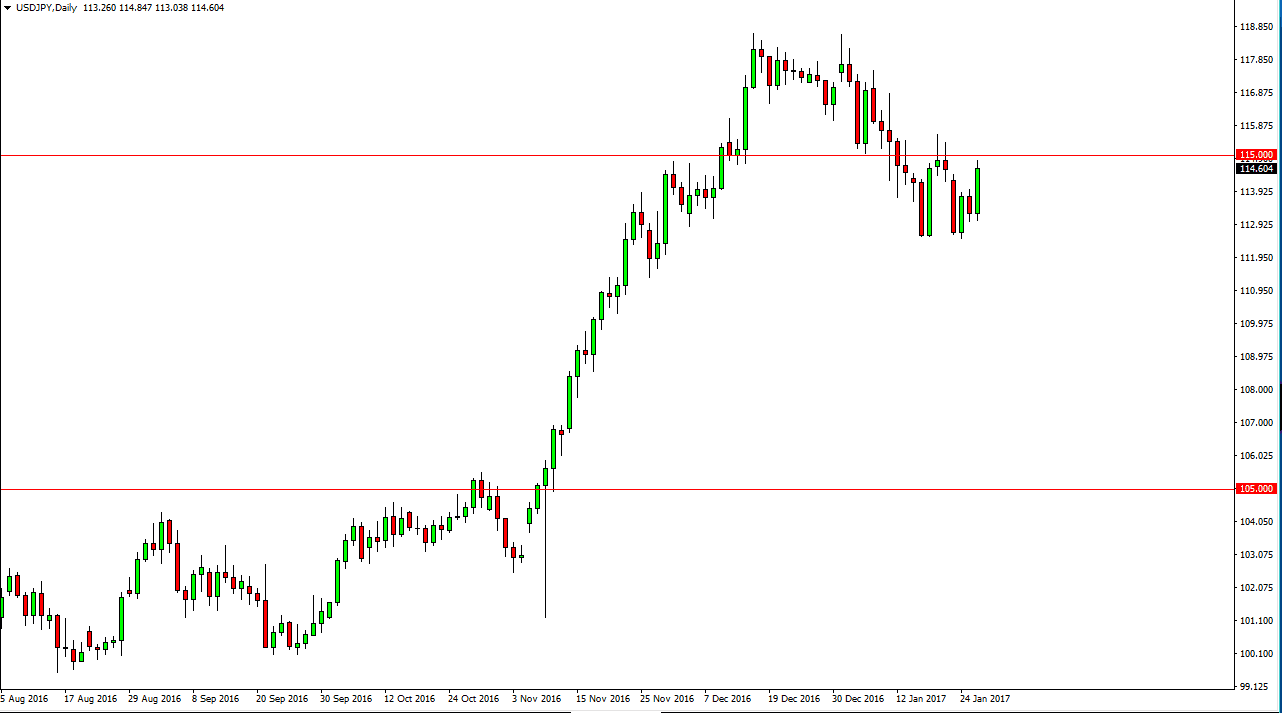

USD/JPY

The US dollar bounce against the Japanese yen during the session on Thursday, testing the 115 handle. This area should be rather resistive, but I believe that if we can break above the top of the shooting star at that level, the market can go much higher. That is my base case scenario, but I recognize we may have to pull back a little bit to pick up the momentum to do so. I believe that the 112.50 level continues to be supportive, and that we will eventually try to get to the 118.50 level. Once we get to that point, I expect a breakout that should reach the 120 handle. I have no interest in selling this pair, the Federal Reserve will continue to raise interest rate while the Bank of Japan will not.

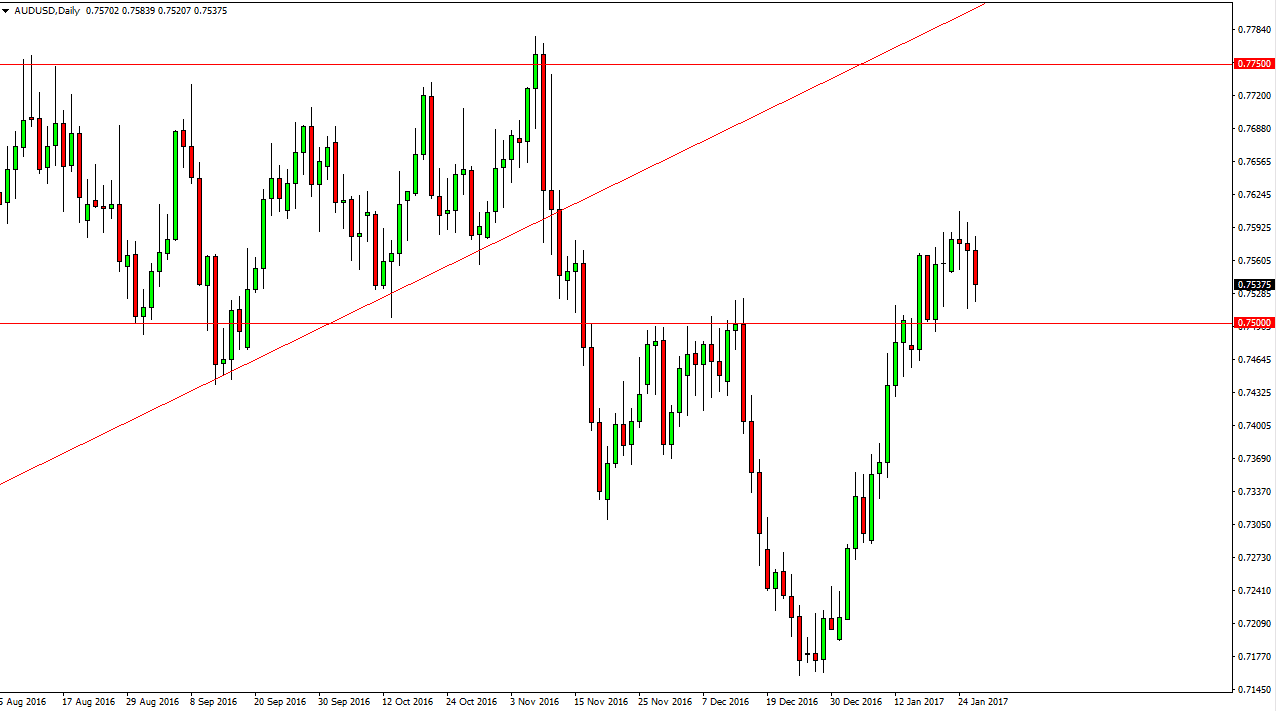

AUD/USD

The Australian dollar had an interesting day as we fell, reaching towards the 0.75 level against the US dollar. However, there is a significant amount of support there, so of course the buyers came back. We are in an inflection point, as the 0.75 level is the beginning of a “floor” in the market that I think extends down to the 0.74 handle. Alternately, we are over done now and of course the gold markets look a bit suspicious. Because of this, you must follow the gold markets and trade this pair accordingly. As gold goes higher, so does the Australian dollar and of course vice versa.

If we do breakout to the upside, we will reach towards the 0.7750 level over the next several weeks, but a breakdown could be rather catastrophic as it would show complete reversal of the impulsive moved to the upside, something not seen very often. Either way, expect choppiness in this general vicinity, so therefore I recommend that you remain as nimble as possible.