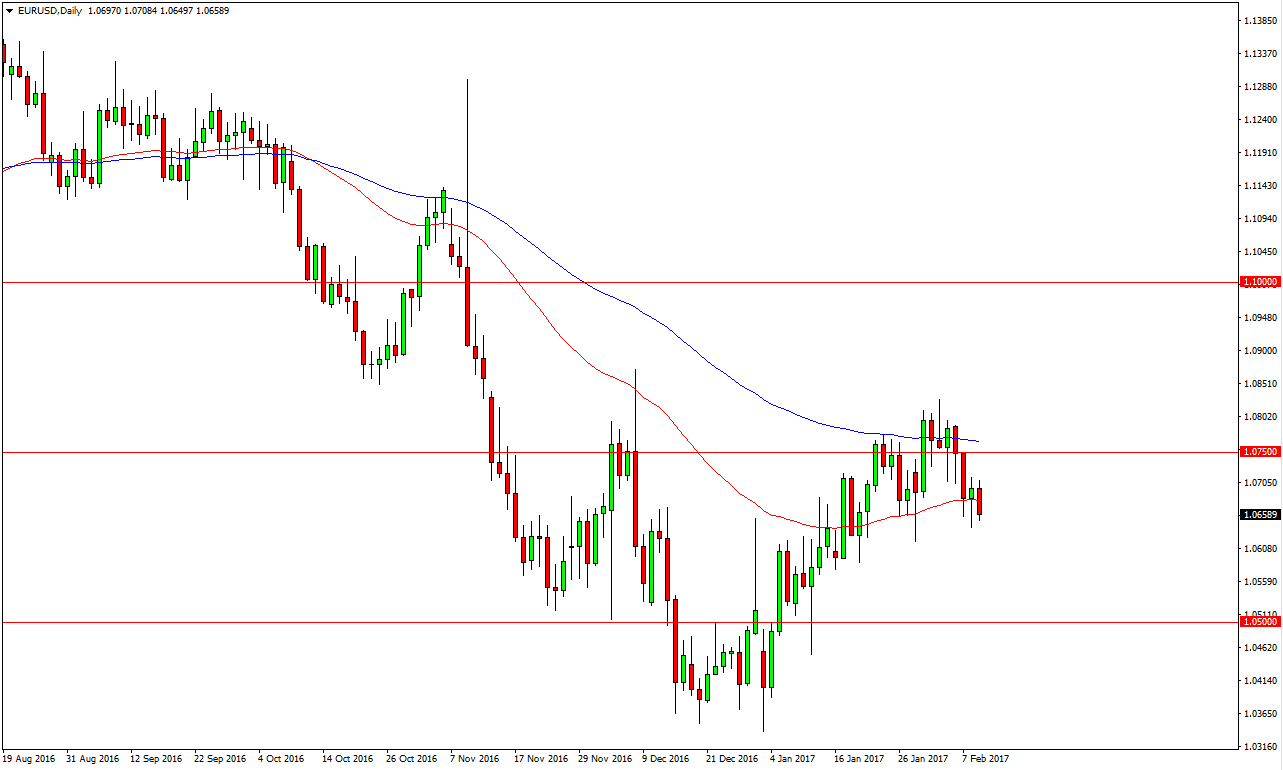

EUR/USD

The EUR fell a bit during the day on Thursday, breaking below the 50-day exponential moving average. The hammer that formed on Wednesday shows signs of support, so if we can break down below the bottom of the candle I think that the market continues to drop towards the 1.05 level below where there is massive support. I see significant resistance above the 100-day exponential moving average as well, as the 1.0750 level looks resistive. I think currently that it’s probably more likely to see bearish pressure in this market due to concerns about the French elections, so I have no interest in buying, at least not into we break above to a fresh, new high.

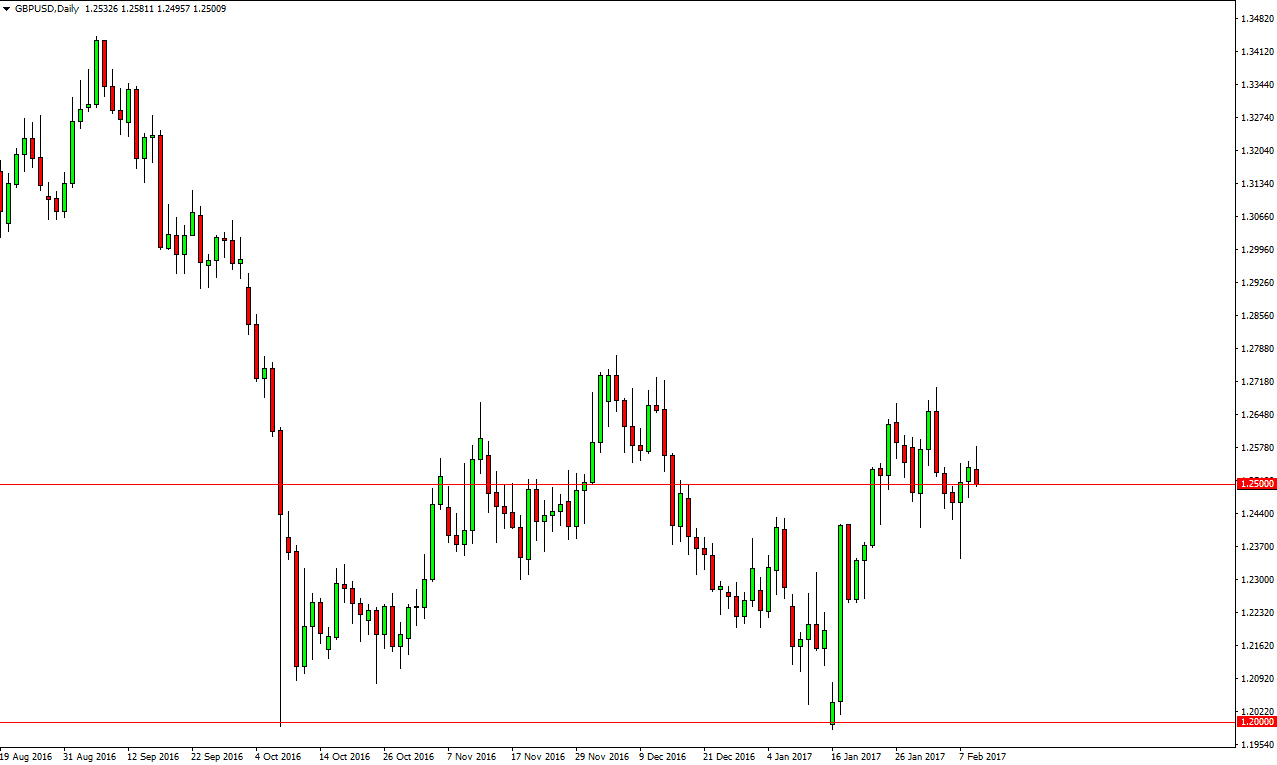

GBP/USD

The British pound rallied on Thursday but then fell backwards towards the 1.25 level. Nonetheless, I believe there is a significant amount of support just below and extending all the way down to the 1.24 level at the very least. Because of this, I’m looking for a supportive candle to start buying, or a break above the top of the candle for the Thursday session. At that point, I would anticipate that the market would reach towards the 1.27 level, and then perhaps the 1.2750 handle. I also believe that the British pound might be trying to change the overall trend, and with that being the case it’s likely that it will continue to be volatile, but eventually I think the buyers will win.

After all, the British economy has done better than most people anticipated, and there’s even hints of a possible rate hike in the future. Granted, that’s not anytime soon, and I do believe that once Article 50 is invoked, the British pound will sell off. However, that will be a short-term automatic reaction, and that will certainly be the absolute bottom by that point. In the meantime, I think we continue to grind higher.