currently the British pound traders are trying to decide what to do next. It’s possible that we have in fact seen a bottom in this pair, but that’s not going to be something that’s very clean. Anytime you see a trend change, it gets very ugly and choppy.

The 1.27 level above is resistive, and I think that will be the initial target on a breakout to the upside. If we break down from here, it’s difficult to imagine that we will be over the sell off for any real length of time. The markets will continue to be difficult to deal with, so small position size is probably what you’re going to have to work with as there could be quite a bit of potential for danger.