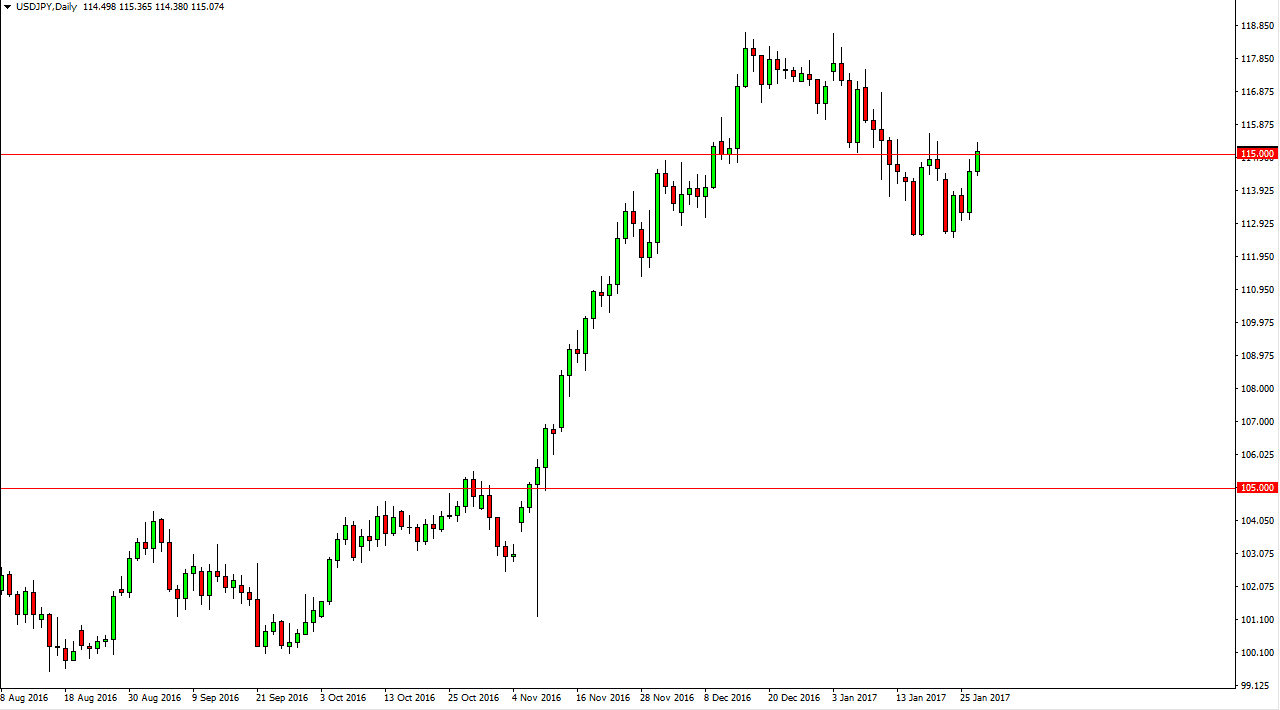

USD/JPY

The US dollar rallied during the Friday session, reaching above the 115 handle. However, there is significant resistance just above, so sonnets a we break above the top of the shooting star from last week that I feel comfortable going long. This of course is unless I find pullbacks that have support just below. I think that the 112.50 level underneath is a short-term “floor” of this market. The US dollar should continue to be supportive, as the Federal Reserve is looking to raise interest rate while the Bank of Japan is light years away from doing the same. Longer-term, I believe that we not only break above the 115 handle, but we eventually reach towards the 118.50 level which was of the recent high.

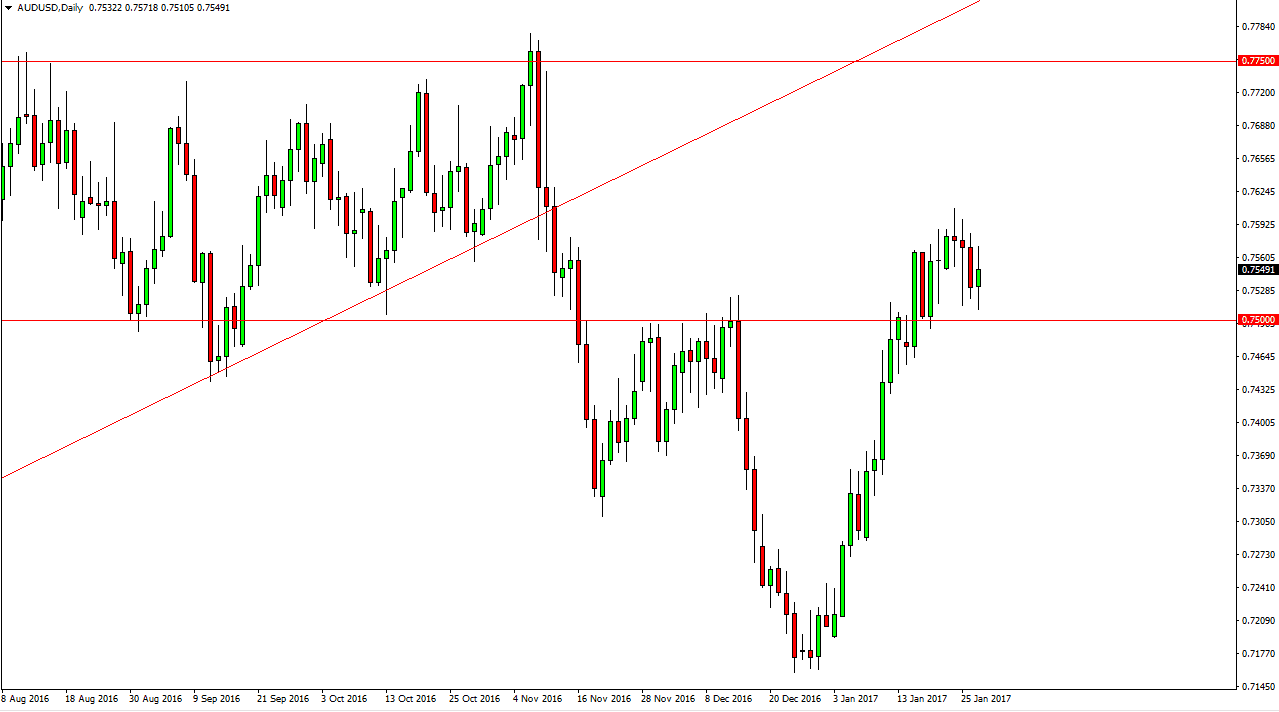

AUD/USD

The Australian dollar had a volatile and choppy session on Friday, so having said that it looks as if we are still trying to find our way forward. The 0.75 level underneath is going to continue to be supportive. A breakdown below that level could see support all the way down to the 0.74 level. Any type of supportive candle between here and there is reason enough to go long but if we broke down below the 0.74 handle, I think at that point the market starts to sell off. A break above the 0.75 level should send this market looking for the 0.7750 level, and ultimately you can have to keep in mind that the gold markets drive the Australian dollar longer term. Because of this, I think you must pay attention of both markets, and as the gold markets are trying to figure out what to do with the current level, so are the Australian dollar markets.

Choppiness will be the mainstay of this market, as I think we will continue to see traders struggle with anything more than short-term trading opportunities. You must be nimble in the AUD/USD pair short-term.