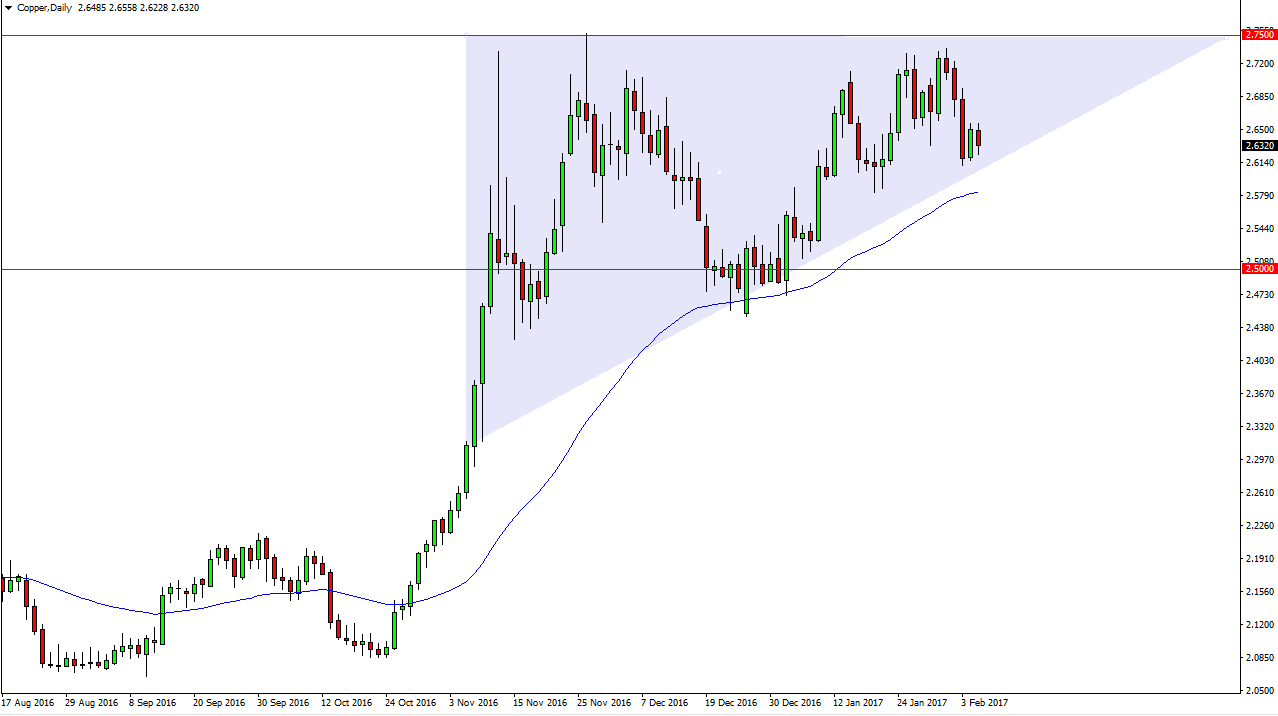

The session on Tuesday saw the copper markets fall slightly, but as you can see on the chart I have a massive rising triangle. I think that we are going to see this market continue to go higher, and what you don’t see is on a long-term multi-year chart, we have recently tested an uptrend line and it has held. Because of this, I believe that every time we pull back, the buyers will be interested. I also have the 50-day exponential moving average on the chart, and it has been offering dynamic support as of late.

Resistance above

That’s not to say that the resistance will be broken easily, and I believe that the $2.75 level is crucial. However, I think we will eventually break above there and when we do we should continue to go much higher. The breaking of that level should send this market to the $3 handle and beyond. The reason I think this chart is ready to go higher is based upon talk of infrastructure spending in the United States, and possibly in other parts of the world. Pay attention to talk of construction in China, because that’s always a major driver of the copper market as well.

Ultimately, I don’t have a scenario in which I am willing to sell this market, at least not until we breakdown below the $2.45 level, something that’s obviously not going to happen anytime soon. I do recognize that the $2.75 level above will be massively resistive, but once it breaks, we should see real momentum in the market. We have been grinding away to the upside and a relatively steady manner, which is very bullish longer-term as we should not have to worry about running out of momentum due to exhaustion in the near term. There are other announcements to pay attention to, such as housing numbers, and construction permits around the world. If they look healthy, this market should go higher.