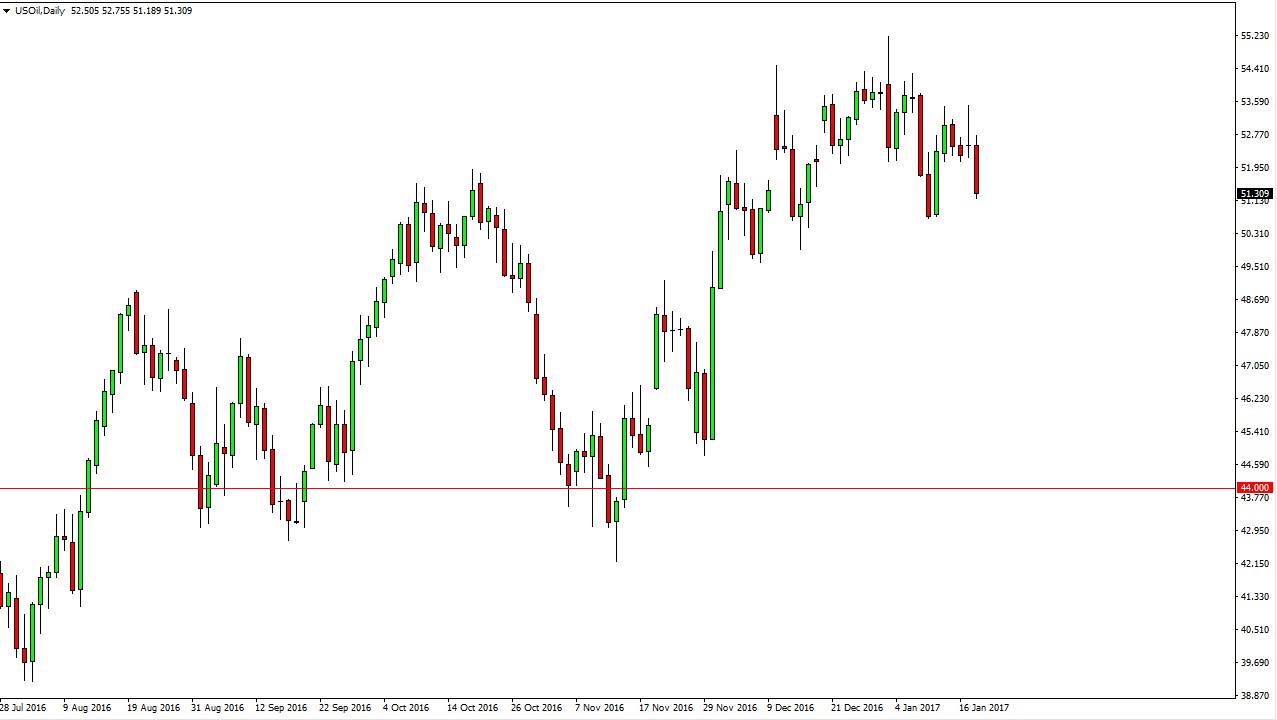

WTI Crude Oil

The WTI Crude Oil market broke down on Wednesday, clearing the bottom of the shooting star from Tuesday. That’s a very negative sign, and I believe that the market is going to continue to drift lower from here, perhaps reaching towards the $50.50 level, which is supportive. I believe that support extends all the way down to the $50 handle as well. However, today is Crude Oil Inventories day, meaning that we will get an idea as to what the demand is in the United States. Expected to be -960,000 barrels, that number will have a massive effect on where we go next. If that number is a lot higher, and I suspect it could be, this could be what causes of the breakdown in this market finally. Rallies of this point in time I think are going to be selling opportunities based upon exhaustion.

Natural Gas

The natural gas markets initially tried to rally on Wednesday, but turned around and continued the downtrend. It looks as if her going to reach towards the $3.25 level, and then possibly the $3.10 level underneath there. At this point, the $3.50 level above seems to act as massive resistance. The gap that started this latest downtrend seems to have at least been tested, so we may continue to go much lower. In fact, there’s no interest on my part whatsoever of buying this market until we get above the $3.50 level, and then it would only be long enough to fill that gap, meaning we could reach all the way to the $3.74 handle.

One temperatures in January are certainly not helping the natural gas markets in the United States, which of course is the biggest driver of where this commodity goes. Because of this, I continue to be very negative of this market longer term.