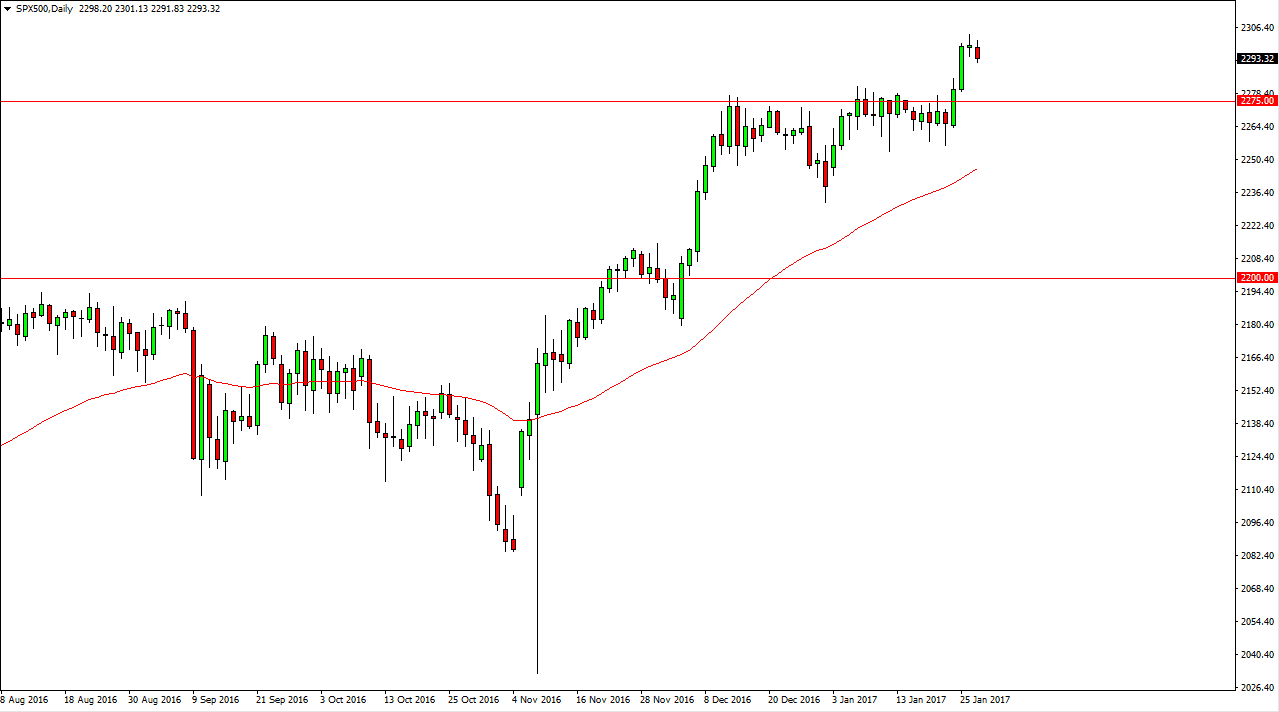

S&P 500

The S&P 500 fell slightly on Friday, as it looks as if the market has run out of momentum. After the massive breakout to the upside though, I believe it’s only a matter of time before the buyers get involved and I think that the market will find the previous resistance at the 2275 level as a possible launch point for buyers to get involved. Because of this, the markets will offer value that people will be looking for, and I believe that the longer-term trend will continue to the upside. The 2300 level has offered resistance, but I believe it is at best psychological resistance, and shouldn’t be much of a hurdle once it comes down to it.

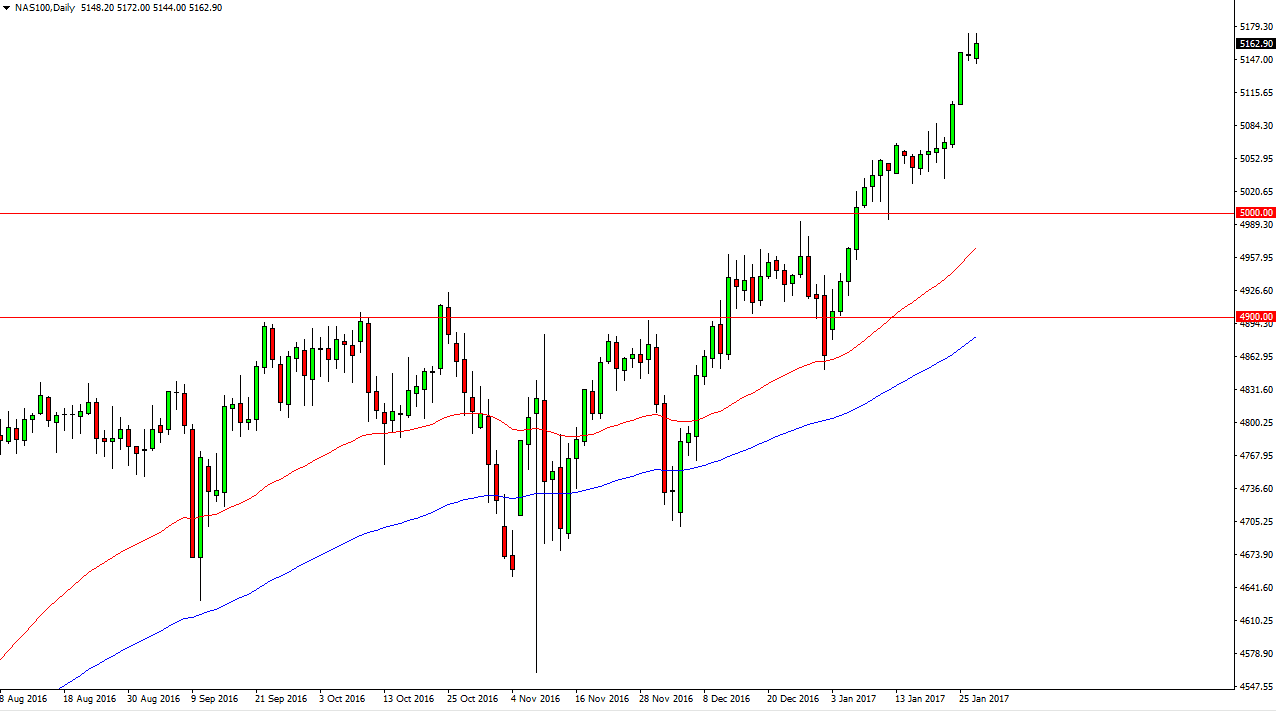

NASDAQ 100

The NASDAQ 100 broke higher during the day, testing the highs from the shooting star on Thursday. A pull back from here is probably coming, and if it does it should only offer value. Alternately, if we break above the top of the shooting star from Thursday, the market should then be able to go much higher. I have no interest in shorting this market, I believe there is more than enough support all the way down to at least the 5000 handle. The move recently of course was very strong, so it wouldn’t make me surprised at all if we saw some type of pullbacks the gives us an opportunity to take advantage of what is a very strong uptrend. I believe that the NASDAQ 100 has been one of the leaders when it comes to US indices recently, and I think that will continue to be the case here. If we break out to the upside, yes, the market should continue to go higher but I think you would be in danger of “chasing the trade” at that point, so I prefer the occasional pull back to buy on the dip.